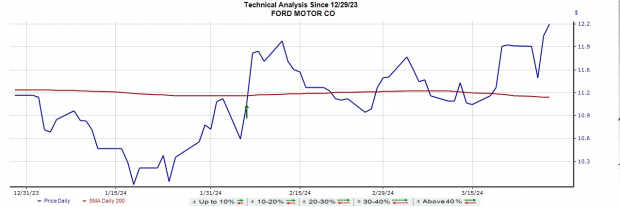

Ford Motor’s F stock lands the Bull of the Day as it recently secured a place on the Zacks Rank #1 (Strong Buy) list. Its shares have seen a commendable +9% increase year to date, signaling a favorable trend in the market.

Image Source: Zacks Investment Research

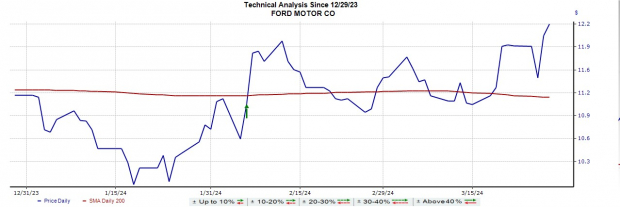

Improved Probability & P/E Discount

Prior to the pandemic, Ford Motor worked diligently to enhance its profitability. Despite experiencing some slowdown, the company saw a peak in its earnings per share at $2.01 last year. Currently, earnings estimate revisions for both FY24 and FY25 have shown positive growth over the last 60 days, indicating a promising outlook for the company.

Image Source: Zacks Investment Research

Moreover, with higher EPS estimates, Ford’s stock is attractively priced at $13, trading at just 6.9X forward earnings. This represents a notable 58% discount from its decade-long high and a slight deviation from the median of 7.3X. Comparatively, Ford’s stock is a compelling investment when juxtaposed with its industry average and primary competitor, General Motors (GM).

Image Source: Zacks Investment Research

P/S Discount

Ford’s stock also demonstrates an attractive price-to-sales ratio of 0.31X, aligning closely with General Motors’ ratio of 0.29X and significantly below the ideal threshold of less than 2X. Noteworthy is the anticipated increase in Ford’s top line this year to $166.3 billion, indicating a positive trajectory compared to its 2023 figures.

Image Source: Zacks Investment Research

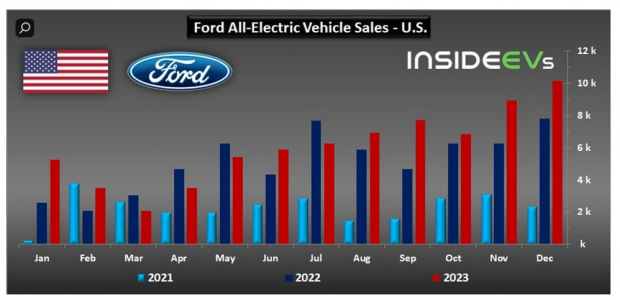

EV Surge

Ford experienced a remarkable 27% surge in its electric vehicle (EV) sales in the last quarter, achieving record highs with 25,927 all-electric vehicles delivered. The surge was primarily driven by the increasing demand for models like the Mustang Mack-E, F-150 Lightning, and E-Transit. Despite a broader slowdown in the EV market, Ford’s impressive performance defied expectations, with Q4 sales reaching $43.3 billion, outpacing estimates by 14%.

Ford’s EV sales growth has been phenomenal, with an 81% increase in the previous month alone. This remarkable streak of success could drive the company’s Q1 results in April to new heights.

Image Source: INSIDE EVs

Bottom Line

With Ford Motor’s attractive valuation, compelling EV expansion, and recent market performance, investing in the company now could lead to significant rewards in the near future. The current upward trajectory of Ford’s stock suggests that now could be the opportune time to include it in your investment portfolio for potentially fruitful outcomes.