Nvidia Corp NVDA is poised to unveil its highly anticipated earnings report for the fiscal second quarter of 2025 following tomorrow’s closing bell. Analysts remain mostly optimistic about NVDA stock, but uncertainties have emerged, setting the stage for a fierce battle. This presents agile traders with the chance to navigate both bull and bear markets for potential profits.

Wall Street Anticipation

Experts on Wall Street project Nvidia to achieve earnings per share (EPS) of 64 cents. In the comparable quarter a year ago, the company reported EPS of 25 cents (adjusted for splits). Revenue estimates stand at $28.68 billion, notably surpassing the $13.51 billion recorded in fiscal Q2 2024.

The spotlight will be on Nvidia’s adept communication regarding artificial intelligence. Over the past five years, NVDA stock has soared over 2,918%, primarily driven by its cutting-edge graphics processors supporting various AI applications, making the company a pivotal player in the race for machine intelligence development.

Diverging Views

Despite the bullish sentiment, some remain skeptical about NVDA stock’s future trajectory. Market analyst Steve Grasso recently divested his entire Nvidia holdings ahead of the Q2 report, opting to observe the stock’s performance before considering re-entry. Additionally, Goldman Sachs raised concerns about the potential productivity returns justifying the projected $1 trillion investment in AI by enterprises over the upcoming years.

The ETF Opportunity

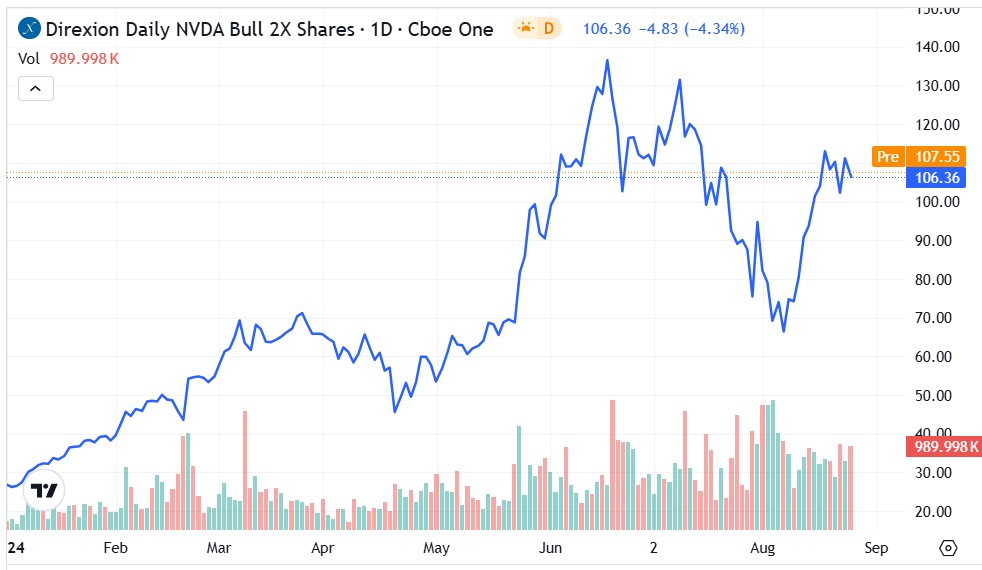

Amidst the mixed opinions surrounding NVDA stock, Direxion’s Nvidia-centric exchange-traded funds provide a stage for capitalizing on market dynamics. The Direxion Daily NVDA Bull 2X Shares NVDU cater to bullish investors, seeking to deliver 200% of NVDA’s daily returns.

On the flip side, the Direxion Daily NVDA Bear 1X Shares NVDD offer a viable means for contrarians to short the semiconductor giant, mirroring 100% of NVDA’s inverse performance.

While Direxion’s ETFs present an accessible way for retail investors to leverage or short securities without delving into the intricacies of options trading, caution is advised due to the inherent risks. These products are more suited for short-term positions to prevent value erosion.

Performance Analysis

NVDU ETF Review: NVDU closely mirrored NVDA’s performance but in an amplified manner, delivering nearly 298% gains since the year’s commencement, eclipsing NVDA’s 162.5% increase during the same period.

- NVDU displayed solid support around the $70 mark, with a recent trend of forming higher lows since June 18.

- Bulls are eyeing a breakout above the $109 consolidation level, aiming for the psychologically significant $120 threshold.

- Increasing acquisition volume signals rising demand, reinforcing positive sentiment towards NVDU.

NVDD ETF Assessment: In stark contrast, the NVDD ETF struggled this year, witnessing a steep 68% decline in market value since January. Efforts to maintain key support levels faltered as NVDA stock surged.

- NVDD remains below the 50-day moving average ($7.97) and the 200 DMA ($13.52), ending Monday at $7.28 below the crucial $7.50 support line.

- Bears aim to reclaim support at $7.50 and breach the $8 mark, with hopes pinned on a lackluster Q2 earnings report.

- Robust acquisition volume for the bearish fund indicates growing interest in contrarian positions, possibly implying overcrowding in bullish sentiment.