Alibaba Group (NYSE: BABA) has experienced a turbulent journey in recent times, witnessing a significant downturn of nearly 60% in the stock value over the past five years. Despite this challenging period, billionaire co-founder Jack Ma has expressed confidence in the company’s restructuring endeavors. Acknowledging past mistakes, Ma highlighted the strategic move to divide the company into six distinct divisions, enhancing its agility and customer-centric approach.

Exploring the potential of Alibaba and evaluating whether investors should consider buying, selling, or holding the stock becomes a pertinent question at this juncture.

The Cash Flow Dynamo

Throughout its adversity, Alibaba has remained a stalwart in generating considerable cash flow. In the fiscal third quarter concluding in December, the company amassed a remarkable $9.1 billion in operating cash flow and $8 billion in free cash flow. Across the initial nine months of the year, Alibaba boasted an impressive $22.4 billion in operating cash flow.

Robust cash flow serves as a cornerstone for companies, providing them with the flexibility to reinvest in growth initiatives, pursue acquisitions, or engage in share buybacks. Alibaba has leveraged this strength by implementing a $25 billion share repurchase program post its fiscal Q3 results in February. Rapidly executing on this strategy, the company repurchased $4.8 billion worth of shares in the first quarter of 2024, totaling $23.3 billion over the past two years.

Alibaba’s strategic focus lies in bolstering its core ventures of e-commerce and cloud computing to stimulate growth. In the e-commerce realm, the company is steering investments towards enhancing price competitiveness, services, and user experience. Initiatives include augmenting product supply, diversifying offerings with branded and direct-from-manufacturer products, and providing flexible models for suppliers to offer competitive prices. Additionally, Alibaba is endeavoring to enrich the customer experience from presale to logistics, while exploring AI integration through internally developed large language models.

On the cloud computing front, Alibaba aims to shift clients from low-margin project-based contracts towards its public cloud services. The company is intensifying investments in AI-related hardware and software, bolstering infrastructure to cater to the surging demand for AI-driven computational power.

Image source: Getty Images.

Navigating Through Risks

Chinese companies face constraints in AI development due to U.S. embargoes on cutting-edge GPU technology, impacting Alibaba’s immediate gains compared to American cloud computing giants like Microsoft and Alphabet. Furthermore, Alibaba reduced cloud computing prices in a bid to attract AI developers to its data center offerings, presenting a potential short-term challenge despite promising long-term prospects in AI integration.

Within the e-commerce sphere, Alibaba encountered pricing pressures amidst the ascent of competitor PDD Holdings and its widely favored Pinduoduo platform. While intensified competition from PDD has stiffened the Chinese e-commerce landscape, Alibaba’s T-Mall and Taobao platforms retain robust positions in the market spectrum, particularly excelling in the high-end segment.

Moreover, Alibaba’s financial performance bore the brunt of a sluggish Chinese economy post-pandemic lockdowns. Despite a mild recovery in the first quarter and the government’s commitment to bolster the economy, lingering risks persist for Alibaba’s trajectory amid economic fluctuations.

An Undervalued Gem

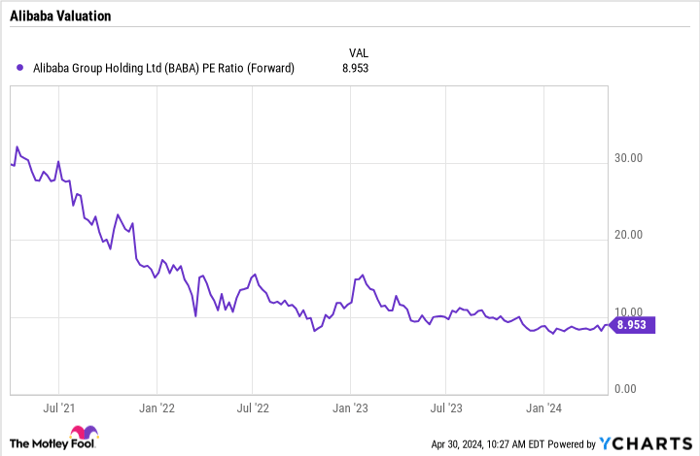

Emphasizing Alibaba’s financial stance, its valuation emerges as a standout virtue. Priced at a meager 9x forward P/E ratio, Alibaba is positioned as an attractively undervalued asset. Demonstrating a 9% revenue growth over nine months and robust cash flow generation, the stock renders an enticing investment proposition.

BABA PE Ratio (Forward) data by YCharts

While a low valuation alone doesn’t warrant an investment decision, Alibaba’s allure as a budget-friendly stock of a leading Chinese entity fueled by robust cash flow, strategic share buybacks, and growth investments signifies a promising trajectory. Though not devoid of risks, Alibaba’s prospective growth in the impending years appears intriguing, affirming its current stance as a viable investment opportunity.

Final Thoughts on Alibaba Group

Contemplating an investment in Alibaba Group necessitates careful reflection on the company’s dynamics:

The analyst team at Motley Fool Stock Advisor recently spotlighted the 10 best stocks poised for significant growth, with Alibaba Group not figuring in the selection. The identified stocks hold considerable potential for substantial returns in the foreseeable future.

Reflecting on past triumphs, consider Nvidia’s inclusion in such a list in April 2005 – an investment of $1,000 at the recommendation juncture culminated in an impressive $544,015 return!

The Stock Advisor service furnishes investors with a clear roadmap for success, offering guidance on portfolio construction, regular analyst updates, and bimonthly stock picks. The service’s performance exceeded that of the S&P 500 by a significant margin since inception in 2002.

*Stock Advisor returns as of May 3, 2024