FedEx reported their fiscal Q4 ’24 on Tuesday night, June 25th, 2024, after the closing bell, leading to a 15% rise in stock price the following day on heavy volume. The earnings release revealed plans for optimizing FedEx Freight operations, including the closure of 7 facilities to align capacity with demand, sparking interest in unlocking sustainable shareholder value.

Let’s delve into the key takeaways from the quarter.

A Steady Valuation Story:

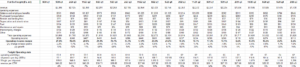

Looking ahead over the next three years following earnings revisions:

- Fiscal ’27 EPS estimate: $26.89, with a 13% expected growth

- Fiscal ’26 EPS estimate: $23.86, anticipating a 15% growth

- Fiscal ’25 EPS estimate: $20.79, aiming for a 17% growth

- Fiscal ’27 PE: 11x

- Fiscal ’26 PE: 12x

- Fiscal ’25 PE: 14x

- Fiscal ’27 revenue estimate: $99.2 billion, expecting 6% growth

- Fiscal ’26 revenue estimate: $93.9 billion, forecasting 4% growth

- Fiscal ’25 revenue estimate: $89.97 billion, projecting 3% growth

Estimate source: LSEG.com (formerly IBES data by Refinitiv)

Despite the 15% stock price surge, the PE ratio remains favorable relative to anticipated EPS growth, with the price to sales ratio below 1.0x at 0.83x post the recent increase.

Free-cash-flow (FCF) has exhibited significant improvement over the last 4 quarters, surging by 45% TTM and 18% over the last 12 quarters.

Even with the spike in FCF during the pandemic, it now stands at $3.13 billion, supporting a 4% yield.

An analysis projecting peak EPS for FedEx reveals promising potential, with a focus on operational margin enhancement.

FedEx Freight Operations:

FedEx’s guidance indicates $5.2 billion in capex for fiscal ’25, aligning with the prior year. The potential spinoff of FedEx Freight could serve as an additional catalyst for stock growth.

Freight, accounting for 10% – 11% of total revenue, has seen improved margins, prompting considerations of its performance and potential divestiture.

Financial data on Freight operations reflects enhanced operating margin trends.

If Freight maintains its profitability, divestment could be a strategic move for FedEx.

Summary and Outlook:

Despite the recent market response, FedEx continues to demonstrate latent value potential, backed by operational efficiency and growth prospects.

Forecasts hint at ongoing margin improvements and revenue upticks, underlining a path towards increased shareholder value.

Expectations of higher revenue growth, enhanced EPS, and improved free-cash-flow signal future promise for FedEx.

Anticipate a more streamlined and profitable FedEx post-restructuring efforts, aimed at bolstering market performance.