For savvy investors, the current climate presents a unique chance to delve into the world of health care stocks that have been unjustly overlooked. These undervalued gems might just be ripe for the picking as they gear up to make a triumphant comeback.

One method to identify potential winners is through the Relative Strength Index (RSI), a tool that compares a stock’s performance on up days versus down days. When this indicator dips below 30, it typically signals that a stock is oversold, hinting at a potential upswing in the near future.

Without further ado, let’s dive into the top three health care stocks that are currently flashing attractive RSI signals, poised for a rebound.

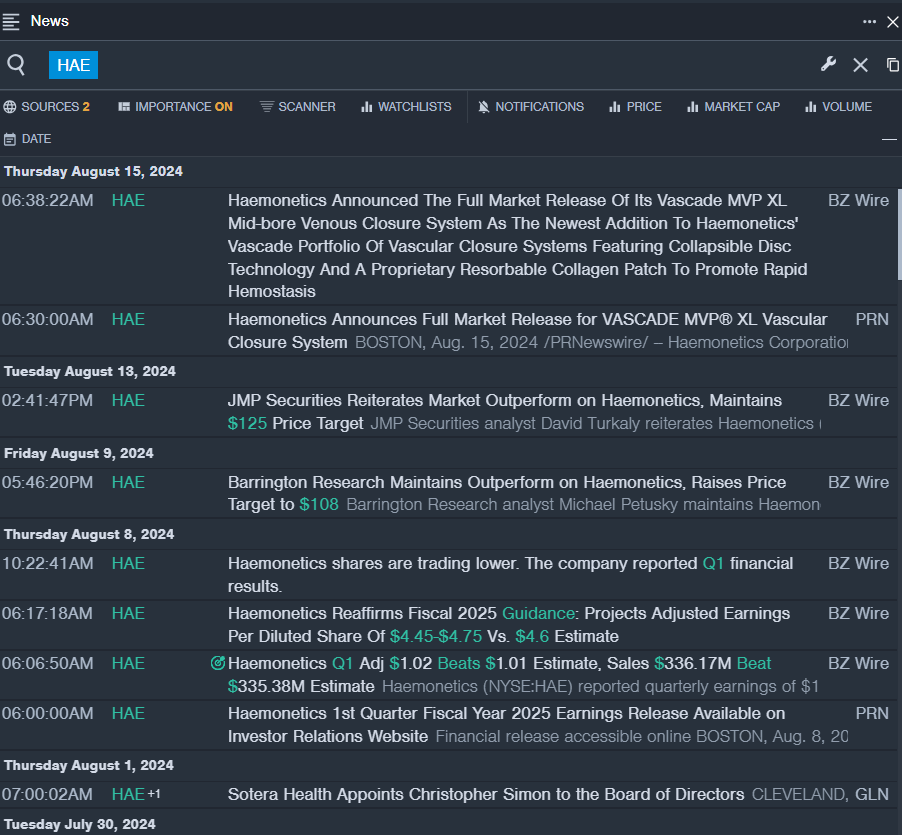

Haemonetics Corporation – HAE

- Haemonetics recently stunned investors with quarterly earnings that surpassed expectations. Despite this, the company’s stock has taken a tumble of approximately 19% over the past month, hitting a 52-week low of $70.74.

- RSI Value: 25.47

- HAE Price Action: Observant traders noted a 1.1% rise in Haemonetics’ shares, closing at $73.99 on the latest session.

Immunitybio Inc – IBRX

- ImmunityBio made waves by revealing a promising study involving ANKTIVA alongside the AdHER2DC cancer vaccine as a potential treatment for endometrial cancer. Despite this groundbreaking news, the company’s stock has plunged by around 38% in the last month, hitting a 52-week low of $1.25.

- RSI Value: 29.87

- IBRX Price Action: In a surprising turn of events, Immunitybio’s stocks edged up by 2.6%, closing at $3.98 in the most recent trading session.

Progyny Inc – PGNY

- Progyny Inc recently reported a disappointing second-quarter revenue, causing a stir among investors. Despite reassuring statements from CEO Pete Anevski regarding treatment demand, the company’s shares have seen a significant drop of approximately 31% in the last month, reaching a 52-week low of $19.60.

- RSI Value: 29.06

- PGNY Price Action: Mirroring a potential turnaround, Progyny saw a 1.7% surge in its shares, closing at $20.85 in the latest trading session.

These companies, once flying under the radar, may be on the cusp of a resurgence as market conditions shift. Keep a keen eye on these health care stocks as they gear up for a potential rebound in the coming weeks.

Read Next: