In the heart of one of the world’s most fertile uranium-exploration regions, North Shore Uranium Ltd. is making significant strides in identifying potential drilling targets in Zone 1 of its Falcon uranium project in Saskatchewan’s Athabasca Basin. This promising development comes as the company unveils its strategic exploration program aimed at uncovering new sources of uranium supply amidst a backdrop of rising global demand.

Unlocking Potential: Target Identification at Falcon

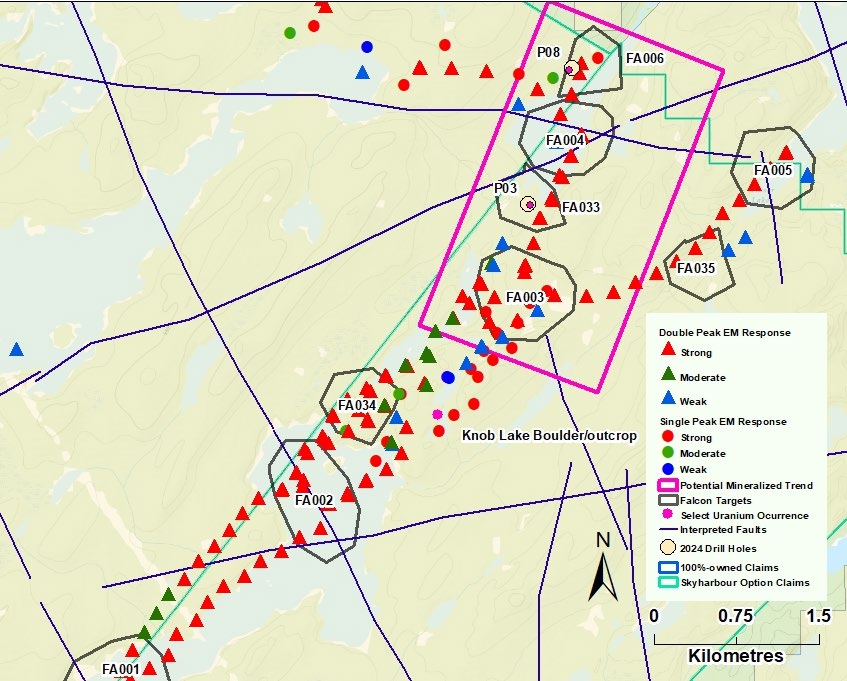

In a quest to unearth the next big uranium discovery, North Shore has pinpointed 12 potential targets within Zone 1 of the Falcon project. Further honing in on their exploration efforts, the company has earmarked three priority targets for potential future drilling activities. These targets were meticulously identified through a comprehensive analysis of electromagnetic data from airborne surveys, gravity-magnetic-radiometric surveys, historical exploration data, and structural interpretation. North Shore’s strategic focus underscores its unwavering commitment to uncovering lucrative uranium deposits in this mineral-rich basin.

Strategic Vision in Action

Besides its endeavors at Falcon, North Shore is strategically positioning itself for success by actively assessing uranium exploration targets at its West Bear project, located a mere 90 km away. With a keen eye on future fieldwork, including potential drill programs, the company is carving out a path towards sustainable growth in the uranium sector. Analysts have taken note of North Shore’s strategic maneuvers, with Red Cloud Securities’ David Talbot expressing optimism about the company’s potential for a significant valuation uptick in the near future.

Addressing the Urgent Need for Uranium Production

Amidst a backdrop of surging global demand for uranium, industry experts emphasize the pressing need for ramping up production to meet the burgeoning consumption levels predicted in the coming years. Projections indicate a substantial growth in nuclear capacity by 2030 and 2040, underscoring the critical role that uranium will play in meeting the world’s escalating energy needs. The imperative for additional production is echoed by forecasts from leading authorities like the World Nuclear Association and financial institutions such as Citi, highlighting the urgency of enhancing uranium output to cater to the spiraling global energy demands.

The Price Catalyst: A Glimpse into Future Trajectories

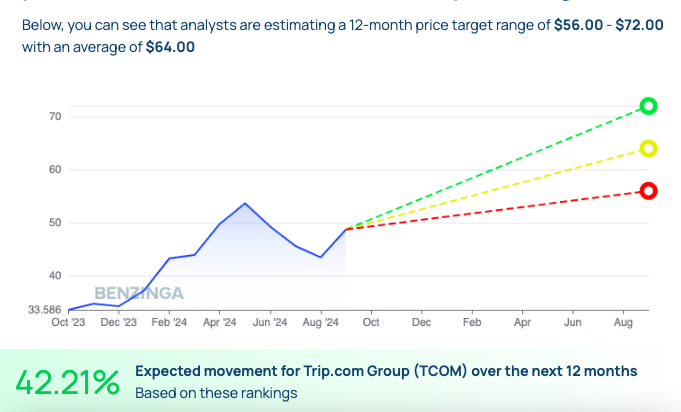

Amidst the evolving landscape of uranium markets, North Shore’s strategic initiatives align with broader market trends pointing towards an imminent uptick in uranium prices. Industry experts anticipate a price recovery in the near term, with Citi projecting a surge in uranium prices to reach significant levels by the end of this year and beyond. This optimistic outlook underscores the inherent value and potential growth opportunities that uranium investments hold in the long run.

Exploring the Future: Falcon’s Initiative in its Drill Program

Falcon has set its sights high, aiming to maximize the chances of discovery success in its upcoming drill program. The plan currently entails follow-up drilling along a 3 km trend and exploration of new targets in Zone 1 and potentially beyond.

As the company gears up for this ambitious program, it remains committed to providing regular updates on its progress.

Underlying Ownership and Share Structure

An intricate web of ownership defines Falcon’s landscape, with insiders and founding investors collectively holding about 45% of the issued and outstanding shares. Notable figures in this structure include Clements, with a 3.56% stake equating to 1.31 million shares, Director Doris Meyer holding 2.11% (0.78 million shares), and Director James Arthur with 1.58% (0.58 million shares). Amidst this, North Shore reveals that 14.92 million shares (40.5%) held by six founding investors are subject to a voluntary pooling agreement, locking these shares until October 19, 2026.

Interestingly, the majority of the remaining shares lie with retail investors, as institutional holdings in the company remain relatively modest.

With a total of 36.84 million outstanding shares, Falcon currently boasts a market capitalization of CA$2.52 million, with each share valued at CA$0.065. Over the past 52 weeks, share prices have fluctuated between CA$0.06 and CA$0.30, showcasing the volatility in Falcon’s stock performance.

Despite the intricate nuances within Falcon’s ownership and share structure, the company remains steadfast in its pursuit of drilling excellence and exploration success.