The rise of the tech industry has historically minted millionaires galore. Take, for instance, the Nasdaq-100 Technology Sector, which has surged by a staggering 377% since 2014, overshadowing the S&P 500‘s modest 184% growth. While recent macroeconomic woes have driven the Nasdaq-100 Technology Sector down by approximately 7% in the past month, seasoned investors understand that a steadfast long-term vision is paramount in the realm of tech investments.

The tech domain thrives on relentless innovation and substantial investments from trailblazing companies, setting the stage for relentless progress. It comes as no surprise that the globe’s five most valuable companies are deeply entrenched in the tech sphere, commanding dominion across consumer products, chip design, productivity software, cloud computing, e-commerce, and beyond.

Unlocking Potential: Revealing Two Tech Powerhouses

Technological advancements, particularly in artificial intelligence (AI), continue to fuel the expansion of key sectors, allowing savvy investors to reap substantial rewards in the coming decade. Here are two standout tech stocks poised to pave your way to millionaire status when the stars align.

1. Nvidia: A Chip-Making Giant

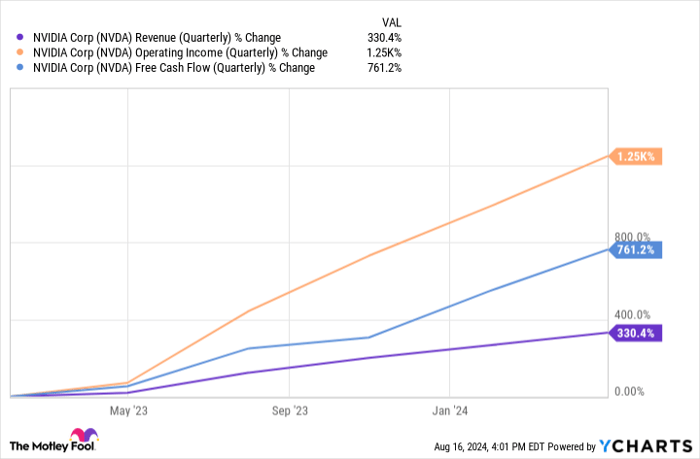

Who hasn’t marveled at the meteoric ascent of Nvidia ((NASDAQ: NVDA)) since the onset of 2023? Witness the company’s remarkable journey from a $360 billion market capitalization in early 2022 to surpassing the $3 trillion milestone, a historic feat for any chip manufacturer.

Nvidia’s hegemony in the graphics processing unit (GPU) realm is unrivaled, with its desktop GPU market share steadily climbing from 65% in 2014 to an impressive 88% in 2024. The emergence of AI has catalyzed a seismic shift in data center chip demand, transitioning the focus from central processing units (CPUs) to GPUs, a transition that Nvidia has adeptly capitalized on.

The company’s financial prowess is evident in its robust performance. Boasting quarterly free cash flow surging to $15 billion, Nvidia eclipses its competitors, with AMD clocking in at $439 million and Intel trailing with a negative $3 billion. Armed with ample resources, Nvidia is primed to navigate the tech landscape, whether it veers towards self-driving vehicles, virtual/augmented reality, or other cutting-edge domains.

2. Microsoft: The Software Maverick

Microsoft ((NASDAQ: MSFT)) stands as a stalwart titan renowned for orchestrating wealth multiplication, with its stock skyrocketing by a staggering 430,000% since its storied IPO in 1986. The conglomerate’s medley of high-caliber brands such as Windows, Office, Azure, Xbox, and LinkedIn has propelled it to historic zeniths, cementing its dominance across software territories.

Microsoft’s supremacy spans an array of tech spectrums, augmented by potent growth drivers strewn throughout the industry. Bolstered by unwavering stock and financial growth, Microsoft’s revenue and operating income have ascended by 96% and 120% in the past five years, with quarterly free cash flow soaring to $23 billion.

Channeling its monumental gains into strategic reinvestments, Microsoft’s prescient $1 billion bet on ChatGPT progenitor OpenAI in 2019 has burgeoned into an estimated $13 billion mutual endeavor, endowing the company with access to some of the most sophisticated AI models on the market.

Leveraging AI’s transformative potential across its software suite, Microsoft has introduced new Azure tools and generative features on its productivity platforms, catalyzing a broad-based uplift in revenue and profits. The tech stalwart’s stock has seen an 834% ascension over the last decade, portraying a compelling narrative for tech investors.

Should You Bet Big on Nvidia?

Before plunging into Nvidia stocks, deliberate on this:

The Motley Fool Stock Advisor analysts have pinpointed prime opportunities that could catapult investors into the elite league of wealth creators.

Unveiling Investment Gems: The Omission of Nvidia in Top 10 Stock Picks

For investors seeking the ultimate stocking fillers, languishing without finding Nvidia on the roster of selected equities is akin to missing the flash of a comet or the crescendo in a symphony. Unveiled as the crème de la crème on April 15, 2005, Nvidia’s absence from this exclusive list may appear as a blot on an otherwise stellar lineup that could potentially yield astronomic returns in the foreseeable future.

The Stock Advisor service, with its beacon of guidance illuminating the path to financial ascendancy, provides meticulous direction to investors as they navigate the labyrinth of stock markets. Boasting a track record that leaves benchmarks trailing in its wake, this service has eclipsed S&P 500 returns by more than fourfold since its embryonic stages in 2002.

Could Nvidia’s non-inclusion be a strategic oversight or a calculated gamble that would elude the financial serendipity that its counterparts might encounter? Decisions, as they say, are the bedrock of investment landscapes, and time will be the ultimate litmus test to unravel the wisdom behind such choices.