The semiconductor market, a critical cog across various industries from automotive to AI, has been thrust into the spotlight by the U.S. government. With the enactment of the CHIPS and Science Act in 2022, the U.S. semiconductor industry has witnessed a surge in investments. Approximately $30 billion in grants and $25 billion in loans have been awarded to seven companies, setting the stage for a monumental shift in the landscape.

Micron Technology: Harnessing the Winds of Change

Micron Technology, in a preliminary agreement with the U.S. government, is poised to receive $6.1 billion in funding and up to $7.5 billion in loans under the CHIPS Act. This financial infusion, dedicated to advancing chip production in the U.S. with a planned capex of $50 billion until 2030, is a strategic move that aims to enhance Micron’s market share. As the memory specialist aims to capitalize on the burgeoning demand for dynamic random access memory (DRAM) chips, particularly in the realm of AI, the company stands at a pivotal juncture.

The explosive growth trajectory envisioned for Micron is underscored by the imminent tripled demand for High-Bandwidth Memory (HBM) in the AI sector. Leveraging the optimistic projections for the memory market’s meteoric rise to $338 billion annual revenue in 2032 from $134 billion in 2023, Micron’s strategic alignment with the U.S. semiconductor industry’s growth bodes well for its long-term prospects.

Taiwan Semiconductor Manufacturing Company: Pioneering Innovation in American Soil

Under the benefaction of the CHIPS Act, Taiwan Semiconductor Manufacturing Company (TSMC) stands as a beacon of technological advancement. With a colossal $65 billion investment earmarked for semiconductor manufacturing in Arizona, TSMC is taking bold strides to meet burgeoning customer demands. The construction of its third fabrication plant in Arizona signifies a commitment to leveraging cutting-edge semiconductor process technology in the U.S.

The strategic focus of TSMC on advanced process technologies, catering to the insatiable hunger for chips on nodes smaller than 7 nanometers, mirrors the industry’s pivot towards AI-driven innovations. The company’s dominant market share of 61%, with leading customers such as Nvidia, AMD, Intel, and Apple in its fold, positions TSMC as a frontrunner poised to capitalize on the semiconductor market’s anticipated tripling by 2032.

In a landscape where the semiconductor market is primed to metamorphose into a $1.9 trillion behemoth by 2032, TSMC’s steadfast commitment to innovation and market leadership positions it favorably as a torchbearer in the realm of chip manufacturing.

The ambitious visions of Micron Technology and Taiwan Semiconductor Manufacturing Company underscore the renaissance unfolding in the U.S. semiconductor sector. As the industry braces itself for a paradigm shift, these two companies exemplify the unwavering commitment to innovation and growth that defines the semiconductor landscape’s future.

Unveiling Potential Gems in the Tech Sector

The Rise of TSMC in the Semiconductor Industry

Transcending conventional boundaries, Taiwan Semiconductor Manufacturing Company (TSMC) is on a steadfast journey towards unprecedented growth in the booming semiconductor sector witnessed in recent years. Steadily expanding its manufacturing capacity, TSMC has managed to secure a larger slice of the market share, positioning itself as a prime player in the digital revolution.

The Future Outlook for TSMC

Analysts project an impressive annual earnings growth of 21% for TSMC over the next five years. Even if the company maintains a slightly lower growth rate of 15% per year for the subsequent decade, the figures paint a rosy picture. With a current five-year average earnings multiple of 21, a presumed similar multiple ten years down the line would potentially catapult TSMC’s stock price to $525, a significant leap from its current valuation.

The Prospects of Micron Technology

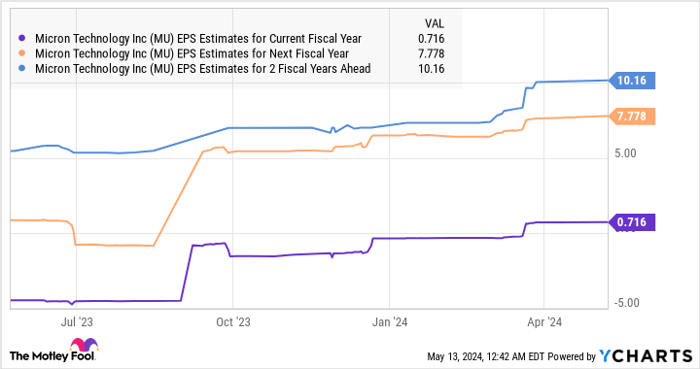

Shifting focus to Micron Technology, potential investors are advised to tread cautiously. While the tech community buzzes with excitement, it’s crucial to weigh the odds. The seasoned analysts at Motley Fool’s Stock Advisor have curated a list of the 10 best stocks, Micron Technology not making the cut. This raises a pertinent query – is Micron Technology truly a glittering gem, or are there brighter stars illuminating the investment horizon?

Reflecting on the meteoric rise of Nvidia after its inclusion in the revered list on April 15, 2005, presents a thought-provoking anecdote. An investment of $1,000 at the recommended time would have blossomed into a remarkable $553,880 today. The lessons are clear, yet the crystal ball remains hazy. The quest for the next tech giant continues amidst a landscape ripe with possibilities.

Evaluating Investment Opportunities

Steering through the labyrinth of tech stocks demands a prudent approach. Motley Fool’s Stock Advisor service emerges as a guiding light, offering a blueprint for success. With insights on portfolio construction, regular analyst updates, and bimonthly stock picks, the service has outperformed the S&P 500 by a remarkable margin since its inception in 2002. A testament to the power of informed decision-making in an ever-evolving market landscape.

As the cogs of the tech industry whir with fervor, investors are faced with a plethora of opportunities. Whether to bank on the steady trajectory of established giants like TSMC or venture into uncharted territories with potential jewels like Micron Technology remains a conundrum. The saga of innovation and disruption in the tech sector continues to unfold, promising a thrilling ride for those daring enough to embrace the future.