AI Infrastructure Propels Stock Growth

Super Micro Computer Inc. (SMCI) has been surfing the AI wave, with its recent revelation about shipping over 100,000 GPUs per quarter causing the stock to skyrocket. This surge translates into potential billions in revenue, given the pivotal role GPUs play in AI development. The company’s liquid cooling technology is also turning heads on Wall Street, promising cost reductions and optimized data center hardware. Yet, investigations, like the Department of Justice probe spurred by short-seller allegations, cast a shadow over this boom.

Challenges Persist Amidst the Rally

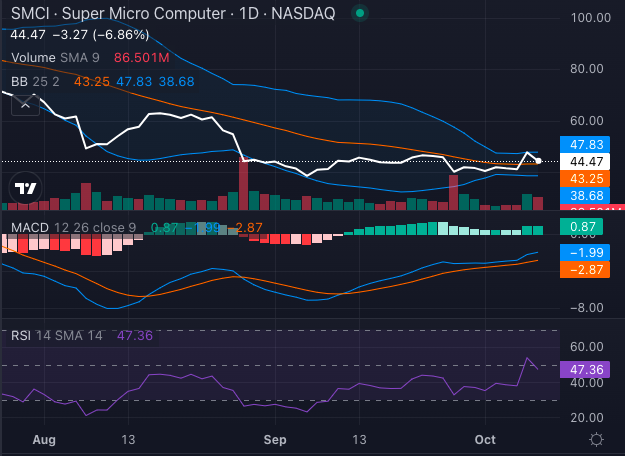

Despite the excitement over the GPU shipment news, Super Micro faces persistent challenges. The stock is down over 50% since its peak in March, hinting at a bumpy road ahead. Trading at $44.44, it sits below both its 50-day and 200-day moving averages, typically a bearish sign.

Chart created using Benzinga Pro

Potential Upsides Amidst Ongoing Uncertainties

Although Super Micro’s stock remains above its short-term moving averages, indicating some bullish signs, negative MACD trends and an RSI hovering near midpoint raise concerns. A surge in AI demand has been the driving force behind Super Micro’s recent success, but legal and financial uncertainties pose a challenge to the sustainability of this growth spurt.

Chart created using Benzinga Pro

The question now is whether this rollercoaster ride in the stock market will continue for Super Micro. Investors seem captivated but wary, ready to see where the AI hype will take this tech giant next.