In the tumultuous arena of the communication services sector, a selection of oversold stocks emerges as diamonds in the rough, ripe for the picking.

One key tool in discerning the potential of these undervalued companies is the Relative Strength Index (RSI), a momentum indicator that juxtaposes a stock’s strength on up days with its strength on down days. When the RSI plunges below 30, the asset is commonly considered oversold, a signal for shrewd investors to tiptoe in, eyes gleaming with anticipation.

Let’s cast our gaze upon the current roster of esteemed players in this sector whose RSIs flutter near or beneath the fabled 30 mark.

Glint of Hope: TIM SA (TIMB)

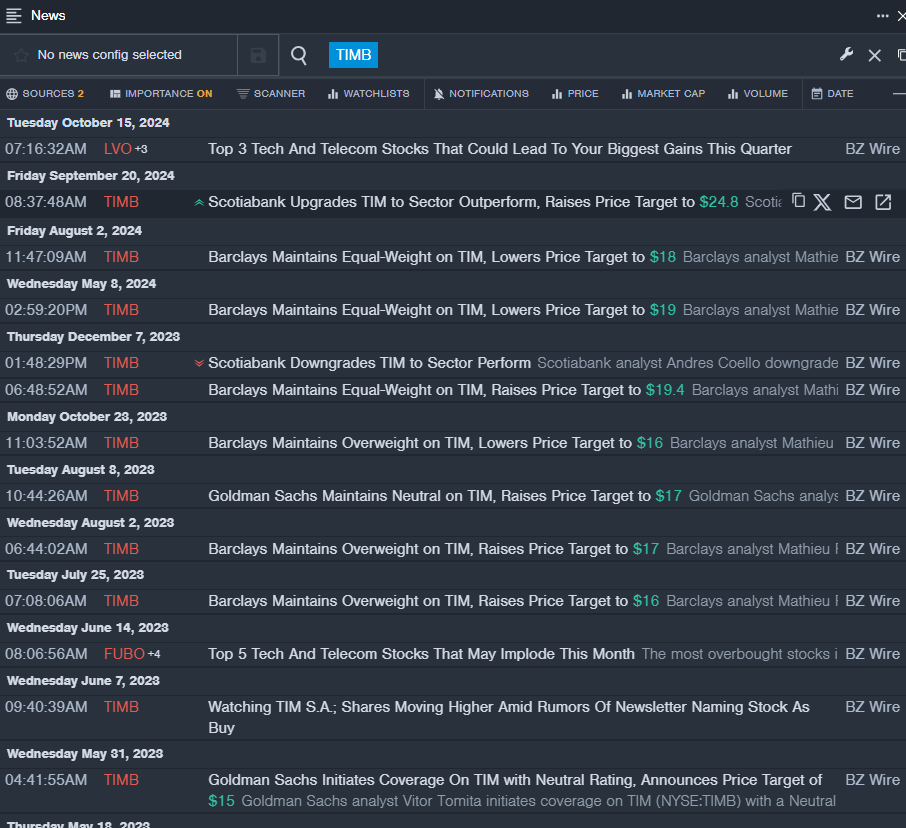

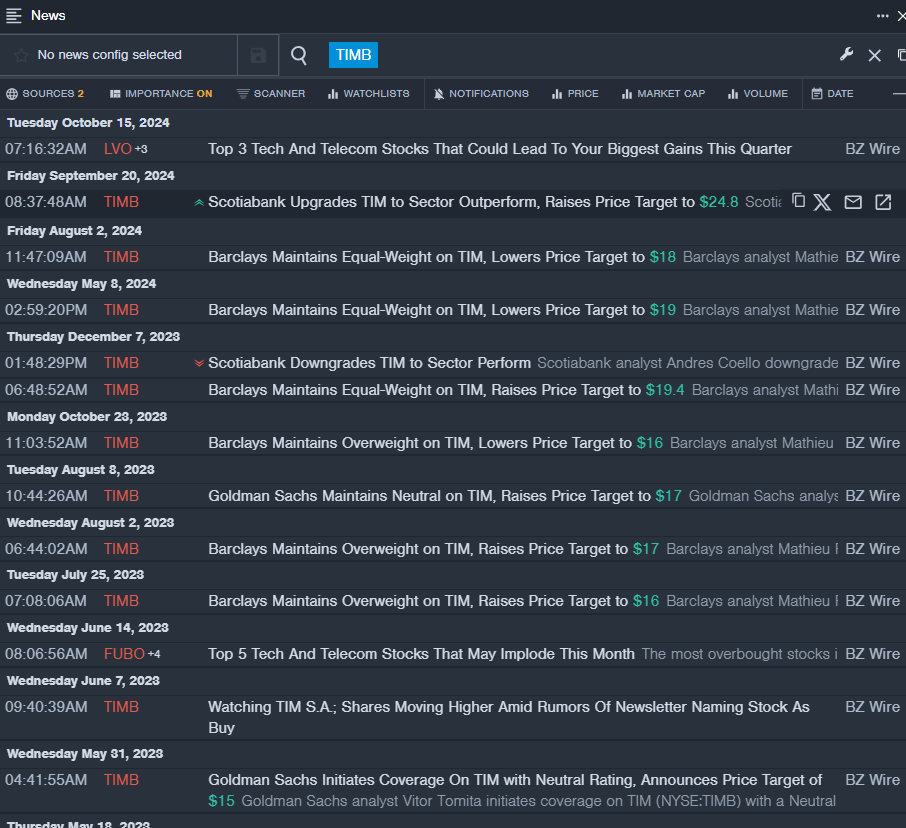

- Scotiabank analyst Andres Coello recently cast a vote of confidence in TIM SA, upgrading it from Sector Perform to Sector Outperform while bumping up the price target from $17.5 to $24.8. Despite enduring a 10% slump in the past month, the company’s stock glimmers near its 52-week low of $13.84.

- RSI Value: 29.36

- Price Movement: Like a phoenix rising from its ashes, shares of Tim scraped up a modest 0.1% climb to close at $15.21 on Monday.

- In the labyrinthine world of stock market ups and downs, Benzinga Pro’s real-time newsfeed acts as a trusty guide for nimble investors.

Resilience Defined: LiveOne Inc (LVO)

- In a move demonstrating tenacity, LiveOne inked a fresh partnership deal with Tesla (TSLA) extending through May 2026. CEO Robert Ellin’s words ring with optimism as the company looks to capitalize on conversion opportunities to drive growth and revenue. Though weathering a stormy 55% downturn in the past month, LiveOne stands tall near its 52-week low of $0.60.

- RSI Value: 23.74

- Price Movement: Like a warrior dusting off after battle, shares of LiveOne fell by 7.4% to rest at $0.66 on Monday.

- Guided by Benzinga Pro’s charting tool, wise investors can discern patterns amidst the chaos of the markets.

Unveiling Potential: Trivago NV – ADR (TRVG)

- Back in July, trivago dazzled investors with quarterly results that surpassed expectations. Despite facing a 7% dip in the past month, the company’s stock beckons near its 52-week low of $1.61, hinting at a possible resurgence.

- RSI Value: 27.82

- Price Movement: Like a seasoned performer bowing to applause, shares of Trivago dipped slightly by 0.6% to conclude at $1.69 on Monday.

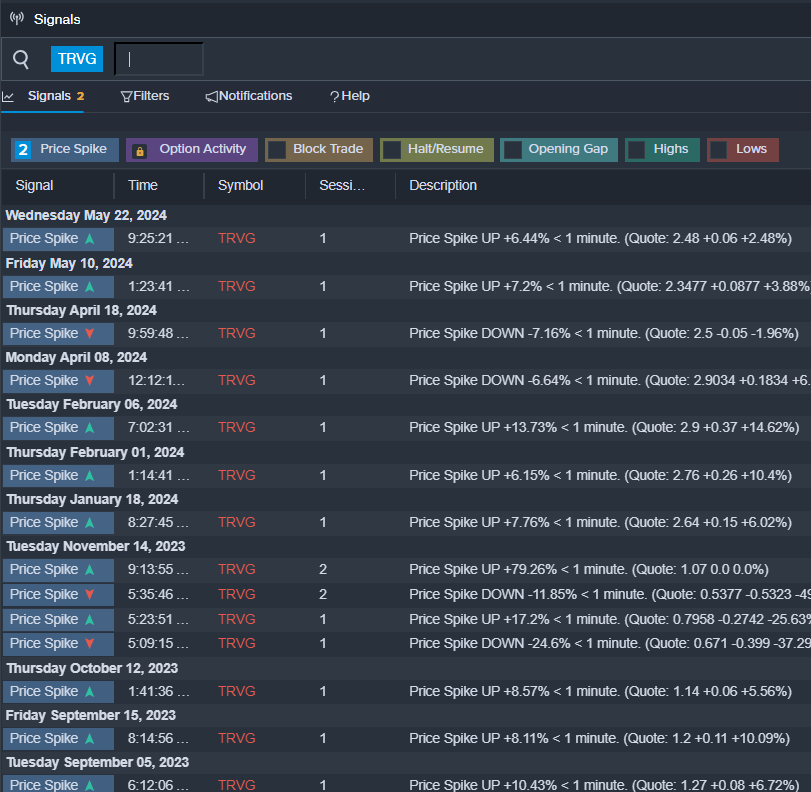

- Alerted by Benzinga Pro’s signals feature, savvy investors can position themselves for a potential breakout in TRVG shares.

A sagacious investor keeps an eye on the unseen, undervalued gems that have the potential to glitter brighter than the rest.