Analyzing Market Dynamics

Amidst a terrain of economic uncertainties, oil juggernauts Chevron Corp and Exxon Mobil Corp made tentative strides in the early hours of Monday, seeking to recuperate from recent setbacks triggered by apprehensions over the global financial landscape.

The disquietude escalated post the release of the August employment report, painting a mixed picture of expansion juxtaposed with unexpected underperformance. Despite unemployment figures aligning with prognostications, an augmented “real” unemployment metric drove concerns skyward.

The ripples of a decelerating economy reverberated in oil markets, with both West Texas Intermediate and Brent Crude indices witnessing significant dips. Coupled with diminished consumer confidence indicators in China, major transnational brands found themselves on tenterhooks, fearing a downturn in global hydrocarbon appetite.

Exploring Geopolitical Influences

Adding to the turbulence are geopolitical intricacies, especially from the Middle East, capable of unsettling energy markets unpredictably. It is worth recalling that historically, OPEC+ constituents have orchestrated production slashes to bolster flagging prices.

However, amidst the somber notes, a silver lining emerges. Recent Ukrainian drone assaults on Russian oil facilities have crippled the latter’s downstream infrastructure, potentially nudging oil prices northwards due to simulated supply constraints.

Looking ahead, the International Energy Agency’s forecast heralding India as the principal driving force behind global oil demand growth till 2030 offers investors a glimmer of hope to offset ebbing Chinese market trends.

Deep Dive into Direxion’s ETFs

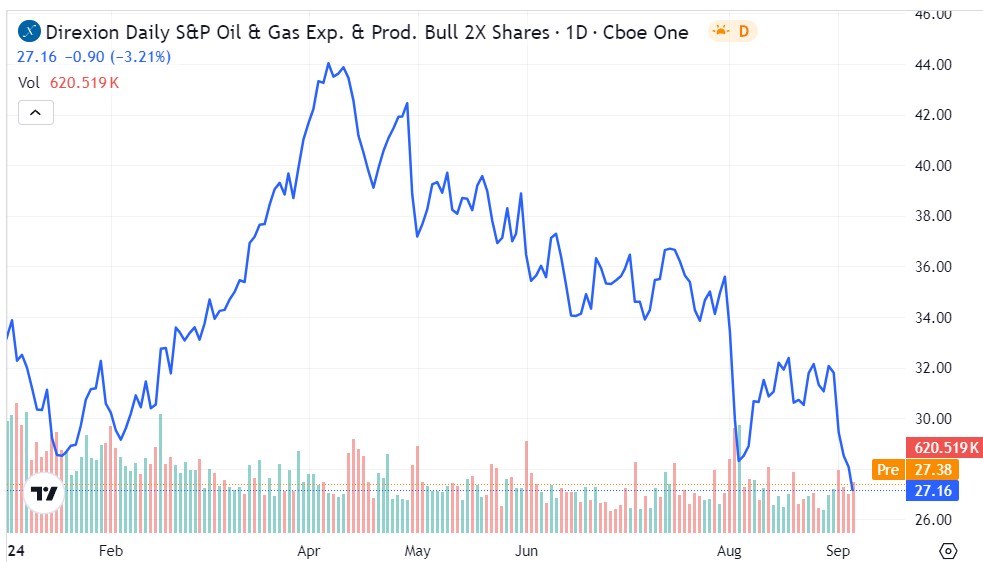

Amidst this intricate tapestry, venture-savvy investors eyeing plays in the multifaceted energy domain can count on Direxion’s expansive suite of leveraged exchange-traded funds. Embracing bullish sentiments, Direxion’s “2X” leveraged ETFs like GUSH offer a 200% stake in the S&P Oil & Gas Exploration & Production Select Industry Index.

Meanwhile, those bearish on oil trends may find solace in the unleashing potential of DRIP, designed to amplify inverse performances by 200% against the same index.

Prudent investors must warrant, however, these funds align with short-term strategies due to the daily compounding effect. Failure to adhere may thwart anticipated outcomes, skewing realized performances.

Insights into GUSH and DRIP

As GUSH navigates a tumultuous year marked by fleeting peaks and valleys, recent sessions have seen the ETF languish beneath key moving averages. Yet, a steadfast support at $27 hints at possible resurgence, buoyed by fundamental undercurrents.

- Echoing a disparate tune, DRIP weathered a rocky commencement in 2024, only to find its footing post-April downturns. With recent gains bolstering the bearish sentiment, DRIP’s resolve may face a litmus test at resistance levels hovering between $12 and $13.

Photos by Pete Linforth on Pixabay.

This post contains sponsored content. It serves informational purposes and is not tantamount to investment counsel.