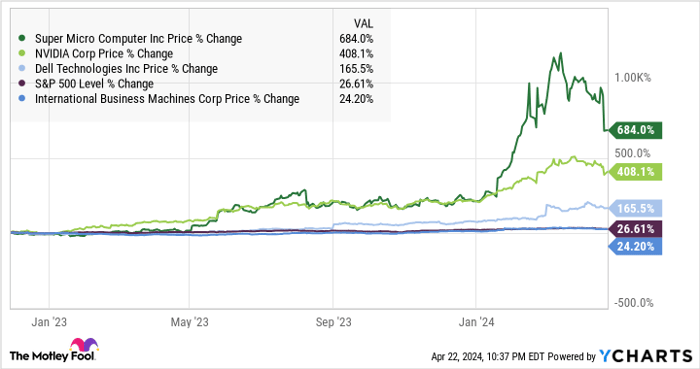

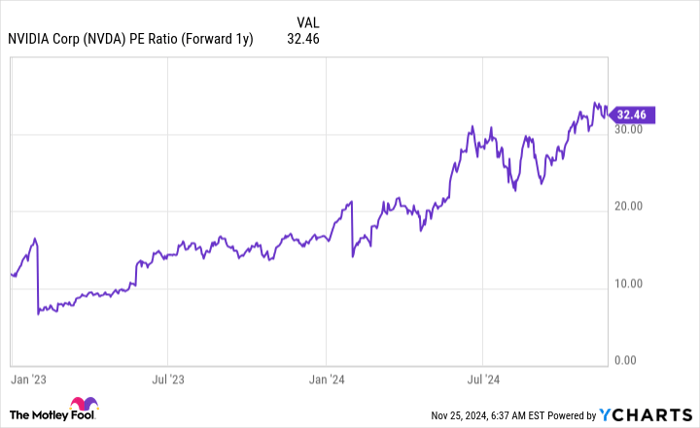

As 2024 unfolds, the market rollercoaster ride continues. The S&P 500 index surged over 10% in the first quarter, only to retrace half of that gain in April. Amidst this turbulence, certain tech giants stand like towering trees in a storm, riding on the crest of artificial intelligence (AI) breakthroughs. Chipmaker Nvidia, tech behemoth Microsoft, and computer systems builder Super Micro Computer command soaring valuations due to their involvement with OpenAI and its groundbreaking ChatGPT tool.

Yet, amidst these sky-high valuations, there are still diamonds in the rough within the AI industry. Enter IBM and Dell Technologies. These veteran tech players are embracing the AI wave, albeit without the market exuberance seen with Nvidia or Super Micro. Despite IBM’s lackluster stock performance since ChatGPT’s introduction, both IBM and Dell represent solid players in the AI market. Let’s delve into their financial prowess and long-term AI prospects.

The Rise of Dell Technologies in AI

While you may not view Dell as an AI juggernaut, the company is proving otherwise. Dell, known for laptops and desktop workstations, has established a robust presence in PC and server-class computers. The AI servers segment contributed $1.5 billion to Dell’s revenues in fiscal year 2024, with a 40% year-over-year growth in fourth-quarter orders for these specialized servers. Dell boasts a $2.9 billion backlog of unfilled AI orders, nearly doubling from the previous period.

This AI segment remains a small fraction of Dell’s $88.4 billion in total sales. However, the rapid growth of AI systems is outpacing other segments, leading to improved profit margins. Dell’s Arthur Lewis sees this as just the beginning of a transformative journey, akin to a baseball game in its early innings.

IBM’s Strategic Move in Enterprise Services

IBM, on the other hand, is capitalizing on the enterprise AI market by offering a unique blend of software and services. The company’s generative AI and watsonx AI platform garnered significant interest, with a doubling of orders from the previous quarter. IBM’s revenue stream includes software licenses, cloud subscriptions, and consulting services, catering to large corporate clients seeking tailor-made AI solutions with comprehensive support.

CEO Arvind Krishna emphasized IBM’s distinctive position in providing both technology solutions and consulting services for generative AI. This integrated approach is a magnet for enterprises navigating the complex AI landscape, positioning IBM as a frontrunner in the AI services domain.

Investing in the Future

Both Dell and IBM offer compelling plays in the evolving AI market. Dell’s stock, priced at 0.9 times sales and 11 times free cash flows, presents a bargain opportunity for investors eyeing the AI growth trajectory. IBM’s software-plus-services mix caters to the demands of enterprise clients, setting the stage for sustainable long-term business relationships.

In a market dominated by high valuations and speculative fervor, the understated prowess of Dell Technologies and IBM shines through as prudent investments in the AI landscape of 2024.