Artificial Intelligence (AI)

Microsoft leads the artificial intelligence brigade, thanks to its early bet on OpenAI. ChatGPT, the brainchild of OpenAI, is now synonymous with AI prowess, setting records for fastest adoption in history. Within a mere two months of its public release, ChatGPT boasted an impressive 100 million active users.

Back in 2019, Microsoft made a strategic move by investing $1 billion in OpenAI. Fast forward to today, and that investment has evolved into a game-changing partnership. OpenAI’s inventive technology fuels Microsoft’s latest gem, Copilot. The AI assistant is already a hit among the business elite, with 40% of Fortune 100 companies jumping on board during its early access phase. Moreover, the GitHub version touts over 1 million paid users.

Microsoft’s vision for Copilot transcends boundaries, with plans to revolutionize various sectors from academia to finance. This innovation marks a stark departure from Microsoft’s infamous digital assistant blunder, the perennially mocked Clippy.

Cloud Computing

Behind Microsoft’s AI triumph lies a masterstroke in cloud computing. The intricate backend processing for ChatGPT and other Large Language Models (LLMs) is no small feat. Azure, Microsoft’s cloud service, plays a pivotal role in handling the processing load for OpenAI, aligning Microsoft’s profits with OpenAI’s expansion.

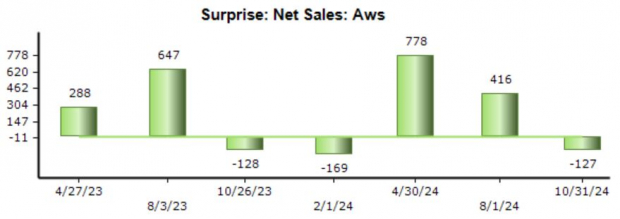

Microsoft’s substantial investment in Azure as a premium AI cloud service is paying dividends, evident from Azure’s revenue surge of 30% in the previous quarter. While Amazon’s AWS has long reigned supreme in cloud services, Azure’s market share is now on the rise, largely fueled by the AI revolution. In the past five years, Azure has outpaced AWS in growth, boasting a 50% increase.

The proof of AI’s financial impact was underscored by Microsoft CFO, Amy Hood, in the recent earnings call, where she revealed a substantial rise in revenue growth attributable to AI within the Azure and cloud services division.

The Stock Market Outlook

For traders eyeing bullish or bearish plays on Microsoft, Direxion offers leveraged ETFs as compelling options. Direxion’s inventive fund portfolio includes two distinct options: one for optimists and another for pessimists. The Direxion Daily MSFT Bull 1.5X Shares (Ticker: MSFU) aims to deliver daily returns of 150% of Microsoft Corporation’s stock performance, while the Direxion Daily MSFT Bear 1X Shares (Ticker: MSFD) seeks to leverage inverse daily returns against Microsoft’s stock performance.

Photo by Christina @ wocintechchat.com on Unsplash.