Stride (LRN) has soared, up 20% since its Q1 release in late April. Achieving record highs, the digital education firm has seen a remarkable 135% surge over the past three years, outpacing the S&P 500 in the last decade.

Stride, represented by Zacks Rank #1 (Strong Buy), presents itself as an intriguing investment opportunity due to its exceptional value proposition.

Introduction to Stride

Specializing in digital education services, Stride caters to students of all ages across the U.S. and beyond. The firm’s diverse portfolio serves K–12 students, adult learners, school districts, businesses, and even the military.

Amidst rising college costs, Stride is capitalizing on the trend towards digital education. The company’s expansion, particularly in the career learning segment, is gaining significant traction, notably among Middle-High School students.

Furthermore, with the digital transformation of the U.S. economy, Stride offers courses like MedCerts and Tech Elevator, aiding individuals in pursuing new career paths in healthcare and IT.

Impressive Growth Trajectory

From $400 million in 2010 to $1.84 billion last year, Stride witnessed a substantial revenue growth. Sales surged by 9% in FY23 and 10% in FY22, following a remarkable 48% increase in FY21 post the Covid-19 pandemic’s impact on education and work environments.

Projections indicate a further 11% revenue growth in FY24 and 7% in FY25, targeting $2.2 billion in revenue compared to $1.0 billion in pre-Covid FY19.

Strengthening Fundamentals

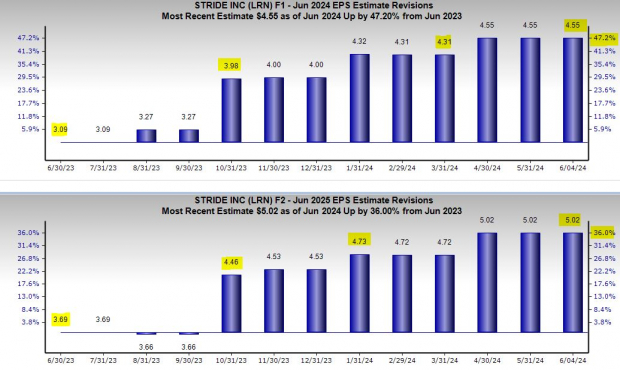

Exceeding the Q1 FY24 EPS estimate and enhancing its earnings guidance, Stride’s adjusted EPS for 2024 surged by 47% over the previous year, with a 36% increase expected for 2025. This positive outlook, alongside expectations of a 53% growth in FY24 and 10% in FY25 for adjusted earnings, underlines Stride’s financial strength.

In the last three years, Stride stock soared by 133%, significantly outperforming both the benchmark and the Schools industry average. Over the past decade, the stock surged by 187%, slightly outpacing the S&P 500 and eclipsing industry peers by a wide margin.

Looking Ahead

Despite recent market underperformance, Stride stock trades close to all-time lows at 13.8X forward 12-month earnings, indicating immense growth potential. This discounted valuation, alongside its robust earnings outlook, suggests a compelling investment opportunity for those considering LRN.

As digital education gains prominence globally, Stride is strategically positioned to leverage this trend, making it a viable option for investors seeking exposure to the evolving educational landscape.

With a strong balance sheet backing its operations, now may be the opportune moment for investors to explore the potential of holding Stride stock in their portfolios for long-term gains.