Market Resilience Amidst Fluctuations

The stock market dances with unpredictability, taking a brief pause to catch its breath as Wall Street capitalizes on profits post a mini-sprint triggered by a crucial short-term moving average. The Nasdaq, dipping below its 21-day parameter, historically a bullish support milestone in the year 2024, signifies a potential juncture for keen-eyed investors.

Long-Term Gains Through Strategic Investments

The bleed-down of major U.S. indexes towards the 50-day or 21-week averages seems inexorable in the grand scheme of market dynamics. The impending plunge, whether now or down the spiral, signals an eventual buy-in opportunity beyond the turbulence.

Embarking on a Lucrative Investment Journey

The persistent bullish sentiment prevails despite the intermittent realignments of Wall Street’s take on inflation and interest rates. With a bullish outlook for 2024, investors eye a stake in the market, particularly in stocks promising long-term growth.

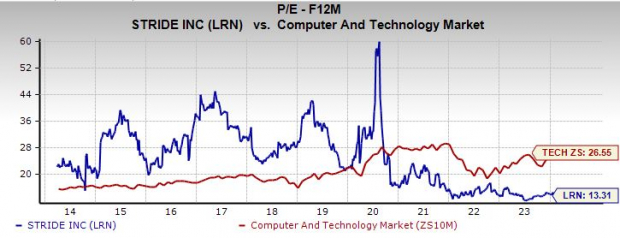

The Educational Dynamo: Stride, Inc. (LRN)

The ascent of Stride stock, by a staggering 110% over the last three years, surpasses the benchmark with a triumphant 53% surge in the past year, towering over the Zacks Tech sector’s 47%. Not a flash in the post-Covid pan, LRN has marked an impressive 180% climb in the last decade, in parallel to the S&P 500 rally.

Charting New Territories in Digital Education

Stride’s robust support at the 21-week moving average is a testament to its resilience, weathering potential short-term market undulations. With Stride trading significantly below its average Zacks price target and boasting an enticingly economical valuation, there exists a window of opportunity for discerning investors.

The Homebuilding Monarch: Toll Brothers, Inc. (TOL)

Toll Brothers, a stalwart in luxury home construction, has seen its stock surge by a monumental 230% over the past five years, catapulting ahead of the S&P 500 and eclipsing the Zacks Construction sector’s 150% stride. Despite treading at all-time highs, Toll Brothers exhibits signs of being undervalued.

Path to Architectural Brilliance

The diverse landscape of Toll Brothers as a luxury home builder, entwined with its ancillary offerings, resonates with the discerning homebuyer. Operating across a spectrum of U.S. states and markets, Toll Brothers emerges as a beacon of architectural serenity amidst a competitive domain.

Embracing the Housing Renaissance

Challenges notwithstanding, Toll Brothers’ earnings resurgence post their February 20 unveiling underscores a promising trajectory, earning it a prestigious Zacks Rank #1 (Strong Buy). As Millennials shape the housing market and Baby Boomers transition to retirement havens, the future appears bright for Toll Brothers amid a climate where demand eclipses supply.

The Phenomenon of Murphy USA: A Powerhouse in the Gas Station Industry

Murphy USA has established itself as a dominant force in the gas station realm. Over the past decade, MUSA stock has seen a remarkable surge of 930%, leaving the standard benchmark’s 180% advancement trailing far behind. This impressive growth trajectory has significantly outshined the Oil and Energy sector, which has experienced a 17% downturn during the same period. Not stopping there, Murphy USA’s shares have skyrocketed by 220% in the last three years, exceeding its sector’s 43% climb. The company’s stock performance is even more evident in its astounding 70% increase over the past 12 months compared to Oil and Energy’s modest 13%.

Riding the Waves of Success

Recently, Murphy USA rebounded above its 21-day moving average, signaling a resurgence towards its record highs. Much like the broader market, MUSA is expected to converge towards its 21-week moving average in the near future. A glance at the historical chart reveals a consistent upward trend over the past decade, underlining the company’s steady climb to the top.

From a valuation perspective, MUSA is currently trading at its 10-year median and sits 33% below its peak levels, with a forward 12-month earnings multiple of 16.2X. Additionally, Murphy USA remains committed to providing returns to investors through dividends and buyback programs, further enhancing its appeal to shareholders.

Roots of Success: A Strategic Overview

Murphy USA operates a network of retail stations that predominantly align with Walmart locations, primarily spanning the Southeast, Southwest, and Midwest regions. With a strong customer base of approximately 1.6 million clients per day, the company stands out for its strategic positioning near key shopping centers. Moreover, Murphy USA’s ownership of a dedicated line space on the Colonial Pipeline, the largest refined products system in the U.S., further bolsters its operational efficiency and market presence.

Looking ahead, Murphy USA’s earnings outlook continues to ascend, reflecting a positive trend over the past five years. The company’s strong performance post-Q4 results has earned it a coveted Zacks Rank #1 (Strong Buy), solidifying its position as a top-performing stock in the market.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.2% per year. So be sure to give these hand-picked 7 your immediate attention.