Renowned investor Warren Buffett and Berkshire Hathaway have earned a stellar reputation as some of the most successful investors in history. Consequently, the company has amassed a considerable following seeking to emulate its investment moves. While blind replication in the stock market is ill-advised, examining Berkshire’s holdings can provide insight into what the management perceives as lucrative investments. Astutely observing their portfolio, two companies emerge as strong investment opportunities while another should be approached with caution.

Visa: An Impenetrable Payment Processing Fort

Buffett has always been partial to toll-booth-style businesses. The concept is elegantly simple: construct an infrastructure and levy a small fee on all transactions passing through. Among the paragons of this business model is Visa’s (NYSE: V) payment processing network.

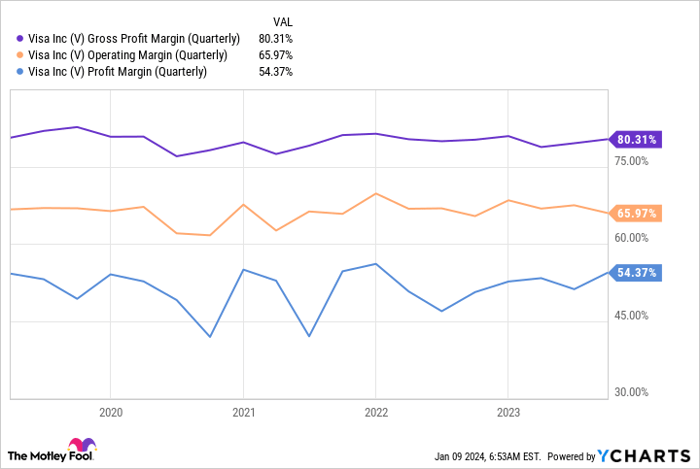

With each swipe of a Visa card, the company garners a modest fee for utilizing its extensive network, culminating in substantial revenue. Evidenced by consistently high profit margins, Visa’s profitability remains unparalleled. Few companies have the capacity to convert over half of their revenue into net profit, a feat Visa consistently accomplishes. Despite being a market leader, Visa continues to exhibit robust growth. In the fourth quarter of fiscal 2023 (ended Sept. 30), its revenue surged by 11% to a record high of $8.6 billion.

In spite of its exceptional business model and robust growth, Visa is currently trading at 32 times trailing earnings and 27 times forward earnings, bearish evaluations seldom witnessed in the past five years. This presents a compelling buying opportunity. Berkshire might not perceive the stock as inexpensive currently, but from a long-term perspective, it appears to be a bargain.

Amazon: An E-commerce Pyramid Ascends

While Berkshire Hathaway holds a relatively modest position in Amazon (NASDAQ: AMZN), the stock presents an excellent buying opportunity at the moment. Under the stewardship of Chief Executive Officer Andy Jassy, Amazon has markedly ameliorated its business operations, particularly in terms of profitability. The company’s concentrated effort on enhancing profitability was reflected in its 2023 performance, with revenue growth rebounding to 13% in the third quarter. Amazon is currently an enterprise firing on all cylinders, and despite Berkshire reducing its position in Q3, it appears to be a formidable investment presently.

Apple: The Withering Core

Undoubtedly, Apple is the darling of Buffett and Berkshire, constituting nearly half of the company’s portfolio. However, this infatuation may become problematic in 2024. Although Apple’s stock witnessed a robust 48% surge in 2023, the business encountered challenges. Throughout fiscal year 2023 (ending Sept. 30), Apple reported declining revenues every quarter. This trend was not confined to a singular product line as iPhones, Macs, and iPads all faced difficulties at different times during the year. When a company grapples with adversity yet its stock remains unflinching or ascends, it is a telltale sign of excessive optimism. This can precipitate a bubble, entailing significant losses when it bursts. While Apple is arguably not in a bubble yet, it commands a hefty valuation of 32 times trailing earnings and 29 times forward earnings estimates – a steep price tag for a contracting company. Consequently, despite Apple’s esteemed status within Berkshire’s holdings, it is far from a prudent investment currently. Compared to Apple, the aforementioned two companies are undoubtedly in more favorable positions for potential investors.