In a whirlwind of activity in the stock market, Amazon shares soared to an all-time high recently, marking a remarkable 53% surge over the last 12 months. The e-commerce giant’s stellar financial performance and its increasing foothold in artificial intelligence (AI) have garnished the attention of Wall Street.

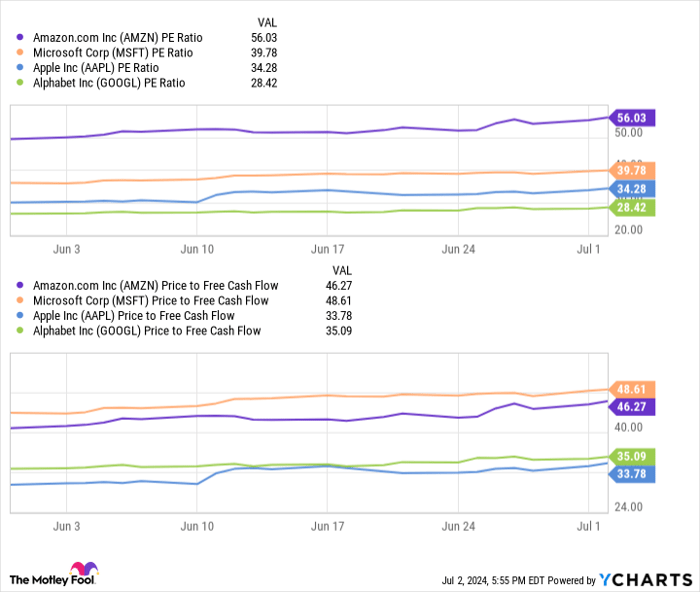

Despite Amazon’s commanding presence in the cloud industry through Amazon Web Services (AWS), which puts it in a promising stance in the realm of AI due to the rising demand for AI platforms, the company’s foray into chip design has stirred up further excitement. However, Amazon’s stock growth does not quite align with its earnings growth over the past year, rendering its shares slightly on the overvalued side for the time being.

This is where the plot thickens. While Amazon boasts a promising outlook in AI, two other contenders, Alphabet and Apple, have emerged as potential bargain buys in the AI sector, hinting at promising prospects that could outshine Amazon in the long run.

A Stellar Contender: Alphabet

Alphabet stands out as a compelling buy at its current valuation. The tech giant has demonstrated impressive earnings and stock growth in the past year, all while trading at a discounted price relative to its peers. Fueled by its powerhouse brand, technological prowess, and substantial cash reserves, Alphabet is positioned for significant advancements in the realm of AI.

With Google Cloud platform securing an 11% market share in cloud computing, trailing behind AWS and Microsoft, but notably surpassing both in growth rate, Alphabet is on a steady ascent. The company’s recent 28% year-over-year surge in Google Cloud revenue in the first quarter of 2024 outshines the growth rates of both AWS and Microsoft Azure during the same period.

Alphabet’s massive investments in AI are set to foster a lucrative ecosystem around its products. With potent brands like Android, YouTube, and Google’s suite of services under its wing, Alphabet is well-poised to enhance its business offerings through AI. From more efficient digital advertising to generative features on its smartphone OS and advanced analytics on YouTube, Alphabet is on a trajectory to revolutionize user experiences through AI.

Unveiling Potential: Apple

Apple, despite a modest 14% stock gain since the year started—dwarfed by Amazon and Alphabet’s over 30% ascents—has been quietly honing its AI strategy. Recent reports indicate a resurgence in Apple’s AI endeavors, with the tech giant set to elevate its smart assistant Siri through a major AI revamp.

Apple’s strategic move to embed OpenAI’s ChatGPT into Siri, enabling it to field a wider array of queries with greater intuitiveness, could mark a watershed moment for the company. Moreover, Apple’s anticipated observer role on OpenAI’s board could potentially align its AI technology closer to Microsoft, enhancing its competitive edge in the market.

Financially robust, Apple exhibits strengths that position it favorably for AI expansion compared to giants like Amazon and Microsoft, boasting superior free cash flow and operating income trends over the past five years. Despite its cautious approach to AI adoption, Apple’s solid financial foundation and strategic positioning make it a viable contender in the AI realm.

Key Considerations for Investors

Given these dynamics, investors eyeing the AI sector should take heed—Alphabet and Apple present compelling investment opportunities that could rival Amazon’s dominance over time. The AI landscape is evolving rapidly, and these two tech powerhouses are well-equipped to capitalize on the burgeoning opportunities in AI innovation.

Investment Insights: Unearthing the Hidden Gems Beyond Alphabet

The Impact of Select Stocks

Investors seeking opportunities often glance past tech giant Alphabet while chasing a pot of gold elsewhere. A list of 10 recommended stocks recently surfaced, boasting the potential for monumental returns that could rival a gold rush in the coming years.

Highlighting Nvidia’s Success

Take a walk down memory lane to April 15, 2005, when Nvidia secured a spot on the illustrious list. Had you invested $1,000 based on the recommendation, a jaw-dropping $771,034 would currently line your pockets!* Such staggering returns could be compared to unearthing buried treasure.

Exponential Growth with Stock Advisor

Stock Advisor, a service renowned for its foresight, offers investors a roadmap to riches with a well-curated portfolio scheme. Ongoing support from seasoned analysts and bi-monthly stock picks are akin to having a treasure map in hand. The Stock Advisor service has outshone the S&P 500, catapulting returns beyond recognition since 2002* – a financial feat akin to scaling new heights.

Exploring Further

Curious about the other nine hidden gems in the recommended stock list? Click the link below to discover more and potentially unearth your next treasure trove:

Disclaimer and Conclusion

*Stock Advisor returns are accurate as of July 2, 2024. Remember, the investment landscape can be as unpredictable as a storm at sea. Proceed with caution and always do your due diligence before embarking on any financial expedition.