From Market Darling to Investor Dismay

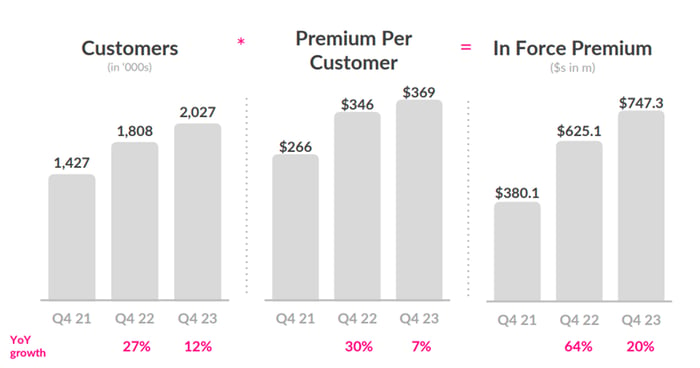

Once hailed as a disruptive force in the insurance industry, Lemonade ((NYSE: LMND) has been facing a downhill slide. The idea of an AI-powered, digital-first insurance company seemed like a dream come true. The ease of signup, quick policy proposals, and streamlined claims process captivated many. Lemonade’s growth was indeed impressive, attracting a younger clientele and reporting higher average policy amounts per customer.

The Harsh Reality Check

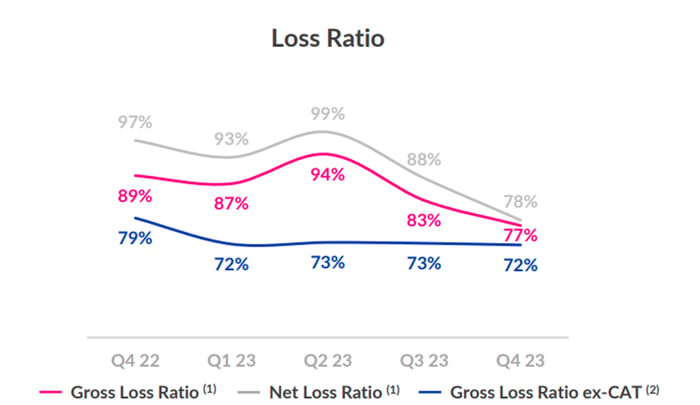

Yet, the euphoria waned as Lemonade struggled to prove its profitability. While traditional insurers banked on decades of data to fine-tune their models, Lemonade tussled to find its footing. Despite improvements in gross profit and margin, the company continued to bleed money. Investors grew anxious as management hinted at escalating expenses to fuel growth, signaling inefficiency in scaling operations.

The Road to Redemption

For Lemonade to redeem itself, it needs a robust underwriting strategy. Regulatory hurdles and geographical challenges have hindered its progress. The company’s model must withstand such disruptions. While management paints a rosy picture of future success, the timeline remains uncertain. Investors face a dilemma: wait for Lemonade to blossom or seek more stable ventures.

Image source: Lemonade.

Lemonade’s recent stock plunge of 90% may seem grim, but it hints at a potential turnaround. If the company recovers and proves its model effective, the rewards could be substantial. Nevertheless, the current uncertainty makes it a risky bet. Patience may be the key to unlocking Lemonade’s true potential without compromising your financial well-being.

Before plunging into Lemonade stock, consider this:

The Motley Fool Stock Advisor analysts have identified the 10 best stocks for investors. Lemonade didn’t make the cut, but the selected stocks are positioned to yield significant returns in the future. By following Stock Advisor‘s guidance, investors can outperform the S&P 500, setting the stage for financial success.

*Stock Advisor returns as of March 18, 2024