Investor Acumen: Uncovering Ford’s Recent Struggles

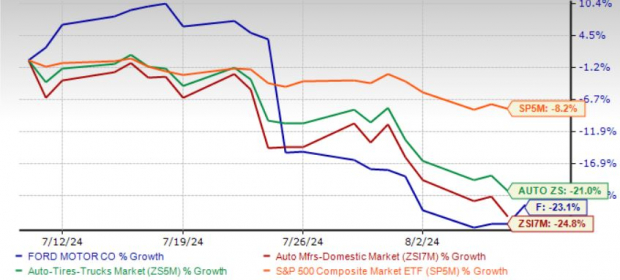

Shares of the renowned American automaker Ford (F) have recently taken a substantial 23% downturn on the stock market, triggered chiefly by disappointing second-quarter financial results. Investors were left disheartened as Ford’s earnings per share fell short of expectations and its net income dropped over 5% year-on-year to $1.8 billion.

Comparative Analysis: Ford Versus General Motors

In stark contrast, Ford’s competitor General Motors (GM) painted a rosier picture by surpassing second-quarter earnings estimates, ramping up sales, and uplifting full-year profit projections. Where General Motors flourished, Ford’s unchanged profit forecast for 2024 quashed investor hopes for a more optimistic future.

Leveraging Opportunity: Ford Pro’s Resilience

Amidst this turmoil, Ford’s bright spot shines through its commercial vehicle division, Ford Pro, boasting a remarkable operating margin of 15.1% in the second quarter – outperforming all other divisions within Ford. Strong demand for Super Duty trucks and Transit commercial vans has been a driving force behind this success.

Emerging Challenges: Ford Model e’s Struggle

However, not all divisions within Ford have been as prosperous. The electric vehicle (EV) segment, Ford Model e, recorded losses amounting to $1.1 billion in the second quarter. Lower sales volumes, pricing pressures, and high manufacturing costs have weighed heavily on the division, posing a significant threat to Ford’s overall profitability.

Steering Through Adversity: Assessing Ford’s Future Trajectory

Despite these challenges, Ford Pro’s ongoing strength is expected to counterbalance losses from the EV segment. Yet, uncertainties loom large, particularly regarding Ford’s ability to boost vehicle quality, cut costs, and revamp its struggling EV business. The road ahead remains fraught with obstacles, demanding a strategic yet cautious approach from Ford to navigate these turbulent times.

Valuation Insights: Ford’s Investment Appeal

From an investment perspective, Ford’s current valuation presents an attractive opportunity. Trading at a forward sales multiple of 0.24, well below the industry average and its historical averages, Ford’s Value Score of A beckons to value-conscious investors seeking potential growth and returns.

Parting Thoughts: Navigating Uncertainty in the Automotive Sector

As Ford stands at a crossroads, balancing financial challenges with operational resilience, investors are advised to tread carefully. While Ford’s value proposition remains enticing and Ford Pro demonstrates steadfastness, internal hurdles such as elevated costs and tepid EV demand cast shadows over the company’s path to recovery. In these times of uncertainty, a cautious wait-and-see strategy might be prudent for new investors, while existing shareholders grapple with the decision of retaining their positions amidst Ford’s volatile journey forward.

Analyzing the Landscape: Ford’s Place Amidst Competitors

The Path Forward for Ford

Struggling with the challenging climate of rising raw material costs and supply chain disruptions, Ford Motor Company seeks stability amidst turbulent waters. Despite such difficulties, the ranking of Zacks #3 (Hold) illuminates a tempered optimism for the company’s future prospects.

Research Chief’s Insight

Indicative of the evolving landscape, the millennial and Gen Z-driven markets have been a focal point for Ford, raking in a substantial revenue of nearly $1 billion in the previous quarter alone. The recent market retracement presents a ripe opportunity to embark on the Ford journey, reminiscent of the historical success stories like Nano-X Imaging’s remarkable surge of +129.6% over a concise span of 9 months.

A plethora of stocks claim elite status, however, one must exercise caution in selecting the standout performer. The ebbs and flows of the market can toss and turn seemingly impregnable stalwarts, underscoring the importance of diligence and thorough research.

With multiple contenders vying for a dominant position in the market, Ford finds itself amidst illustrious company, including the likes of General Motors Company, Tesla Inc., and Rivian Automotive Inc. Each competitor brings its unique set of challenges, driving Ford to push the boundaries of innovation and efficiency.