Stock Market Momentum

As May ushers in a fresh wave of trading, the S&P 500 (SP500) (VOO) (IVV) has regained its footing, rebounding from April’s sell-off. BlackRock’s (BLK) lead strategist, Wei Li, has articulated three compelling rationales for investors to maintain their stake in the equity market.

Challenging the Status Quo

Embracing the contrarian spirit, Li contested the popular “Sell in May and go away” mantra deeply entrenched on Wall Street. This sentiment emerged following April’s market correction, where the S&P 500, Nasdaq Composite (COMP:IND) and the Dow industrials (DJI)(DIA) witnessed a halt to their five-month winning streak.

Validating Market Confidence

Li’s argument defies convention as she adamantly believes in staying the course despite prevailing skepticism. She elaborated on her stance through a comprehensive LinkedIn post over the weekend.

- The Federal Reserve remains committed to maintaining accommodative measures for a prolonged period, signaling strong market support.

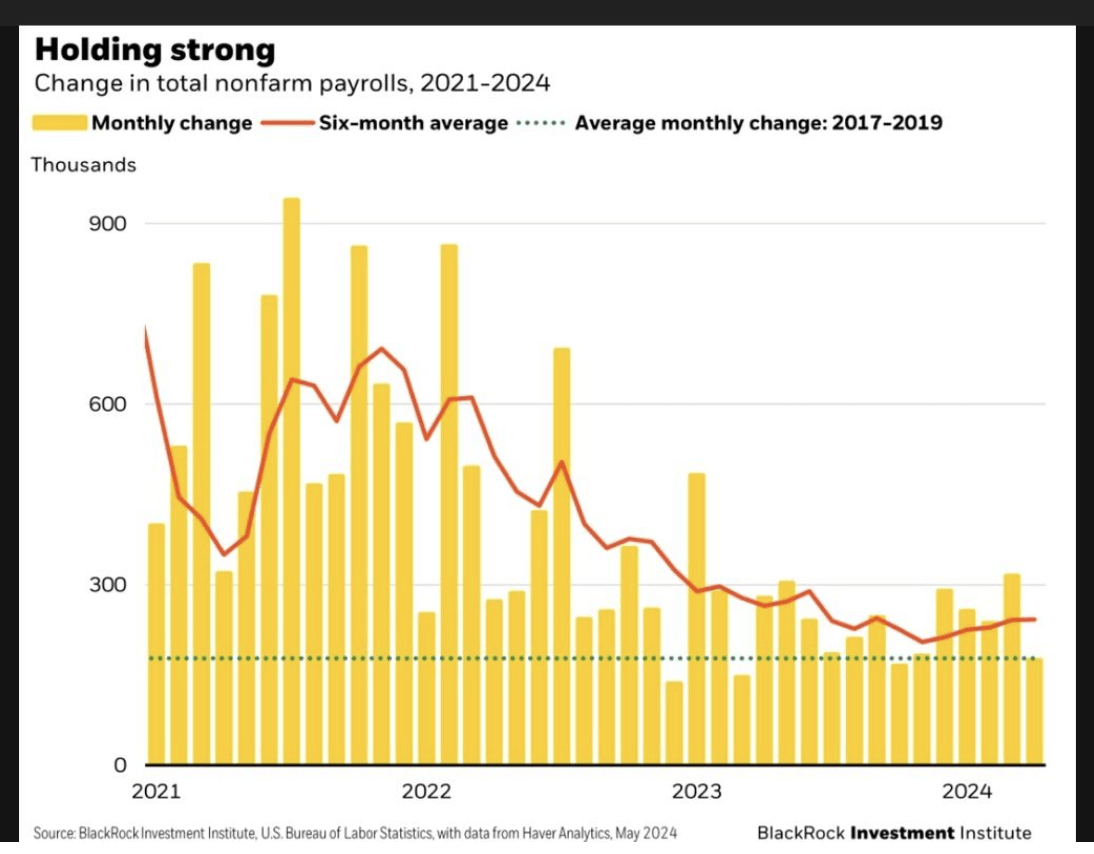

- Although the labor market’s vitality continues, signs suggest a slight easing in its tightness.

- A surge in stock buyback activities across a wide spectrum of corporations underscores a bullish sentiment in the market.

Market Observation

Li’s analysis sheds light on the Federal Reserve’s stance, emphasizing patience in addressing inflation concerns. The tone set by Federal Reserve Chair Jerome Powell assured investors that rate adjustments would only be made after a thorough review, alleviating fears of an immediate interest rate hike.

Li pointed out the growing trend of stock buybacks within leading corporations, such as Apple (AAPL), Disney (DIS), Meta Platforms (META), Uber (UBER), and Airbnb (ABNB), stimulating market activity and instilling confidence among investors.

Furthermore, Li delved into labor market dynamics, highlighting subtle shifts suggesting a slight relaxation in tight labor conditions. This shift, she argued, could potentially curb services inflation. She supported her claim with a chart showcasing nonfarm payroll changes from 2021 to the present year.

Market Performance

The S&P 500 (SP500) has demonstrated resilience in May, recording a 2% increase as of the latest market close, showcasing investor confidence in Li’s optimistic outlook.

For investors seeking to align their strategies with the buyback trend, Invesco offers two exchange-traded funds (ETFs): the Invesco BuyBack Achievers ETF (PKW) and the Invesco International BuyBack Achievers ETF (IPKW), tailored to capitalize on this market theme.