Much akin to Wile E. Coyote’s sudden discovery of gravity after careening off a cliff, Intel (INTC) saw a nosedive in its share price today, plunging over 5% following an initial uptick earlier in the week despite an industry-wide chip slump.

The culprit for Intel’s stumble? CrowdStrike (CRWD). An extensive outage that hit the cybersecurity firm had a ripple effect on Intel, a major supplier of processors to CrowdStrike. Though no direct link between the processors and the security glitch was established, the mere association was ample to spook investors into fleeing from the supposedly fragile stock.

An Unwelcome Perception for Intel

This fragility image couldn’t have struck at a worse time for Intel, grappling with ongoing CPU stability issues that seem to be worsening. Originally confined to desktops, reports now highlight the problem seeping into laptops, prompting customers like Alderon Games to trade Intel hardware for AMD chips.

Adding to Intel’s woes, rumors swirl around the next-gen desktop chips potentially overheating, with projections pegging them to reach laptop chip levels of heat. The upcoming Arrow Lake and Panther Lake chips might max out at 105 degrees Celsius, triggering automatic throttling post that threshold.

Intel’s Investment Appeal: Buy, Sell, or Hold?

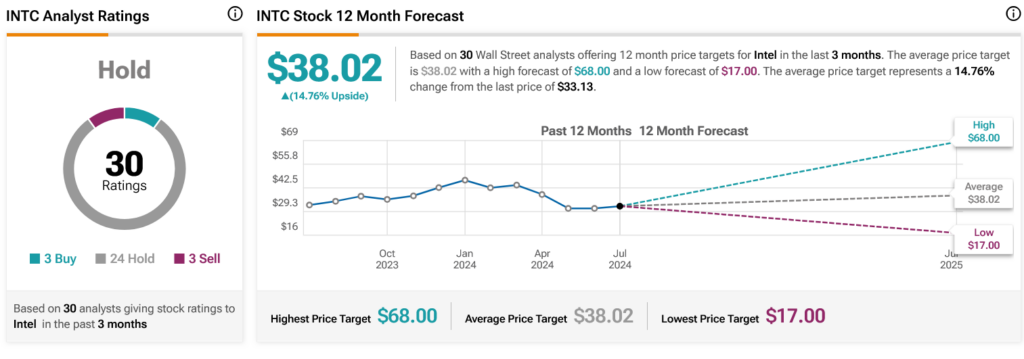

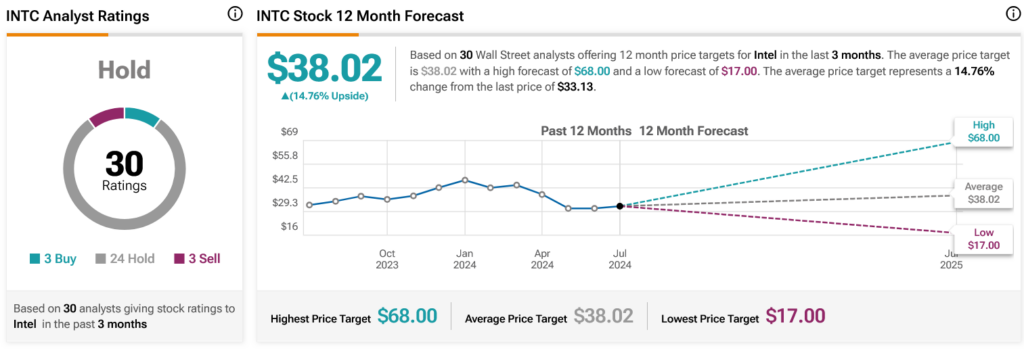

On Wall Street, Intel has garnered a Hold consensus with analysts: three Buy ratings, 24 Holds, and three Sells in the past three months. Despite a meager 0.36% rise in the share price over the last year, the average price target of $38.02 per share forecasts a 14.76% upside potential.