Generous dividend yields can be dangerous. Double-digit dividend yields often show a company is in deep trouble, where a stalwart series of boosted payouts couldn’t drive stock prices higher. At the same time, cash-machine businesses can power their payouts from excessive cash flows, resulting in a strong yield that can last for many years.

Fortunately, a couple of perfectly healthy high-yield dividend stocks are on fire sale right now. Read on to see how International Business Machines (NYSE: IBM) and Darden Restaurants (NYSE: DRI) would fit in an income-oriented stock portfolio today.

Why these yields stand out

The average American savings account offers an annual percentage yield of roughly 0.5%. The S&P 500 (SNPINDEX: ^GSPC) market index has seen an average dividend yield of 1.6% over the last 5 years and currently stands at just 1.3%.

With dividend yields of 3.5% for Darden shares and 3.1% for IBM’s stock, these cash-sharing veterans are on a different level. Among these popular wealth-storage options, only the individual stocks can outrun the government’s long-term inflation target of approximately 2% per year.

Diverse giants with shared strengths

These two household names don’t have much in common at first glance. Big Blue is a legend of the computing sector, setting up a promising artificial intelligence (AI) business just in time for a massive AI boom. Darden manages full-service restaurant chains, such as Olive Garden, Bahama Breeze, and Longhorn Steakhouse. The company is expanding its international business while remodeling many domestic locations. Apples, meet oranges.

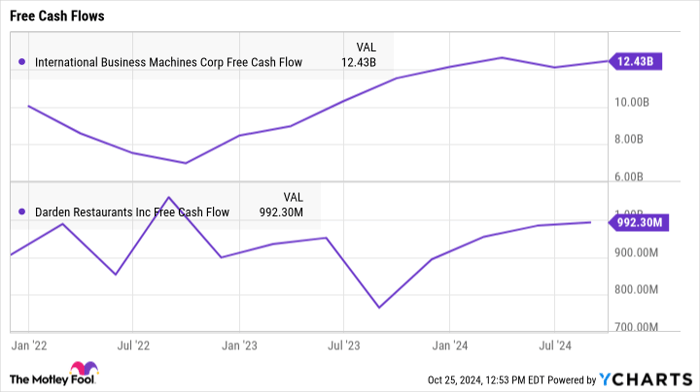

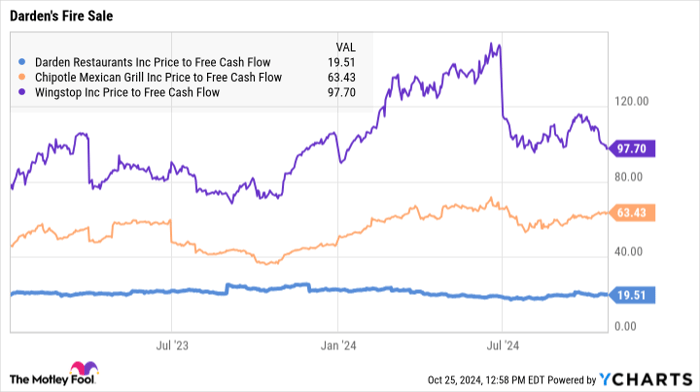

IBM Free Cash Flow data by YCharts.

But they actually have a lot in common where it matters the most. The two businesses are growing their sales and collecting robust cash profits. They also have a commitment to sharing their cash flows with investors in the form of strong and growing dividends.

IBM generated $12.4 billion of free cash flows over the last four quarters. It funneled 49% of that surplus cash into dividend checks. Darden used 64% of its $992 million free cash flow for the same purpose. Both dividend policies are fully funded by current cash profits, and they have room to grow without causing a financial crisis.

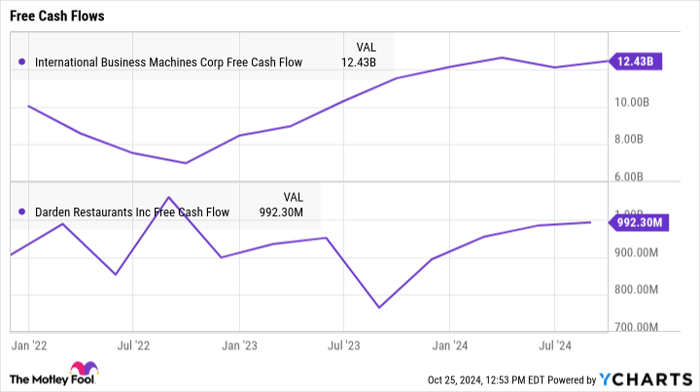

IBM Price to Free Cash Flow data by YCharts.

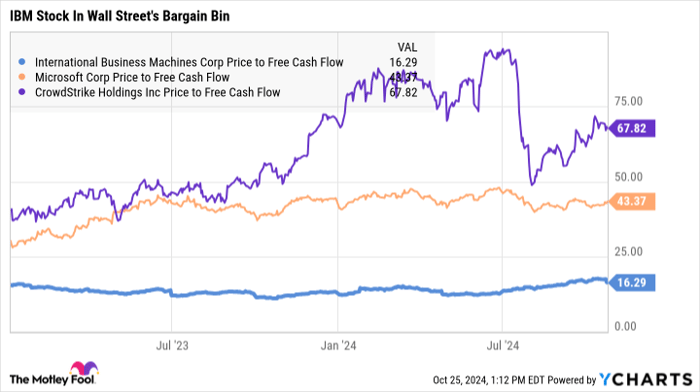

DRI Price to Free Cash Flow data by YCharts.

It’s time to lock in those rich yields

Finally, Darden and IBM are firmly established leaders in their respective industries, with convincing growth plans for the foreseeable future. Yet, their stocks look quite affordable next to market-darling rivals. Buying the stocks right now will lock in those juicy dividend yields and provide plenty of opportunity to enjoy price gains in the long run.

Remember, Darden has been around for nearly a century, and IBM is even more experienced. These deep-pocketed income generators should stick around for decades to come, building shareholder wealth along the way thanks to generous dividend policies.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,154!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,777!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $406,992!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 21, 2024

Anders Bylund has positions in International Business Machines. The Motley Fool has positions in and recommends Chipotle Mexican Grill, CrowdStrike, Microsoft, and Wingstop. The Motley Fool recommends International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft, short December 2024 $54 puts on Chipotle Mexican Grill, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.