Nvidia, a semiconductor juggernaut, faces a perilous path ahead. In a recent cautionary missive, investment firm Raymond James sends shivers through the market by predicting a potential 16% nosedive in Nvidia’s stock price. This projection from analyst Javed Mirza comes as Nvidia’s shares have already taken a tumble from their lofty 52-week peak of $140.76 per share to the current trading waters at $113.06. Should Mirza’s prophecy hold true, the chip maker’s market value could plummet to a disheartening $94.94 per share.

Mirza cites a concerning sign: Nvidia has tripped a ‘mechanical sell signal’ according to the moving average convergence/divergence indicator gauging price momentum. Furthermore, the stock is inching below its 50-day moving average, signaling the emergence of selling pressures. These red flags hint at a looming 1-3 month correctional phase. If Nvidia’s stock continues to breach the 50-day moving average over several successive days, the analyst sees a probable trajectory towards the forewarned price target.

Rollercoaster of Sentiment for NVDA Stock

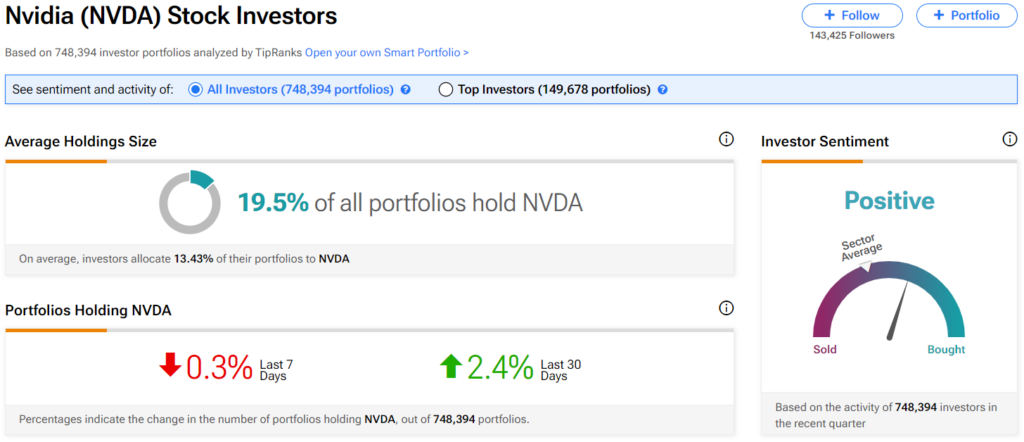

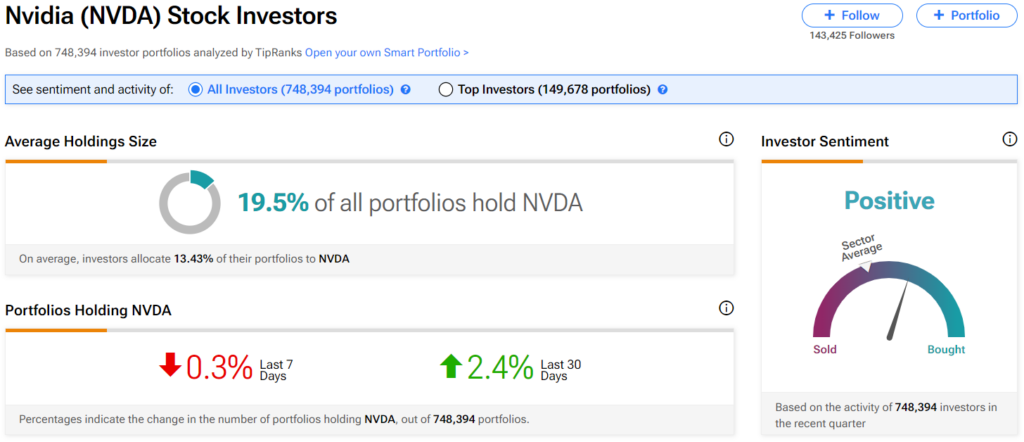

Despite the foreboding forecast, optimism lingers in the hearts of investors. TipRanks’ data reveals a positive outlook among stockholders, with 19.5% of the 748,394 tracked portfolios invested in Nvidia. Moreover, those who have taken the plunge allocate an average portfolio weight of 13.43% towards the chip giant, showcasing unwavering faith in its future performance.

Over the past month, 2.4% of existing stockholders have upped their stakes, further underscoring the buoyant sentiment surrounding Nvidia’s shares. This sentiment outpaces the sector average, painting a rosy picture amidst the brewing storm.

The Elusive Target Price for NVDA

On the flip side, Wall Street analysts cling to a Strong Buy consensus for NVDA stock. With 37 Buy ratings versus a mere 4 Holds and no Sells over the last three months, optimism prevails in the analyst community. Following a staggering 146% surge in share price over the past year, the average price target for Nvidia hovers at $142.74 per share, forecasting a promising 26.25% upside potential.

For more insights on NVDA analyst ratings, click here.