Celestica Inc. CLS recently unveiled SC6100, a cutting-edge, 2U rackmount all-flash storage controller aiming to elevate performance for enterprise application workloads. Flanked by two EPYC Embedded 9004 series processors from Advanced Micro Devices, Inc. AMD, this innovation promises enhanced energy efficiency for upcoming networking, security, and storage applications.

Leveraging the new “Zen 4” core architecture, the SC6100 accommodates up to 24 dual-port U.2 PCIe Gen 5 solid-state drives with versatile input/output configurations and hot-swappable components for unwavering uptime and reliability. This robust infrastructure offers a secure, cost-efficient storage solution for enterprises navigating the realms of vast data generation, storage, and real-time analytics driving strategic decisions.

Driving Forces for Growth

Celestica has notably been riding the wave of the burgeoning generative AI sector, propelled by the sturdy demand for AI/ML compute and networking products from hyperscale players. Besides the high-powered 800G family of network switches and storage solutions like the SC6100 controller, Celestica offers the SD6200 platform – a scalable data storage solution tailored for AI endeavors. Their groundbreaking Photonic Fabric, an optical compute and memory fabric, acts as a turbocharger for AI infrastructure, furnishing a bedrock technology to advance AI while ensuring scalable, sustainable, and profitable business models.

By integrating state-of-the-art networking products with silicon photonics packaging solutions, Celestica strives for optimal supply chain solutions to expedite time-to-market delivery. The coupling of data center switches with optical transceivers has the capacity to manage copious amounts of inbound and outbound network traffic, catering to the surging demand for data center bandwidth supporting AI/ML and data analytics applications.

Embracing Enhanced Production Capabilities

With the escalating proliferation of AI-centric applications and generative AI tools, corporations are compelled to scale their future computing platforms to handle the mounting AI workloads with low-power, high-bandwidth data transfers, escalating the I/O bandwidth exponentially.

To fortify its dominant position in AI-enabled products, Celestica is embarking on the expansion of more than 100,000 square feet of additional capacity in Thailand while augmenting its production capabilities with an additional 80,000 square feet in Malaysia. Besides, Celestica is collaborating with industry giants to commercialize cutting-edge technologies like On-Board Optics and Co-Packaged Optics, catering to the need for swift and cost-effective solutions amidst the evolving tech landscape.

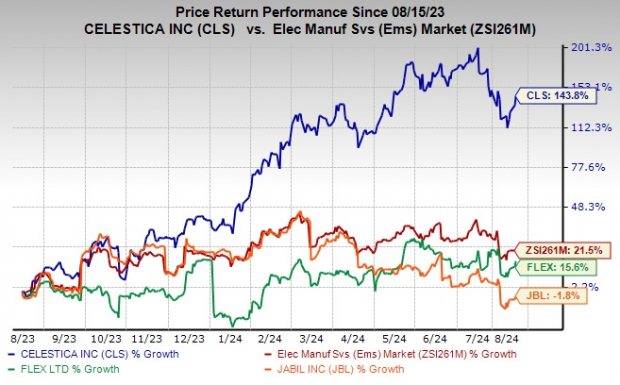

Price Performance and Future Projections

Fuelled by robust AI adoption, Celestica has seen a remarkable surge of 143.8% over the last year, overshadowing the industry’s growth of 21.6%. Demonstrating dominance over competitors like Flex Ltd. FLEX and Jabil Inc. JBL during this period, Celestica has emerged as a stealth winner of the AI revolution. Rooted in Toronto, Canada, Celestica functions as an unsung hero of the AI transformation, offering end-to-end solutions in the electronics domain, from design to manufacturing to supply chain management. With a diverse product suite integral to AI applications, Celestica’s shapeshift in recent years has bestowed a competitive edge within the broader tech market.

Heightened Industry Position

Anticipated escalations in the use of silicon photonics across varied sectors like automotive, data centers, high-performance computing, telecommunications, medical, aerospace, and defense bode well for Celestica. Fueled by robust infrastructure investments, sound technological acumen, and an extensive industry experience spanning three decades, Celestica stands primed for sustainable growth. Backed by an impressive trailing four-quarter average earnings surprise of 12.2%, and a VGM Score of A, Celestica currently holds a Zacks Rank #1 (Strong Buy), projecting a compelling narrative for future stock price appreciation and promising returns for prospective investors.