Market Trends and Earnings Season

The current apprehension surrounding the potential hesitancy of central banks to significantly cut rates amidst persistent inflation has created unease among investors. As earnings season unfolds, providing a welcome opportunity to temper the recent market fervor, the S&P 500 and Nasdaq are poised to test their longer-term moving averages in the early months of 2024.

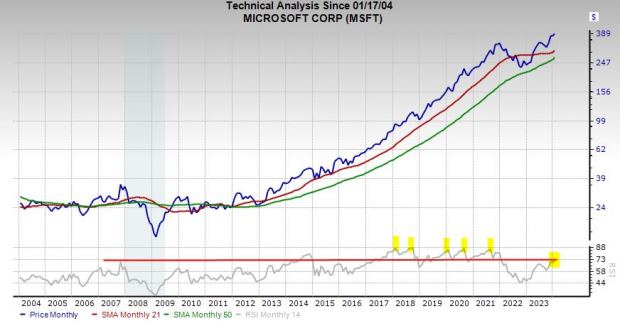

Microsoft: Seizing Growth Opportunities

Microsoft’s upcoming Q2 FY24 earnings release on January 30 is highly anticipated. Fueled by the growth in cloud computing and AI investments, Microsoft’s strategic expansion, including the acquisition of Activision Blizzard for approximately $70 billion, underscores its commitment to innovation and market leadership. With a solid revenue and adjusted earnings growth projection, Microsoft presents a compelling case for long-term investment.

Procter & Gamble: Steadfast Consumer Staples Titan

Procter & Gamble, a stalwart in the consumer packaged goods arena, is scheduled to announce its second-quarter fiscal 2024 earnings results on January 23. Benefiting from a diverse product portfolio and a robust presence in consumer essentials, Procter & Gamble is well-positioned for sustained success, regardless of economic fluctuations. With consistent sales expansion and a favorable adjusted earnings outlook, Procter & Gamble presents a compelling investment opportunity for long-term growth.

United Rentals and Procter & Gamble: Investment Opportunities Unveiled

Procter & Gamble: A Safe Bet for Investors

Procter & Gamble (PG) stock might be on the brink of breaking out of a prolonged holding pattern. The company is currently trading at a 16% discount to its decade-long highs and near its median at 22.4X forward earnings. PG’s dividend yields 2.5%, surpassing its industry’s 2.4% average. Furthermore, it stands among the exclusive group of S&P 500 Dividend Aristocrats, signifying its robust track record of paying and increasing dividends for at least 25 consecutive years.

United Rentals: Riding High on Growth

United Rentals (URI), a leading equipment rental company, is poised for a strong performance as it prepares to release its Q4 FY23 results. The company’s diverse portfolio includes a wide range of equipment, from scissor lifts to generators, catering to clients across construction, utilities, energy, and home building sectors. After facing setbacks during the pandemic, URI has rebounded impressively, delivering sales growth of 14% in FY21 and 20% in 2022.

Positive Outlook for United Rentals

Despite a slight dip in the earnings outlook, United Rentals’ 2025 estimates have shown improvement recently. The company’s sales are projected to soar by 22% in 2023 and another 4% in 2024, while its adjusted earnings are expected to surge by 26% and 6% in the respective years. United Rentals has outperformed the S&P 500 and the Zacks Construction sector, with a remarkable 590% surge in the past decade.

Investment Prospects and Analyst Insights

While United Rentals’ stock recently dipped below its 21-day moving average, indicating a potential test of its 50-day level, it remains poised at neutral RSI levels, offering potential opportunities for investors. Despite short-term fluctuations, the stock presents an attractive proposition, trading at a 21% discount to its sector and 25% below its highs, with a 12.9X 12-month forward earnings ratio and a 1.1% dividend yield.