The Significance of Analyst Recommendations

When contemplating investment decisions, one often turns to Wall Street analysts for guidance. These financial gurus, employed by prestigious brokerage firms, can sway market tides with their rating modifications. But, are their verdicts truly gospel truth?

Before we delve into the prognostications of esteemed analysts regarding Ulta Beauty (ULTA), let’s explore the credibility of broker recommendations and how savvy investors can leverage them.

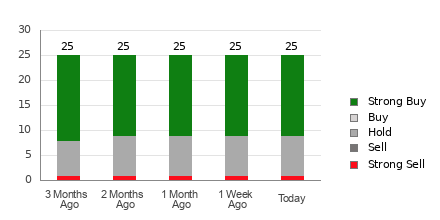

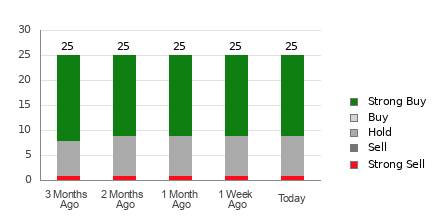

Ulta’s average brokerage recommendation (ABR) currently stands at 1.80 on a scale from 1 to 5, hinting at a ‘buy’ sentiment based on inputs from 25 brokerage entities. This equates to a rating treading the boundary between ‘Strong Buy’ and ‘Buy’.

Out of these 25 recommendations, a substantial 64% endorse Ulta as a ‘Strong Buy’.

Brokerage Recommendation Trends for Ulta

While the ABR leans towards a favorable outlook on Ulta, it’s imprudent to base investment decisions solely on this metric. Numerous studies have exposed the limitations of brokerage advice in predicting stocks with the most promising upward trajectory.

Why the skepticism? Analysts, to a large extent, exhibit a conspicuous bias towards favoring stocks they cover, often showering them with unwarranted accolades. Research indicates that for every ‘Strong Sell’ recommendation, there are five ‘Strong Buy’ endorsements.

Thus, their interests may not always align with those of individual investors, failing to provide a reliable compass for a stock’s future path. Instead, it’s best to treat these recommendations as a validation tool for personal research or a yardstick with a proven track record in gauging stock movements.

With a proven audited history, the Zacks Rank, our proprietary stock evaluation tool categorizing stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), emerges as a dependable gauge for gauging a stock’s short-term price performance. Hence, juxtaposing the ABR with Zacks Rank could enrich your investment decision-making process.

ABR versus Zacks Rank: Deciphering the Dichotomy

Despite their shared 1-5 range, ABR and Zacks Rank embody distinct ideologies.

ABR hinges solely on brokerage endorsements and often displays fractional ratings, while Zacks Rank relies on numerical models predicated on earnings estimate revisions. The former portrays an analyst-led perspective, whereas the latter emphasizes earnings forecasts.

Historically, brokerage analysts have shown a propensity for unfounded optimism in their recommendations, painting a rosier picture than warranted by research. Conversely, the Zacks Rank underscores the importance of earnings estimate adjustments, closely correlating with stock price deviations.

Moreover, the Zacks Rank impartially assigns ratings proportionally across all stocks monitored by brokerage analysts, ensuring equity in the evaluative process.

One pivotal disparity between ABR and Zacks Rank lies in their timeliness. While ABR may lag in real-time updates, Zacks Rank swiftly reflects changing earnings forecasts, offering a more contemporaneous view of future price dynamics.

Ulta’s Investment Viability

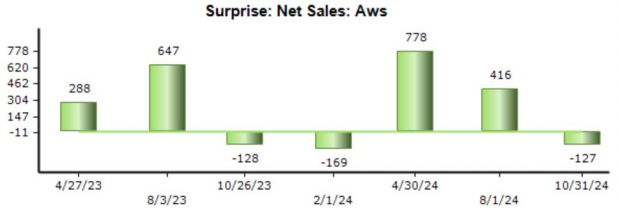

Scrutinizing Ulta’s earnings estimate revisions, the Zacks Consensus Estimate for the ongoing year suffered a 0.2% decline to $25.70 in the past month.

An escalating pessimism among analysts concerning Ulta’s earnings trajectory, evident in their unanimity in downward EPS revisions, could precipitate a near-term slump in the stock’s performance.

Given the magnitude of the recent estimate revision and other pertinent earnings-related factors, Ulta presently sits at a Zacks Rank #4 (Sell). For updated insights on top-performing Zacks Rank #1 (Strong Buy) stocks, refer to the provided link.

Hence, prudence dictates a cautious stance on the ‘Buy’-equivalent ABR for Ulta.