The rapid adoption of artificial intelligence (AI) is expected to give the global economy a substantial boost. By 2030, PricewaterhouseCoopers (PwC) estimates that AI could contribute a staggering $15.7 trillion, or 14%, to the global gross domestic product (GDP). These numbers spell out enormous potential for investors seeking lucrative opportunities in the AI industry.

It’s no surprise then, that the market has witnessed a surge in investors buying AI stocks to capitalize on this unprecedented economic growth. With the promise of substantial returns, it’s essential to explore key AI stocks that could play a pivotal role in creating wealth in a diversified portfolio. Two such stocks to consider are Nvidia (NASDAQ: NVDA) and Snowflake (NYSE: SNOW).

Nvidia – Powering the AI Revolution

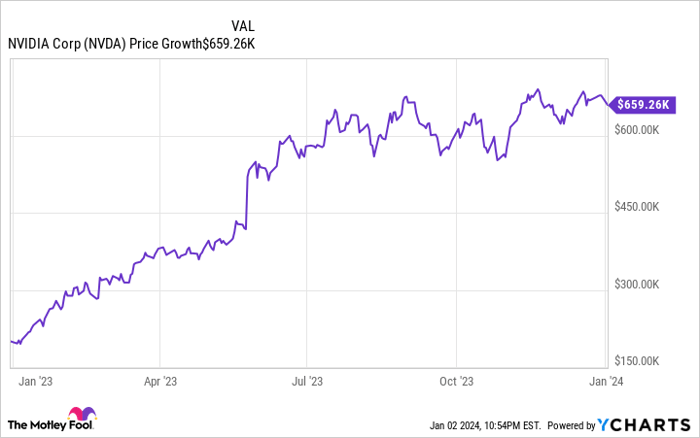

Nvidia has experienced exceptional demand for its graphics processing units (GPUs) due to the AI boom, resulting in remarkable revenue and earnings growth in recent quarters. The company’s stock reflects this success, turning a $200,000 investment into a substantial $659,000 over the past year.

However, this could just be the beginning for Nvidia. The market for AI chips is projected to generate a massive $258 billion in annual revenue by 2033, marking a 24% annual growth rate over the next decade. With Nvidia’s current market share of over 80% in AI chips, the company is positioned to capitalize on this multibillion-dollar market. In the last reported quarter, Nvidia’s data center revenue tripled year over year to $18.1 billion, with a staggering 279% surge, reaching $14.5 billion.

Nvidia’s strategic initiatives further reinforce its dominance in the AI chip market. By accelerating its product roadmap and ramping up chip supply, Nvidia is poised for robust growth in the coming years. Assuming a conservative 50% control of the AI chip market, Nvidia’s data center revenue could soar to nearly $130 billion by 2033, a substantial leap from the $15 billion revenue generated in fiscal 2023.

With additional catalysts, such as AI-enabled personal computers, cloud gaming, digital twins, and automotive applications, analysts expect Nvidia’s earnings to grow at an annual rate of 102% over the next five years. This is a significant increase from the 48% annual earnings growth in the preceding five years. An investment of $200,000 in Nvidia made five years ago would now be worth almost $2.9 million, further illustrating the potential for substantial returns and a route to millionaire status.

Snowflake – Harnessing the AI Data Revolution

Snowflake provides a cloud-based data platform that offers customers access to diverse functions such as data warehousing, data lakes, data science, data engineering, and secure sharing on a single interface, positioning it at the forefront of the AI data revolution.

As the demand for training large language models (LLMs) grows, Snowflake’s cloud-based services are poised for significant adoption. Large-scale language models like ChatGPT and GPT-4 require massive amounts of data for training, exemplified by the over 45 terabytes of data needed for these models. Snowflake’s role in providing high-quality data for training these models has become instrumental.

Nvidia’s partnership with Snowflake to enable businesses to create custom generative AI applications using their proprietary data within the Snowflake Data Cloud presents a new growth avenue for Snowflake. Furthermore, a survey by enterprise AI company Expert.AI revealed that almost 40% of respondents planned to build custom enterprise LLMs, indicating a potential surge in demand for Snowflake’s data platform.

Snowflake’s Cortex platform, which facilitates enterprises in building LLMs in a cost-effective manner, reflect the company’s anticipation of gaining an expanded market. Snowflake’s total addressable market (TAM) is projected to more than double from $140 billion in 2022 to $290 billion in 2027, indicating the potential for substantial revenue growth.

With Snowflake generating $2.6 billion in revenue over the trailing 12 months, there is enormous untapped potential for the company to scale and capitalize on the burgeoning AI data market, further cementing its position as a potential wealth generator.

Unveiling the Lucrative Potential of Snowflake and Nvidia in the Stock Market

The Growth Trajectory of Snowflake

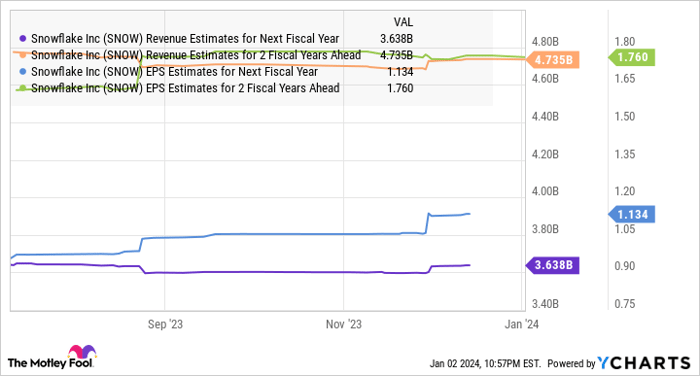

The dazzling rise of Snowflake Inc. in recent years has ignited the excitement of investors keen on reaping the fruits of tech stocks. With a projected 35% upsurge in revenue, poised to reach a striking $2.8 billion by the end of the current fiscal year, the pace of Snowflake’s expansion is akin to a supersonic jet thundering through the clouds. The future seems equally auspicious, as the company’s earnings are expected to soar, potentially surging to $0.80 per share in fiscal 2024, marking an astronomical triple from the previous years. Such robust financial indicators have fanned the flames of anticipation regarding its value in the stock market.

SNOW Revenue Estimates for Next Fiscal Year data by YCharts

Moreover, analysts are prophesying a stunning annual growth rate of 66% for Snowflake’s earnings over the next five years. If this prediction materializes, the company could achieve a staggering $10 per share in fiscal 2029. Pondering upon this meteoric growth, the prospective stock price of $300, representing a 58% surge from the current levels, materializes like a financial marvel. However, the present 175 times forward earnings valuation of Snowflake does not imperil the allure for investors eyeing a shot at turning a thousand bucks into a million. Additionally, complementing a Snowflake investment with Nvidia shares could offer a formidable duo in a diversified portfolio, akin to the perfect blend of flavors in a luscious cocktail.

The Case for Nvidia Investment

Amidst this fervor, the allure of Nvidia is not to be overlooked. As the sage of Wall Street gazes into the crystal ball, investors are contemplating the wisdom of pouring their hard-earned cash into Nvidia stock. The financial pundits at Motley Fool Stock Advisor, renowned for their prescient insights, excluded Nvidia from their list of the 10 best stocks for investors to buy now, casting a shadow of doubt over Nvidia’s immediate prospects. Despite this, Nvidia’s allure remains undiminished, charmed by a potential for monumental returns that looms like an unsolved riddle.

The Stock Advisor service, described as an easy-to-follow blueprint for success, tantalizes investors with regular updates and the promise of two new stock picks each month. Its outperformance, tripling the return of S&P 500 since 2002, is like a shimmering beacon of success, guiding ships through treacherous seas. These impressive credentials pose an intriguing question: does Nvidia possess the untapped potential to replicate or perhaps even surpass such soaring growth?

Engulfed in this volatile tango of speculation and aspirations, investors find themselves at a crossroads, endeavoring to navigate these choppy waters with an air of confidence akin to a seasoned explorer setting out on a daring adventure.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Snowflake. The Motley Fool has a disclosure policy.