Small-cap stocks toasted their third consecutive week of gains, propelled by rising investor confidence in interest rate-sensitive industries and firms, buoyed by strong expectations of a looming Federal Reserve rate cut in September.

Investors have priced in a 100% probability of a Fed rate reduction within the next two months, with nearly three cuts anticipated by the end of the year, as per CME Group’s FedWatch tool.

This positive sentiment is underpinned by the absence of concerns over an impending economic slowdown, creating an environment particularly conducive to small-cap equities.

Recent economic reports unveiled that the U.S. economy accelerated its growth at a 2.8% annualized rate in the second quarter, surpassing the anticipated 2% surge and doubling the first-quarter performance. Additionally, jobless claims exhibited a decline last week, alleviating worries of a swift deterioration in labor market conditions.

As real expansion has strengthened, price pressures have notably relaxed. The previous month saw a prominent Federal Reserve inflation measure dip to 2.5%, its lowest point since February 2021.

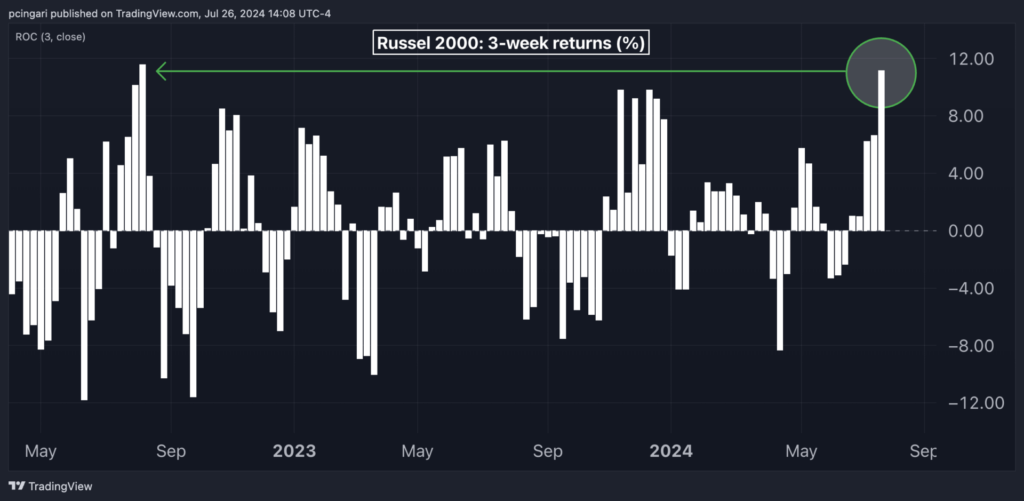

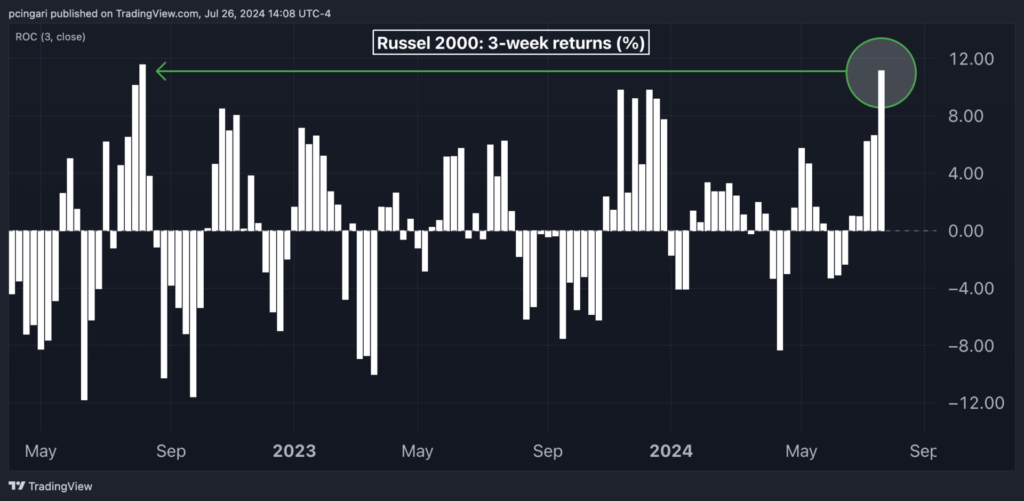

Over the past three weeks, small-cap stocks have surged over 11%, marking their most robust three-week upswing since August 2022.

In July, the iShares Russell 2000 ETF IWM raked in over $6 billion in inflows, recording the highest influx year to date.

Chart: Russell 2000 Index Shows Strongest Three-Week Rally In Nearly Two Years

Small Caps Indicate Confidence In Strong Economic Environment

Small caps are seen as ‘an economic barometer,’ according to Quincy Krosby, chief global strategist for LPL Financial.

Krosby explains that the expectation of rate cuts has fueled a surge in smaller stocks, which are more reactive to interest rate shifts than the S&P 500, especially when compared to the tech giants that have dominated the market for much of the year.

Appealing valuations have further bolstered this trend. Krosby points out that the stability and gains in the broader financial sector have positively influenced the Russell 2000, which has a significant weighting tied to small to mid-sized banks.

Current data suggests that while the economy is slowing down, it is not on the brink of collapse, as noted by Krosby.

Krosby indicates that the ongoing inflows into small-cap stocks, amidst political and economic uncertainties, signal investor trust in a robust economic backdrop combined with expected lower interest rates.

However, she warns that small-cap equities, with their higher risk profile relative to the S&P 500, are susceptible to rapid sell-offs if investors perceive a notable shift in the economic trajectory.

The upcoming week will focus on a substantial array of economic data, including the payroll report, factory orders, the FOMC meeting, and crucial technology earnings reports, which are expected to continue supporting the revival of small-cap stocks.

Read Next:

Don’t miss the chance to excel in a volatile market at the Benzinga SmallCAP Conference on Oct. 9-10, 2024, at the Chicago Marriott Downtown Magnificent Mile. Gain exclusive access to CEO presentations, one-on-one meetings with investors, and valuable insights from top financial experts. Whether you’re a trader, entrepreneur, or investor, this event offers unparalleled opportunities to expand your portfolio and network with industry leaders. Reserve your spot and secure your tickets today!

Image created using artificial intelligence via Midjourney.