Investor extraordinaire Warren Buffett famously advises to err on the side of fear when others are brimming with greed, and conversely, to seize opportunities when others cower in fear. One metric to gauge the prevailing sentiment towards a stock is the Relative Strength Index (RSI), a technical analysis tool that measures momentum on a scale ranging from zero to 100. Typically, when a stock’s RSI plunges below 30, it signifies that the stock might be oversold.

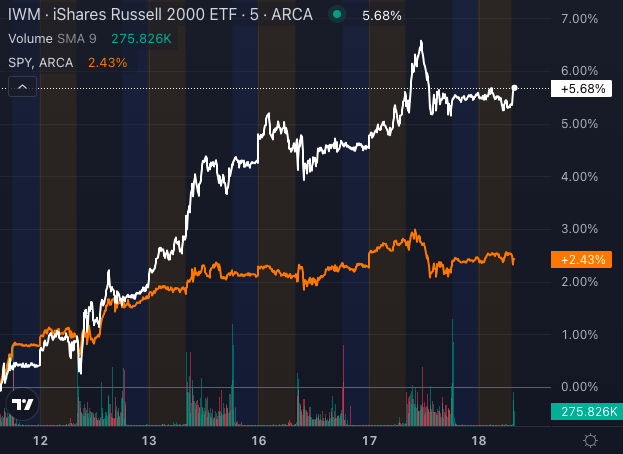

During trading on Wednesday, shares of Advanced Micro Devices Inc (Symbol: AMD) descended into the realm of oversold territory, registering an RSI reading of 28.9, as they exchanged hands at a low of $154.4514 per share. To put this into context, the S&P 500 ETF (SPY) currently boasts an RSI reading of 34.3. For an optimistic investor, AMD’s RSI of 28.9 today could be viewed as an indication that the recent flurry of selling activity is nearing its end, potentially heralding opportunities to enter the market on the purchasing side.

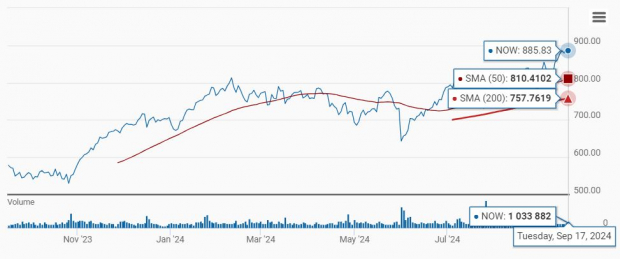

Examining the aforementioned chart, we observe that AMD’s performance over the course of a year has swung between a low of $81.02 per share and a high of $227.30 per share — a significant range when juxtaposed with the last traded price at $154.54 per share.

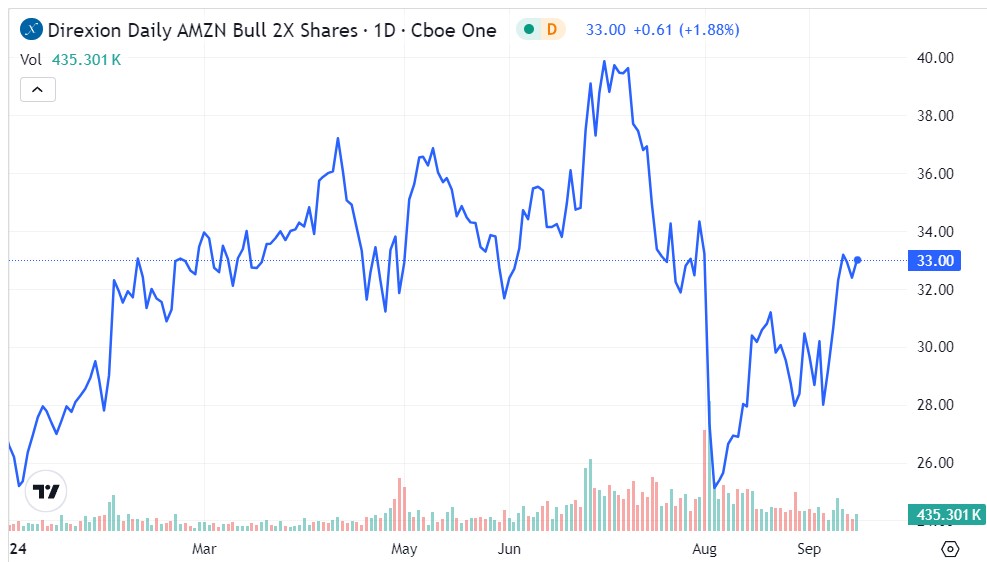

![]() Discover more about 9 other stocks currently in oversold conditions

Discover more about 9 other stocks currently in oversold conditions

Further Insights:

Explore Historical Stock Prices with Detailed Analysis

Unveiling Average Annual Returns for your Consideration

Dive into the Riveting Shares Outstanding History of CBUS