Sector Analysis: Financial Landscape

The cannabis industry witnessed a 15.24% plunge in the MSOS ETF following regulatory delays, intensifying market volatility on the brink of a pivotal election season with conflicting cannabis policies rife. Remarkably, amidst this whirlwind, a cadre of cannabis penny stocks, valued lower than a McDonald’s Big Mac, emerged as sturdy pillars in the turbulence.

The Financial Resilience of Select Players

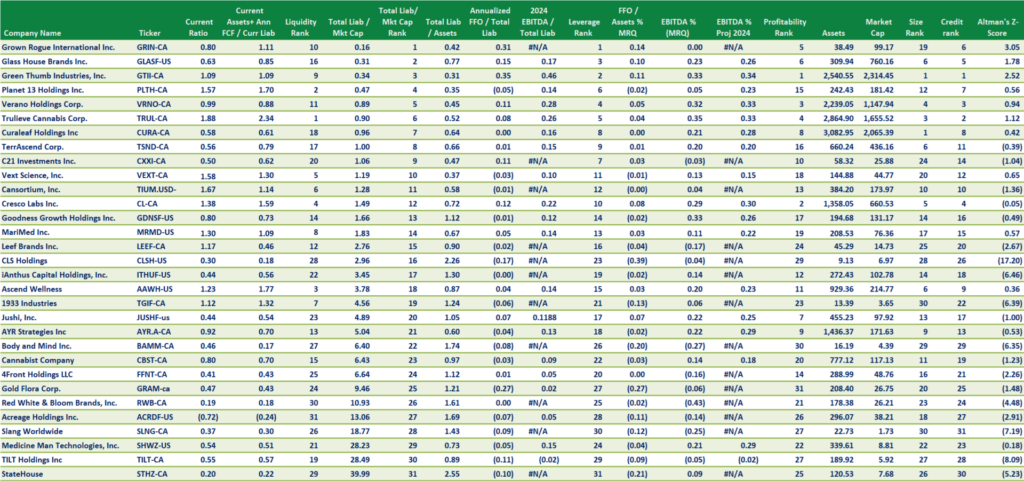

Data from Viridian Capital Advisors reveals a median debt-to-EBITDA ratio of 2.98 among cannabis companies, implying a sustainable debt stance amid prevailing challenges linked to tax codes like the 280e. Nevertheless, the top quartile showcases high leverage ratios, raising flags about the industry’s financial stability, teetering on a precarious edge of uncertainty.

Notable Performers Embrace Market Challenges

Companies like Vext Science, C21 Investments, and iAnthus Capital Holdings demonstrated financial acumen amid adversity. Vext Science, with a stock price decline despite steady trade volumes, eyes growth through strategic expansions. Meanwhile, C21 Investments weathered inflationary pressures, reporting marginal revenue gains and positive cash flows. iAnthus, although experiencing stock price dips, showcased credit metric improvements and impressive revenue figures.

Scrutinizing Credit Concerns Across the Board

Conversely, players like TerrAscend, AYR Strategies, and MariMed faced credit rating downgrades, signaling struggles in financial health, as total liabilities eclipsed market cap ratios. Red White & Bloom, Acreage, and Slang Worldwide grappled with alarming financial ratios, sounding the alarm bells for potential distress.