As lower economic sentiment and mixed earnings cast a shadow over the market, shrewd investors see not disappointment but a golden opportunity. The recent correction, marked by a 3% dip in the S&P 500, presents a unique chance to scout for tech stocks on sale. Despite the post-earnings tumble of top names, the fundamental value of these tech stocks remains intact. While first-quarter earnings stood strong, subdued forecasts for future periods triggered drastic drops. Yet, for tech-savvy investors, this downturn spells a shopping spree fixed on a silver lining.

The Meta Platforms Meltdown

Engulfed by the Meta Platforms (NASDAQ: META) meltdown, investors witnessed a staggering 15% slide post a stellar performance in 2024’s first quarter. Despite robust metrics, including heightened user engagement and ad impressions, coupled with a hefty capital return to stakeholders crossing $15 billion, the stock plummeted. The primary culprit? Zuckerberg’s tepid second-quarter revenue outlook projecting a mere 18% year-over-year growth, a far cry from the 27% surge in Q1. Heightened capital expenditures aimed at bolstering Meta’s AI prowess further fueled investor jitters. Some may eye Zuckerberg’s metaverse ventures as an AI gateway, yet overlooking Meta’s penchant for visionary but slow-burning projections could be shortsighted.

The Netflix Narrative

Netflix (NASDAQ: NFLX) found itself tumbling, shedding over 10% post-an earnings revelation showcasing substantial growth and consumer-centric strategies. Despite exceeding revenue expectations, witnessing a surge in subscriptions, and unveiling a partnership with TKO Group Holdings (NYSE: TKO) for live-streamed wrestling, Netflix’s per-share price slumped. The decision to halt subscriber stat disclosures in 2025 muddied waters, yet the bigger tale of subscriber behaviors and spending habits outweigh mere numerical shifts. This misalignment between stock pricing and stellar earnings heralds Netflix as another tech gem to snag while the dip lasts.

The Palantir Paradox

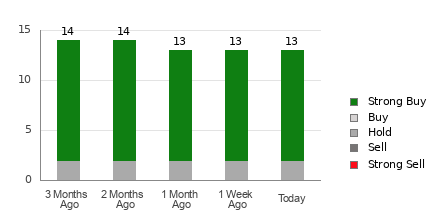

Palantir Technologies (NYSE: PLTR) found itself in a dip sans a discernible impetus, hinting at a cooling sentiment following a stupendous earnings rally. While not an archetypal dip, this tech maverick’s subdued stance warrants attention before the next upswing. Unusual options activity projecting vigorous stock movements within a month sparks intrigue, with historical trends underlining a surge before settling at a new base. Post its May 6th earnings report, this dip might just be the last call to own a piece of Palantir’s future at bargain rates.

On the date of publication, Jeremy Flint held no positions in the securities mentioned. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Jeremy Flint, an MBA graduate and skilled finance writer, excels in content strategy for wealth managers and investment funds. Passionate about simplifying complex market concepts, he focuses on fixed-income investing, alternative investments, economic analysis, and the oil, gas, and utilities sectors. Jeremy’s work can also be found at www.jeremyflint.work.

More From InvestorPlace

The post 3 Tech Stocks to Buy on the Dip: April 2024 appeared first on InvestorPlace.