Netflix: First in Line for a Split?

2022 has been kind to the market, with the S&P 500, Nasdaq Composite, and Dow Jones Industrial Index posting year-to-date gains. As share prices surge, whispers of impending stock splits grow louder. Among the top contenders are Netflix, a tech giant that last split its shares in 2015. With a current share price exceeding $700, speculation is rife that another split may be on the horizon. While some believe a split might not materialize, investors are advised to consider bolstering their portfolios with shares of this streaming powerhouse. Despite formidable competition from the likes of Amazon, Apple, and Disney, Netflix has managed to increase revenue by 22% over the last three years. Moreover, operational efficiency has soared, with the company boasting its highest-ever operating margin of 24%. Netflix’s strategic decisions, such as implementing an ad-supported tier and curbing password sharing, have fortified its position in the market.

Spotify Technology: Ripe for Expansion

Spotify Technology, which went public in 2018 without ever splitting its stock, is another front-runner for a potential split. Boasting an impressive year-to-date share price growth of nearly $360, the music streaming service has emerged as one of the year’s best performers. CEO Daniel Ek’s drive for austerity has significantly boosted Spotify’s operational margin from a low negative 6.9% to a promising 2.7%. By hiking subscription fees and executing layoffs, the company has shown commendable financial acumen. Stock split speculations aside, investors are encouraged to take a closer look at Spotify and its evolving profitability landscape.

Meta Platforms: A Tale of Exceptional Growth

Amidst the market frenzy, Meta Platforms has solidified its status as a standout performer in 2024, with its shares skyrocketing by 68%. While many hope for a stock split, history reveals that Meta has never split its shares, making it the sole member of the “Magnificent Seven” that abstains from such tactics. Yet, the tech titan’s exponential growth and profitability figures are undeniable. In the recent quarter alone, Meta recorded a staggering 22% revenue surge and a whopping 73% increase in net income. With a substantial presence in the burgeoning digital advertising realm, Meta remains a force to be reckoned with. Whether or not a split occurs, investing in Meta could prove to be a lucrative move for discerning portfolios.

Seizing the Moment for Potential Gain

Have you ever missed out on investing in high-performing stocks? If so, don’t overlook this opportunity. Stay alert for potential stock splits in the tech sector to make informed investment decisions that align with your financial goals.

Unveiling the Veil: Stock Market Analysis Beyond the Buzz

Investors hunting for the next big thing to strike it rich have been barraged with the tantalizing allure of “Double Down” stock recommendations. Promising a ticket aboard the express train to financial fortune, these recommendations suggest that the opportune moment to invest is now, before the ship has sailed.

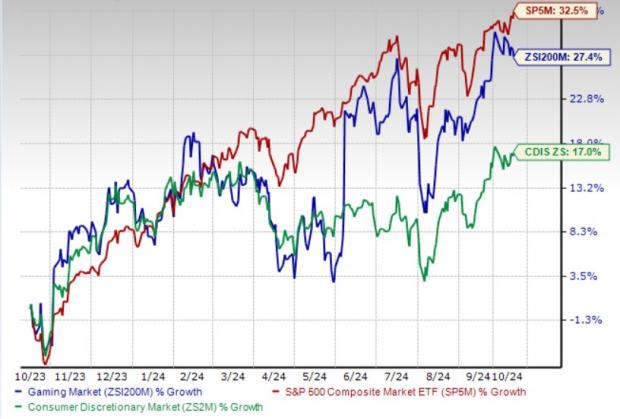

Stock Performance at a Glance

- Amazon: In 2010, a $1,000 investment made during the Double Down recommendation would have swelled to $21,122.

- Apple: Back in 2008, seizing the opportunity during the Double Down call would have turned $1,000 into $43,756.

- Netflix: An investment made in 2004 during the Double Down hype would now stand at an impressive $384,515.

The historical retrospect of these monumental stock performances is indeed dazzling. But the burning question on everyone’s lips remains: can lightning strike thrice?

A Fresh Lineup of Choices

As the Double Down siren call echoes once more, heralding potential riches, investors are now faced with three tantalizing new picks. The allure of striking gold while the iron is hot beckons, tempting all with the promise of lucrative returns.

So, what are you waiting for? Dive in and explore the top three “Double Down” stocks that could be your golden ticket to financial success.

*Stock Advisor returns as of October 14, 2024