Resilient Earnings Performance: In the Q1 earnings season, profitability has displayed a robust and steadily improving trend, marked by both growth rate resilience and positive revisions. While revenue surprises were slightly less frequent, margins saw a better-than-expected expansion.

- Q1 Earnings Snapshot: Total earnings for the 474 S&P 500 members reporting Q1 results show a 4.2% increase from the same period last year, with revenues up by 3.9%. Notably, 77.8% beat EPS estimates and 60.5% exceeded revenue estimates.

- Tech Sector Driving Growth: The Tech sector has been a primary growth engine in the 2024 Q1, playing a crucial role in uplifting overall earnings. Without the Tech sector’s substantial earnings growth, the rest of the index would have encountered a 0.6% decline instead of the 4.2% increase observed.

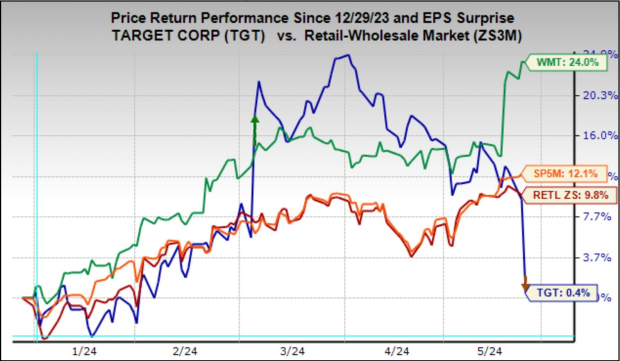

- Upward Trajectory for Q2: Projections indicate that S&P 500 earnings for Q2 of 2024 are expected to rise by 9.0% compared to the same period last year, accompanied by a 4.6% increase in revenues. While estimates have moderated slightly in recent weeks, they still surpass initial levels for the quarter.

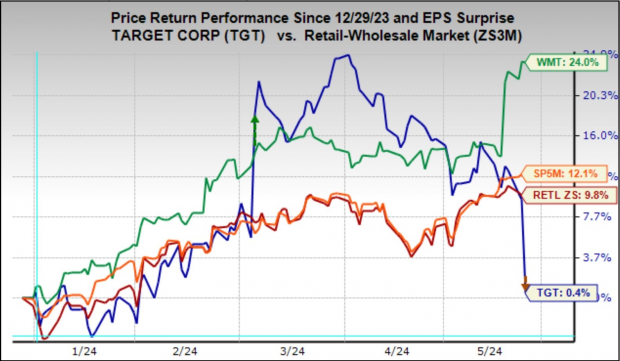

Recently, the focus has been on the Retail sector, with Target falling short in its quarterly report while Walmart excelled due to market share gains in higher-income households. Target, working on enhancing its grocery offerings, faces challenges in a sluggish demand environment for discretionary products.

Despite Target’s strategies to improve its grocery segment through price adjustments, its performance lags behind that of Walmart. While signs of stabilization in discretionary sales are emerging, competitive forces suggest that Target’s stock performance may not reverse soon in comparison to Walmart.

The comparative chart below illustrates the year-to-date performance of Target shares against Walmart, the Zacks Retail sector, and the S&P 500 index.

Image Source: Zacks Investment Research

Envisioning Earnings Outlook: As of Q2 2024, total S&P 500 earnings are forecasted to climb by 9% alongside a 4.6% revenue surge. Although recent weeks witnessed a mild dip in aggregate earnings estimates, they continue to exceed initial quarter levels, as illustrated below.

Image Source: Zacks Investment Research

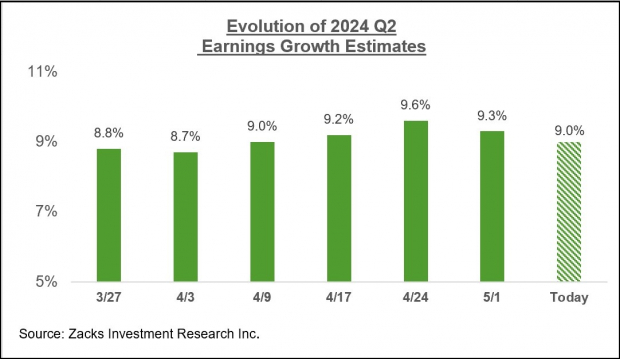

While the Energy sector notably bolstered estimates, positive revisions outside this sector also contributed favorably. The chart below delineates the evolution of index earnings, excluding the Energy sector.

Image Source: Zacks Investment Research

The subsequent charts depict the earnings trajectory both on a quarterly and annual basis for the S&P 500 index, underscoring the dominance of the Tech sector in propelling overall earnings growth in 2024.

Tech’s forward momentum is substantiated by a positive revisions trend and a prosperous margin outlook, attributed to the increasing share of higher-margin software and services in the Tech sector’s earnings profile, fueled by optimism surrounding AI’s productivity-enhancing impacts.

Unearth Opportunity with Dividend Stocks: To fortify your retirement plan, Zacks Investment Research presents a Special Report detailing 5 dividend-yielding stocks covering diverse sectors like property management, financial institutions, upscale outlets, and energy producers, offering unique insights absent from traditional financial advice.

Download Now – Embrace Retirement with 5 Dividend Stocks to Elevate Your Strategy!