Faced with an array of oversold stocks in the consumer discretionary sector, investors find a silver lining in the potential to capitalize on undervalued companies.

One yardstick that traders rely on, the Relative Strength Index (RSI), offers insights into a stock’s performance trajectory based on its strength during upward and downward price movements. When the RSI dips below 30, it flags a share as being oversold, marking a potential buying opportunity.

Highlighted below are three prominent players in the consumer domain with RSI levels hovering around or under the 30 mark, indicating they may be ripe for a rebound.

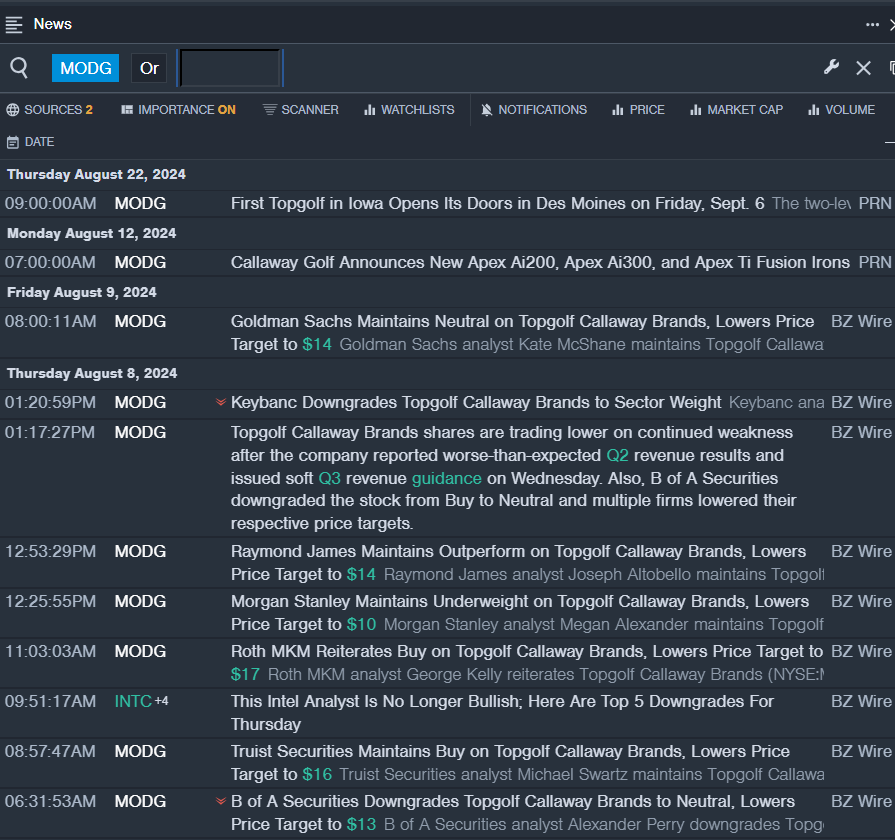

Chipped but Not Broken: Topgolf Callaway Brands Corp (MODG)

- While it might seem like an uphill battle for Topgolf Callaway Brands with disappointing second-quarter revenue results and a lackluster third-quarter outlook, Chip Brewer, the company’s President and CEO, remains steadfast. Despite economic headwinds, including adverse FX trends and inflationary pressures, Brewer lauds the team’s efforts in bolstering market share within the products division and enhancing digital capabilities at Topgolf venues. The stock, down 27% in the past month, hit a 52-week low of $9.84.

- RSI Value: 29.11

- MODG Price Action: Topgolf Callaway Brands shares closed at $11.38, marking a 2.5% decline on Thursday.

Battling the Storm: Red Robin Gourmet Burgers Inc (RRGB)

- Aug. 22 marked a setback for Red Robin as the company reported disappointing second-quarter earnings and revised its full-year revenue forecast downwards. G.J. Hart, President, and CEO of Red Robin, expressed surprise at the industry-wide slowdown impeding progress despite strides made in the fulfilling the North Star plan. With a 22% drop over the past month, Red Robin shares hit a yearly low of $4.50.

- RSI Value: 26.81

- RRGB Price Action: Red Robin Gourmet Burgers closed at $4.73, registering a 6.3% fall on Thursday.

Seeking a Genius Play: Genius Group Ltd (GNS)

- Genius Group recently announced a reverse stock split, signaling strategic maneuvers. With a 32% decline in share value over the past five days, the stock saw a bottom of $1.03 in its 52-week range.

- RSI Value: 25.58

- GNS Price Action: Genius Group shares closed at $1.07, reflecting a 12.3% drop on Thursday.