The Resilience of Apple Inc. (AAPL) Amidst Market Trends

Apple (AAPL) has captured the attention of many investors recently, with its stock showcasing noteworthy performance amidst market fluctuations. As the maker of iconic products such as iPhones and iPads, Apple has managed to outperform the Zacks S&P 500 composite over the past month, displaying a robust growth trajectory within the Zacks Computer – Mini computers industry.

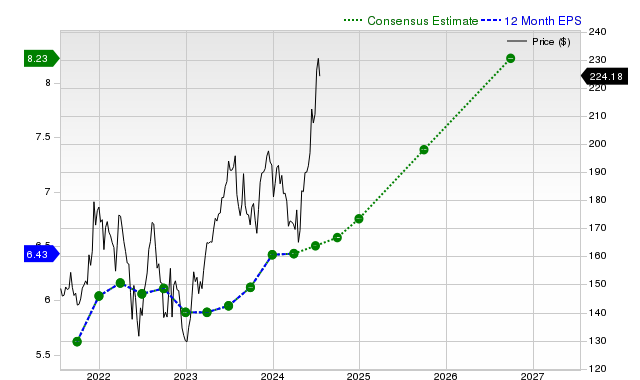

Assessing Earnings Estimates – A Key Indicator

Delving into the realm of earnings estimates, a critical determinant of a stock’s value, presents a compelling case for Apple. The modification of earnings projections by sell-side analysts serves as a pivotal factor in assessing the stock’s trajectory. The consensus estimates for the current and upcoming fiscal years indicate a positive outlook, showcasing growth potential for the tech giant.

Projected Revenue Growth and Historical Performance

Foreseeing the revenue trajectory of a company is vital in evaluating its financial stability. Apple’s estimated sales figures for the quarters ahead demonstrate a steady upward trend, reflecting a positive outlook. Furthermore, historical performance metrics such as revenue and EPS surprises underscore Apple’s consistent ability to surpass expectations, a testament to its operational efficiency.

Valuation and Market Positioning

Evaluating Apple’s valuation metrics provides insights into its market positioning. By comparing price-to-earnings and price-to-sales ratios with historical data, investors gain a nuanced understanding of the stock’s intrinsic value. Apple’s current valuation indicates a premium status relative to its peers, suggesting a strong market presence despite premium pricing.

Final Thoughts on Apple Inc. as an Investment

In conclusion, the comprehensive analysis of Apple Inc. (AAPL) unveils a promising investment opportunity amidst the current market landscape. While market buzz may fluctuate, Apple’s Zacks Rank #2 (Buy) signifies a bullish sentiment, hinting at a potential outperformance compared to broader market indices in the near future.

Infrastructure Stock Boom to Sweep America

A monumental drive to revamp the U.S. infrastructure beckons on the horizon, heralding a wave of opportunities for investors. With trillions set to be invested, astute investors stand to reap substantial rewards in this transformative landscape.

The only question remains – are you poised to capitalize on this monumental shift and maximize gains as the infrastructure sector gains momentum?