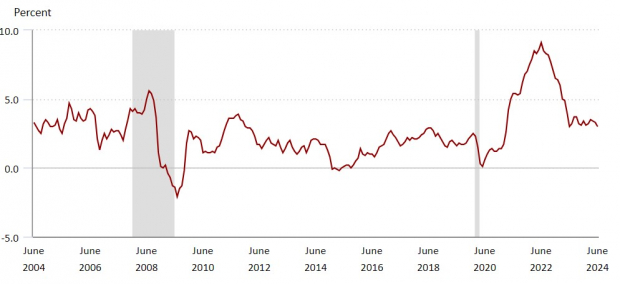

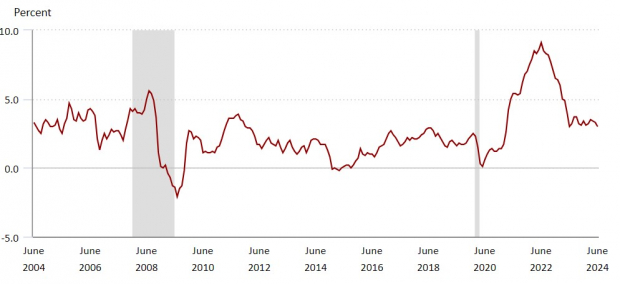

CPI Data Indicates Positive Trends

Optimistically, the Consumer Price Index (CPI) has cooled for two consecutive months with June’s data being very encouraging on Thursday. CPI climbed 3% compared to the same period last year, a nice decrease from May’s 3.3% rate. Monthly, CPI decreased 0.1% after being unchanged in May.

Implications for the Tech Sector

Core CPI, which excludes volatile food and energy costs, was up 3.3% annually compared to 3.4% in May. Core CPI also rose more moderately monthly, up 0.1% in June after rising 0.2% in May. This is favorable news for the broader market with the tech sector being one area of the economy that can benefit immensely from cooler inflation. Furthermore, there is a stronger argument that the proponents for a rate cut are upon us as Fed officials are starting to get proof that inflation is slowing at an ideal pace and it’s no longer too soon to do so.

Potential Stock Performers in Tech

Consumer Price Index, All Items

Image Source: U.S. Bureau of Labor Statistics

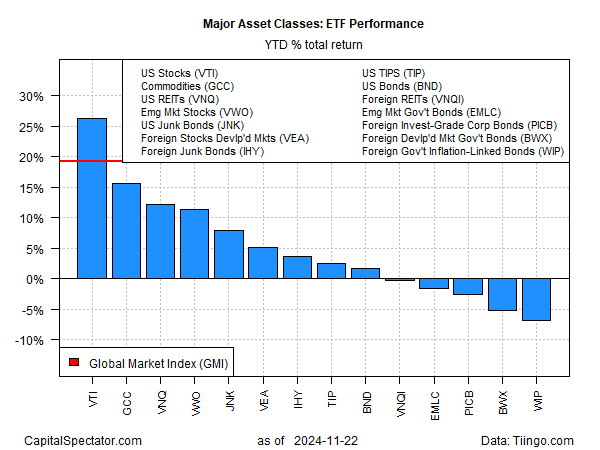

RingCentral (RNG) and Twilio (TWLO)

We’ll start with two new additions to the Zacks Rank #1 (Strong Buy) list in RingCentral (RNG) and Twilio (TWLO) which were added today. RingCentral’s stock spiked +6% on Friday and the rally could certainly continue as RNG looks undervalued at 7.9X forward earnings.

Easing inflation is what investors have been wanting to see in regard to choosing RingCentral’s stock despite the company having lofty growth projections as a leading provider of contact center software-as-a-service (SaaS) solutions.

The same scenario largely applies to Twilio which has seen its stock plummet -23% YTD as the cloud communication provider has often underwhelmed in its ability to offer positive guidance.

However, the likelihood of a more favorable operating environment spurred by easing inflation should start to peak investor and consumer interest in Twilio with its services allowing developers to build, scale, and operate real-time communications within software applications.

Image Source: Zacks Investment Research

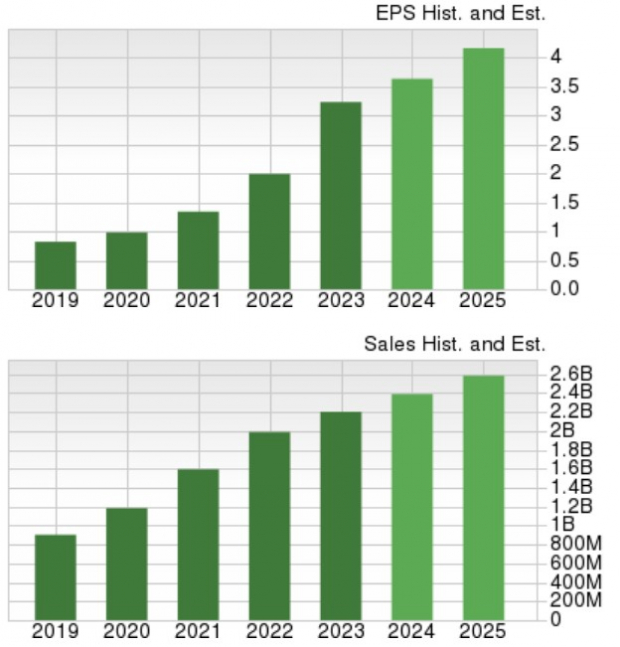

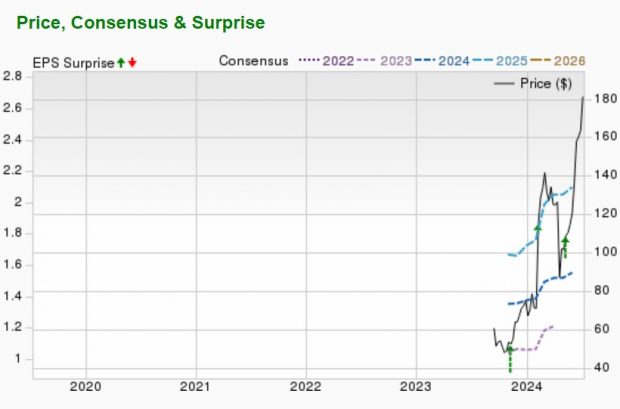

Arm Holdings (ARM)

Following the pandemic, a higher inflationary environment had deterred the IPO market but Arm Holdings is one of the notable companies to take the leap of faith in 2023. Arm Holding’s expansion has been compelling with the UK-based company providing processor designs and tools for software platforms, having several noteworthy customers in the US including Amazon (AMZN), Alphabet (GOOGL), and Nvidia (NVDA) among others.

With high excitement for its A-list customers, investors in Arm Holdings have been heavily monitoring the global economic environment, particularly in the US. ARM spiked +4% in today’s trading session and had recently hit 52-week highs on Tuesday.

ARM currently lands a Zacks Rank #3 (Hold) after soaring over +150% since its IPO last September.

Image Source: Zacks Investment Research

Final Thoughts

The anticipated expansion of RingCentral, Twilio, and Arm Holdings may start to come to fruition with a more favorable economic landscape due to cooling inflationary pressures. Investors are eyeing these tech stocks for potential growth prospects in the current market conditions.

Exploring Technology Stocks in Light of Cooling Inflation

Technology stocks have flourished amidst the backdrop of cooler inflation, with all three stocks receiving an impressive “A” Zacks Style Scores grade for Growth. This aligns perfectly with the current market trend, where the recent data on June’s Consumer Price Index (CPI) has significantly boosted overall market sentiment.

Embracing Growth Opportunities

As technology continues to evolve and infiltrate various aspects of our daily lives, companies such as ARM Holdings PLC, Ringcentral Inc., and Twilio Inc. are poised to capitalize on the expanding market opportunities. The increased demand for advanced technology solutions in a digitally-driven world bodes well for these innovative companies.

Historical Insights

Reflecting on past market cycles, it becomes evident that technology stocks have historically thrived during periods of economic stability. When inflation remains in check, investors often flock to growth-oriented assets, driving the stock prices of tech companies to new heights.

Looking Ahead

Considering the robust performance of technology stocks in the current economic landscape, investors are keen on exploring opportunities within companies such as Amazon.com Inc., NVIDIA Corporation, and Alphabet Inc. These industry giants have established themselves as leaders in the tech sector, continuously pushing boundaries and innovating to meet evolving consumer needs.

To gain further insights into the potential growth trajectory of these technology stocks amidst cooler inflation, investors are encouraged to leverage comprehensive stock analysis reports provided by Zacks Investment Research. Equipped with valuable data and expert perspectives, investors can make informed decisions to navigate the dynamic tech market successfully.