Ciena Corporation CIEN and Arelion have made history by achieving the first-ever 1.6 terabits-per-second (Tb/s) wavelength data transmission in a live network field trial. This remarkable feat was accomplished through the utilization of Ciena’s advanced WaveLogic 6 Extreme (WL6e) technology, marking a significant advancement in data transmission capabilities.

Revolutionizing Data Transmission

Spanning over Arelion’s 470km route connecting Ashburn, Virginia (Equinix) and Telxius’ Virginia Beach cable landing station, this breakthrough has greatly enhanced connectivity between crucial Points-of-Presence (PoPs) in Arelion’s expansive North American network.

Addressing the myriad connectivity challenges faced by multinational enterprises worldwide, Arelion’s innovative approach provides IP services for seamless global Internet access. Their cutting-edge solutions encompass enterprise, networking, and mobile data services, enabling the seamless connection of critical content and applications to global audiences.

Meeting Industry Demands

Following the successful trial, Arelion is set to deploy Ciena’s WL6e technology network-wide to cater to the ever-growing bandwidth requirements fueled by the demands of 5G, AI/ML applications, cloud services, and content delivery for both wholesale and enterprise clientele.

This milestone wouldn’t be possible without the leap in energy efficiency and performance offered by WL6e, delivering a 50% reduction in space and power consumption per bit and a 15% boost in spectral efficiency compared to its predecessors. Arelion is poised to provide multiple 400 and 800 gigabits-per-second (Gb/s) services with the 1.6 Tb/s line capacity, enhancing traffic handling capabilities and accelerating connectivity speeds across its network.

Driving Innovation and Efficiency

In addition to WL6e, Ciena’s open, programmable 6500 Reconfigurable Line System (“RLS”) played a crucial role in the demonstration. RLS streamlines and automates network service provisioning and reconfiguration processes, underscoring Arelion’s commitment to open optical networking and advanced coherent optic solutions that drive performance enhancements, energy efficiency improvements, and cost-saving measures.

Ciena, a global leader in optical and routing systems, services, and automation software, specializes in building adaptive networks to address the ever-rising digital demands and deliver seamless user experiences in an increasingly connected world.

Despite a 19.6% year-over-year revenue decline in the second quarter of fiscal 2024, totaling $910.8 million, primarily due to slower-than-expected recovery in order volumes from service providers, Ciena remains optimistic. The sustained demand for bandwidth, driven by increased cloud adoption and widespread utilization of AI technology, positions the company for future growth.

Ciena’s Market Performance

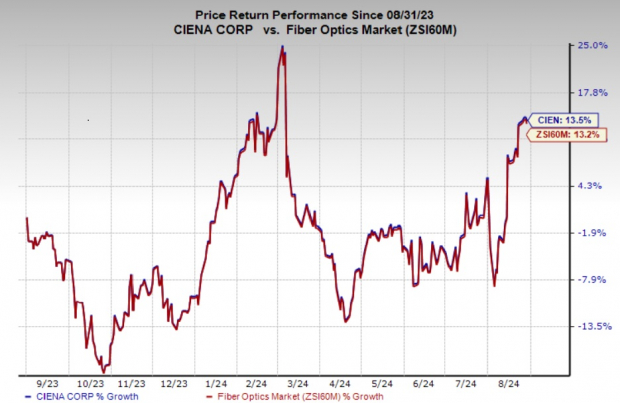

Currently holding a Zacks Rank #3 (Hold), CIEN’s stock has witnessed a 13.5% increase over the past year, outperforming the sub-industry’s growth of 13.2%.

Image Source: Zacks Investment Research

Exploring Investment Opportunities

For investors seeking opportunities in the tech sector, consider stocks like Manhattan Associates, Inc. MANH, ANSYS, Inc. ANSS, and Adobe Inc. ADBE. MANH boasts a Zacks Rank #1 (Strong Buy), while ANSS and ADBE hold a Zacks Rank #2 (Buy) each.

Manhattan Associates has consistently delivered positive earnings surprises, with the Zacks Consensus Estimate for 2024 earnings showing an upward trend. ANSYS and Adobe also exhibit strong growth potential, backed by solid earnings performance and long-term growth expectations in the tech sector.

Investors eyeing the tech industry for growth opportunities may find promising options in these companies.