High-stakes investors are making bold moves against GameStop, and it’s a symphony that retail traders shouldn’t ignore.

The signals emerged through Benzinga’s analysis of publicly available options data. While the identities of these players remain veiled, their significant positions on GME suggest a dance of privileged insights.

On the tarot, Benzinga’s options scanner caught sight of 8 unconventional trades for GameStop today. It’s an unusual twist in the melody.

An Orchestration of Sentiment

The sentiment among these showstoppers is in discord – 25% sounding bullish notes while 37% drumming up bearish beats. Amongst the options observed, one put worth $41,700 stood in a groove with 7 calls striking a chord of $518,300.

Harmonizing Projections of Price Targets

Considering the Volume and Open Interest across these contracts, the symphony of whales seems to have set their sights on tuning GameStop within a range reaching harmonic heights of $20.0 to $125.0 during the past 3 months.

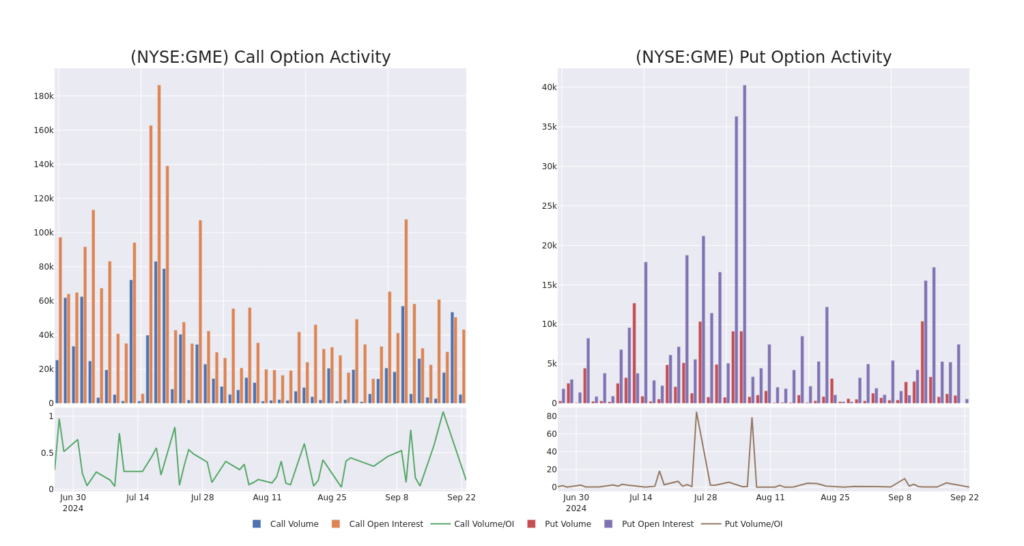

Capturing the Crescendo of Volume & Open Interest Trends

In today’s performance, the average open interest for GameStop’s options crescendoes at 8758.4, with the overall volume resonating at 5,267.00. The score depicts the harmonious interplay of call and put option volume and open interest among high-value trades on GameStop, executed between the $20.0 to $125.0 strike price range, throughout the last 30 days.

Illustrating GameStop’s Options Symphony: A 30-Day Overture

Unearthing Epic Options Trades

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | CALL | TRADE | BEARISH | 01/16/26 | $2.74 | $2.05 | $2.2 | $125.00 | $187.0K | 9.8K | 859 |

| GME | CALL | TRADE | NEUTRAL | 10/18/24 | $2.59 | $2.5 | $2.55 | $20.00 | $127.5K | 13.7K | 1.3K |

| GME | CALL | TRADE | BEARISH | 06/20/25 | $7.0 | $6.8 | $6.8 | $20.00 | $54.4K | 2.2K | 127 |

| GME | CALL | TRADE | NEUTRAL | 10/18/24 | $2.51 | $2.44 | $2.48 | $20.00 | $49.6K | 13.7K | 815 |

| GME | CALL | TRADE | BULLISH | 01/17/25 | $4.65 | $4.55 | $4.65 | $20.00 | $46.5K | 17.3K | 26 |

A Brief Riff on GameStop

GameStop Corp, a U.S. juggernaut in multichannel video games, consumer electronics, and services retailing, spreads its domain across Europe, Canada, Australia, and the United States. The company’s commerce encompasses both new and pre-loved video game hardware, physical and digital software, and harmonious video game accessories retailed mainly through GameStop, EB Games, and Micromania stores and various international e-commerce platforms. The symphony of sales crescendoes predominantly in the United States.

For a deeper delve into the options trading symphony revolving around GameStop, let’s delve into a more nuanced reflection of the company – examining its current market position and performance.

The Current Sonata of GameStop in the Market

- With a rhythmic volume of 3,761,340, GME’s price takes a minor note at -1.57% resting at $21.51.

- RSI indicators give a melodic suggestion that the stock might be nearing an overbought zone.

- The next act of earnings is slated for unveiling in 72 days.

Maestros Weigh In on GameStop

In the latest movement, 1 symphonic analyst struck a chord with target price harmonies at $10.0.

Turn $1000 into $1270 in just 20 days?

A veteran options trader unveils his one-line chart symphony revealing the perfect moments to buy and sell. Mirror his trades boasting an average 27% profit for every 20-day octave. Experience the crescendo.

* An analyst from Wedbush maintains their Underperform verdict on GameStop, orchestrating a target price at $10.

Trading options paints a canvas with amplified risks, yet it also promises the potential for grander profits. Astute traders manage these hazards through ongoing learning, strategic adaptations, leveraging various signals, and harmonizing with market dynamics. Stay attuned to the latest variations in GameStop’s options symphony with Benzinga Pro for live updates.

Market News and Data brought to you by Benzinga APIs