Challenges in the First Quarter

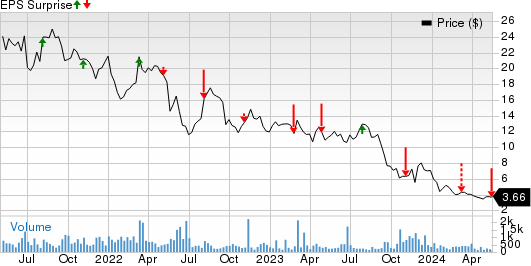

In a disappointing turn of events, Lazydays Holdings, Inc. (GORV) reported results for the first quarter of 2024 that fell short of both earnings and revenue expectations for the third consecutive quarter. The company experienced a decline in both top and bottom lines compared to the previous year. The market responded negatively, with a 3.8% drop in share prices during after-hours trading on May 15.

CEO’s Response and Market Outlook

John North, CEO of Lazydays, attributed the poor performance to challenging market conditions and unexpected losses in the first quarter. Despite the setback, the company remains optimistic about maintaining positive EBITDA and adjusted operational cash flow. Amid tough economic conditions and industry competition, Lazydays expresses confidence in the earning potential of its stores and looks forward to capitalizing on future industry recoveries.

Financial Performance Decline

Layzdays reported an adjusted loss per share of $1.63, significantly wider than the expected loss of 43 cents. Total revenues amounted to $270.6 million, missing the consensus estimate of $285 million. The decline in revenues by 8.5% year over year was primarily driven by poor results in new vehicle retail, pre-owned vehicle retail, and service, body, parts, and other segments.

Operational Analysis

New vehicle retail sales slumped by 13.6% to $152.7 million compared to the previous year. Pre-owned vehicle retail and service, body, parts, and other revenues also saw declines of 6.1% and 11.6%, respectively. The company’s gross margin contracted by 760 basis points to 14%, with notable drops in both new and pre-owned vehicle retail margins.

Financial Position

As of March 31, 2024, Lazydays had $39.4 million in cash, down from $58.1 million at the end of fiscal 2023. Long-term debt, in the non-current portion, stood at $27.8 million, slightly lower than the previous fiscal year. Despite the challenges, GORV maintains a Zacks Rank #2 (Buy).

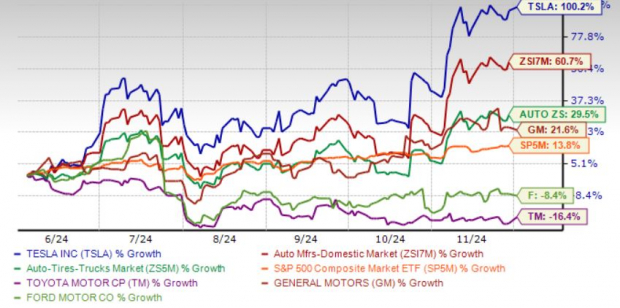

Other Stock Considerations

For investors looking beyond Lazydays, other top-ranked stocks in the Consumer Discretionary sector include Strategic Education, Inc. (STRA), Netflix, Inc. (NFLX), and Royal Caribbean Cruises Ltd. (RCL). Each of these companies boasts favorable Zacks Ranks and promising financial performance metrics.