Sales on the real estate calendar shrunk for the third consecutive month come May, spotlighting ongoing hurdles to affordability that have hammered the crucial spring selling cycle this year. Fresh data showed a harsh 11.3% tumble in U.S. sales of new single-family homes last month.

Traditionally, the spring selling spree reigns as the prime season for property peddlers. Kicking off in March and winding down by May or June, this period typically unfolds as warmer climates emerge from the winter chills, nudging buyers to secure a new abode before the academic year sways into gear. Conversely, wintertime often marks a lull in the property scene due to sogginess in the southern regions and icy frost gripping the north.

Industry insiders estimate that a hefty 40% of home transactions unfurl between April and July across the U.S. However, the current saga has seen the SPDR S&P Homebuilders ETF XHB and iShares US Home Construction ETF ITB deflate by 8.3% and 11% respectively since April (as per figures till Jun 27, 2024). Rising mortgage rates and soaring property prices have dragged down the sector.

Exorbitant Prices Dominate

An incessant scarcity in housing stocks has jacked up prices to unprecedented heights. The median selling price catapulted by 5.8% compared to the previous year, fueled by a surge in high-end property deals and bidding wars galore. NAR’s Chief Economist, Lawrence Yun, stressed that towering home prices are crowning the divide between current homeowners and potential first-time buyers.

Recovery on Ice

Though mortgage rates have slightly softened, the Federal Reserve seems intent on holding off any interest rate slash until later this year. Yun hinted that this delay could be delaying the resuscitation of home sales, which have meandered around a 4 million annualized rate in recent memory. At the current pace, offloading all available homes would consume 3.7 months, marking the lengthiest stretch in four years.

Ray of Optimism?

Yun pins his hopes on a swell in inventory catalyzing home transactions in the imminent months. The pool of existing homes for sale has inflated by 18.5% over the year, tallying 1.28 million homes, largely spurred by homeowners—sitting on the fence for softer mortgage rates—finally opting to list their properties. Despite the uptick, the inventory lingers below its pre-pandemic levels when mortgage rates held way lower.

Is a Fed Rate Cut in the Offing?

The latest inflation and retail sales metrics have stirred market whispers of interest rate snips later in the year, with the CME FedWatch Tool pegging a 56.3% chance of the Fed trimming rates to 5%-5.25% by September and a 42.1% probability for a cut to 4.75-5.00% by December.

Compelling Valuation Metrics

The homebuilding sector is currently marked by a forward P/E of 8.22X, a stark contrast to the 18.25X P/E tagged to the S&P 500 ETF IVV. Additionally, the sector’s price-to-book ratio stands at a favorable 1.31 versus IVV’s 3.85. The price-to-sales ratio for the sector also tilts in its favor at 0.92 compared to IVV’s elevated 2.70.

Bright Financial Outlook

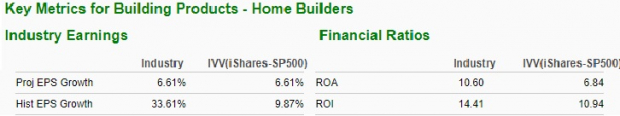

Forecasts point to a 6.61% growth in projected EPS for the sector, in alignment with IVV, while historical EPS expansion clocked at 33.61% against IVV’s 9.87%. Historical sales uptick for homebuilders at 12.29% outstripped IVV’s 9.87%. Moreover, the industry boasts a return on assets at 10.60 times in contrast to IVV’s 6.84, while the return on investment for homebuilders stirs at 14.41 times relative to IVV’s 10.94 times.

Image Source: Zacks Investment Research

Promising Industry and Sector Standings

The Zacks Building Products – Home Builders industry encompasses many such stocks and presently nestles in the top 30% out of an approximate pool of 250 sectors. Ranked within the upper echelon of Zacks’ industry roster, this league is anticipated to outshine its peers over the next 3 to 6 months. Despite a sluggish 0.2% progress hitherto, this cluster could potentially sprout ahead on the back of attractive valuations and a prospective softening in interest rates.

Quantitative investigations opine that around half of a stock’s future valuation arises from its industry categorization. In fact, the top 50% of Zacks’ Industry Rank tends to lap the bottom half at more than a 2 to 1 ratio. Aside from its upbeat industry stature, homebuilders ascend from a thriving Zacks Construction sector, seated in the top 25% out of a cluster of 16 segments. The sector has accrued a 4.5% uptick since the dawn of the year.

Want key ETF intel sent straight to your mailbox?

Zacks’ complimentary Fund Newsletter delivers a weekly digest of prime news, analyses, and top-performing ETFs.

SPDR S&P Homebuilders ETF (XHB): ETF Research Reports

iShares U.S. Home Construction ETF (ITB): ETF Research Reports

iShares Core S&P 500 ETF (IVV): ETF Research Reports