Apple (NASDAQ: AAPL) has undoubtedly evolved from its groundbreaking days with the iPhone, where excitement ran high. While the fervor may have diminished, the investment potential remains robust. Despite the dwindling fanfare, Apple continues to hold significant promise often overlooked by the investing masses. Here are three compelling reasons why acquiring Apple stock today may be the savvy move.

The Revolutionary AI-enabled iPhone

Upon the grand reveal on September 9, Apple’s latest offering, the iPhone 16, showcased incremental upgrades such as an enhanced camera and a more functional action button. Notably, these devices are powered by the A18 processor chip, facilitating on-device artificial intelligence (AI) operations, reducing reliance on cloud servers, thus streamlining processes.

While the market’s response to this unveiling was lackluster, the tech landscape is witnessing fierce competition from the likes of Alphabet’s Google Gemini and Microsoft’s Copilot in the AI domain. Yet, the underestimated power of the Apple brand and its users’ unwavering loyalty set a formidable backdrop for Apple’s upcoming move into AI.

Despite the delayed launch of Apple’s AI platform, the company’s unmatched user loyalty, coupled with forecasts predicting a surge in AI-capable smartphones, position Apple to grab a substantial market share, underpinning its potential for long-term growth.

Shifting Focus to Lucrative Services

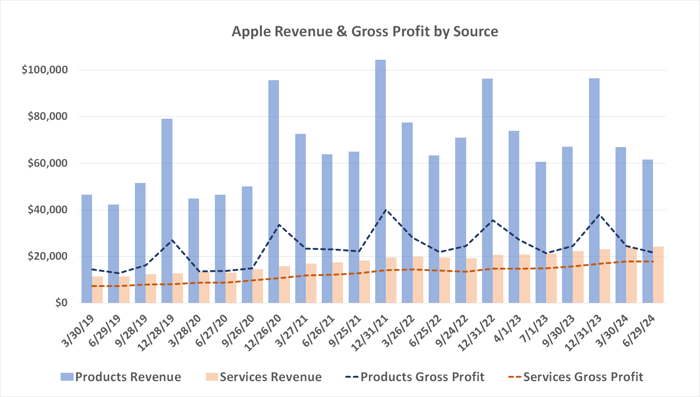

In its nascent stage, the iPhone stood as a profit behemoth for Apple. Today, although still a revenue juggernaut, the iPhone’s emergence as a facilitator for digital services marks a strategic shift for the tech giant. These services – encompassing apps, streaming platforms, music, and more – now rank as Apple’s second-largest revenue stream after the iPhone, comprising nearly a quarter of the company’s revenue.

While the iPhone remains the primary revenue driver for Apple, the burgeoning services segment represents a significant share of the company’s gross income, commanding nearly 40% of this crucial metric. This transition signifies Apple’s adept maneuvering to leverage the iPhone’s popularity to fuel the growth of high-margin services.

The Rocky Path of Apple’s Stock: An Investor’s Journey

As Apple’s AI initiatives gain traction, the stock faces a bumpy road ahead. Investors who have been closely following Apple might be scratching their heads at the recent stock performance. The expected surge post the July peak has not materialized, puzzling many market observers.

Diverging from the Usual: Apple’s Stock Falters

Normally, Apple’s annual September events act as a catalyst, propelling the stock to new heights. However, this year seems to be an anomaly. The market had already factored in the company’s AI aspirations since June, causing the stock to plateau. Despite the high-profile product launch this month, Apple failed to reignite investor enthusiasm.

But is this downward trend a sign of a prolonged slump? Unlikely. Wall Street remains optimistic about the tech giant’s prospects. Analysts, in their majority, advocate a bullish outlook on the stock, with a consensus target price of $247.22. While the current price is not far off, it suggests a starting point for a potential revival.

As Apple’s AI initiatives mature into meaningful revenue drivers, it won’t be long before Wall Street revises its price target upwards, possibly setting the stage for a renewed stock surge.

Timing the Market: Investing in Apple Now?

Before diving into Apple’s share, ponder this – renowned analysts at Motley Fool Stock Advisor excluded Apple from their list of 10 best stocks for future growth. While Apple may not be part of this elite group, those stocks that made the cut are forecasted to deliver exceptional returns in the years ahead.

Take Nvidia, for example, which featured on a similar list back in April 2005. A $1,000 investment at the time would have ballooned to a staggering $716,375. Clearly, the potential in selectively chosen stocks is sky-high.

Stock Advisor doesn’t just offer investment advice; it maps out a clear roadmap to financial success. With regular updates, expert analysis, and bi-monthly stock picks, the service has outperformed the S&P 500 by over four times since its inception in 2002, a track record that speaks volumes about its effectiveness.

For those looking to explore further investment opportunities, a glimpse at the 10 recommended stocks by Stock Advisor might just unveil the next big winner in the market.

*Stock Advisor returns as of September 9, 2024