Investors often ponder over analyst suggestions before making investment decisions. Brokerage recommendations tend to sway market sentiment, but do these evaluations truly hold weight?

Before delving into the reliability of brokerage inputs, let’s scrutinize MINISO Group Holding Limited Unsponsored ADR (MNSO) and what the financial gurus of Wall Street have voiced about it.

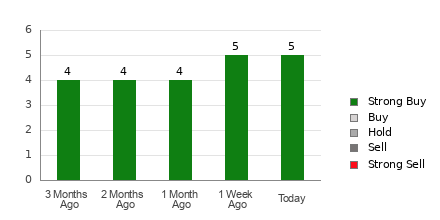

Currently holding an average brokerage recommendation (ABR) of 1.00 on a scale of 1 to 5 (ranging from Strong Buy to Strong Sell), MINISO Group Holding Limited has garnered this rating from five brokerage firms. All five have bestowed a Strong Buy rating, representing a unanimous 100% of all recommendations.

Evolution of Broker Recommendations for MNSO

The ABR advises purchasing MINISO Group Holding Limited, but blindly basing investment verdicts on this data might prove shortsighted. Research indicates that broker ratings exhibit limited efficacy in guiding investors towards stocks poised for significant appreciation.

Curious as to why? Brokerage organizations’ vested interests in the covered stocks often lead analysts to exhibit marked positivity in their assessments. Studies show that for every “Strong Sell” directive, brokers assign five “Strong Buy” ratings.

Thus, relying solely on brokerage recommendations may not align with the best interests of retail investors when gauging a stock’s future price trajectory. It’s recommendable to use such intel to corroborate personal analysis or employ tools renowned for predicting stock movements.

With a laudable audited historical performance, our internally developed Zacks Rank tool categorizes stocks into five brackets, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), proving reliable in signaling a stock’s immediate price potential. Thus, juxtaposing the Zacks Rank against ABR could assist in making astute investment calls.

Decoding the Dissimilarities Between Zacks Rank and ABR

Although both Zacks Rank and ABR feature on a 1 to 5 scale, they are fundamentally distinct metrics.

ABR is gleaned solely from broker suggestions and is commonly expressed in decimals. Conversely, Zacks Rank is a quantitative model harnessing earnings estimate revisions expressed in whole numbers from 1 to 5.

Brokerage analysts’ overtly optimistic ratings stem from institutional biases, frequently leading to inflated recommendations that misguide rather than aid investors. In stark contrast, Zacks Rank revolves around earnings estimates, reflecting a robust correlation between estimate trends and stock price movements in the short term.

Moreover, Zacks Rank grades are uniformly applicable across stocks with associated earnings estimates provided by brokerage analysts for the ongoing year, ensuring equitable distribution among the five categories at all times.

One significant disparity between ABR and Zacks Rank is their timeliness. ABR may lag in updates, whereas Zacks Rank swiftly absorbs analysts’ revised estimates, thereby ensuring adequacy in predicting future stock valuations.

Is MINSO a Lucrative Investment?

Concerning earnings estimate variations for MINISO Group Holding Limited, the Zacks Consensus Estimate for the current year has recently dipped by 1.1%, settling at $1.21.

Analysts’ growing pessimism regarding the company’s earnings outlook, evidenced by substantial consensus in revising EPS estimates downward, may result in a potential short-term setback for the stock. Consequently, MINISO Group Holding Limited has garnered a Zacks Rank #4 (Sell).

Given these considerations, treating the Buy-equivalent ABR for MINISO Group Holding Limited with discernment may prove wise.

An Infrastructure Stock Resurgence Beckons America

An impending surge to revamp the dilapidated U.S. infrastructure is imminent. A bipartisan, pressing, and unavoidable initiative awaits. A colossal financial outlay looms ahead, promising wealth creation.

The pivotal question remains, “Will you stake early claims in propitious stocks, poised for maximal growth?”

Zacks has unveiled a Special Report to guide this discerning venture, now accessible for no charge. This compendium reveals five specialized entities slated to flourish amidst extensive renovation and fortification endeavors across roads, bridges, structures, freight transport, and energy advancements of monumental proportions.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>