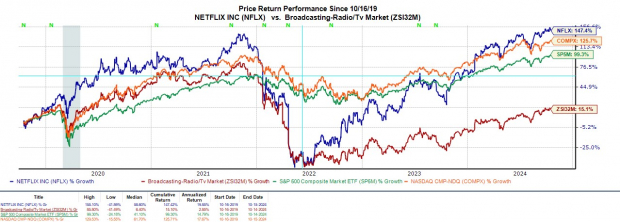

Trading over $700, Netflix NFLX shares have rallied more than +40% year to date and are sitting on gains of nearly +150% in the last five years.

Despite a hefty price tag, Netflix stock sports a Zacks Rank #2 (Buy) with the streaming giant’s third quarter results approaching on Thursday, October 17. That said, here is a look at why now is still a good time to invest in Netflix.

Image Source: Zacks Investment Research

Strong Subscriber Growth

Boosting investor confidence, subscriber growth has been the primary catalyst to the strong price performance of NFLX. Netflix is thought to have added 4.75 million users during Q3 after adding an astonishing 8.76 million subscriptions during the prior year quarter which was 2.9 million more than expected. Most recently, Netflix added 8.04 million subscriptions during Q2, adding more than 2.24 million users than expected.

Enhancing its portfolio of original shows and content, Netflix has stayed on top of the hill in regards to streaming services having over 277 million users at the end of Q2 which still topped all of Disney’s DIS main subscribers (Disney+, Hulu, and ESPN). This was also well ahead of Paramount Global PARA and Warner Bros. Discovery WBD which had 68 million and 103 million subscribers respectively.

Image Source: Zacks Investment Research

Q3 Financial Growth

Attributed to its strong subscriber growth, Netflix is expected to post double-digit top and bottom line expansion in fiscal 2024 and FY25. Netflix’s Q3 sales are expected to rise 14% to $9.77 billion compared to $8.54 billion a year ago.

More impressive, Q3 earnings are thought to have soared 36% to $5.09 per share versus EPS of $3.73 in the comparative quarter. Notably, Netflix has surpassed the Zacks EPS Consensus in three of its last four quarterly reports posting an average earnings surprise of 6.15%.

Image Source: Zacks Investment Research

Netflix’s Reasonable Valuation (P/E)

Addressing the elephant in the room, Netflix’s valuation is far more reasonable than in the past despite its stock price suggesting otherwise. To that point, NFLX trades at 37.3X forward earnings which is nicely beneath its five-year high of 100.6X and slightly beneath the median of 37.9X during this period.

Image Source: Zacks Investment Research

Key Takeaway

The year to date rally in NFLX shows no signs of stopping if Netflix meets or exceeds earnings expectations and maintains its impressive subscriber growth momentum. With a firm grip on the streaming market, any post-earnings dip could open up attractive buying opportunities, given Netflix’s robust long-term growth prospects and its valuation finding a solid footing.

Infrastructure Stock Expansion to Sweep America

A monumental effort to revamp the crumbling infrastructure of the United States is looming. It’s a bipartisan, pressing, and unavoidable mission. Trillions will be invested, and fortunes will be created.

The only question is, “Will you invest in the right stocks early when their growth potential is at its peak?”

Zacks has unveiled a Special Report to assist you in doing just that, and it’s now available for free. Explore 5 unique companies poised to benefit the most from the restoration and enhancement of roads, bridges, buildings, as well as the augmentation of cargo transportation and energy conversion on an almost unimaginable scale.

Download FREE: How To Profit From Trillions Of Spending For Infrastructure >>

Want the most up-to-date recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click here to access this report.

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Warner Bros. Discovery, Inc. (WBD) : Free Stock Analysis Report

Paramount Global (PARA) : Free Stock Analysis Report

Read the original article on Zacks.com here.