Dubbed the “Magnificent Seven” by Bank of America (BAC) strategist Michael Hartnett, tech giants Apple (AAPL), Alphabet (GOOGL), Nvidia (NVDA), Amazon.com (AMZN), Meta Platforms (META), Microsoft (MSFT), and Tesla (TSLA) emerged as leaders of the bull market that kicked off early in 2023, sparked by massive enthusiasm over the generative AI boom. Despite notable underperformance this year in names like TSLA, an ETF tracking the group has surged 48% over the past 52 weeks, compared to the S&P 500 Index’s 22.7% rise.

Among this elite group, one analyst says AMZN stock could be set to soar higher, fueled by its live-streaming platform, Twitch. In a recent note, Needham’s Laura Martin said she sees the upstart YouTube rival as Amazon’s $46 billion “hidden gem.” Martin upped AMZN’s target price to $210, encouraged by expanding service margins, particularly from Twitch and artificial intelligence (AI) ventures that are enhancing Amazon’s overall value.

With the mega-cap stock sporting double-digit upside potential to Wall Street’s mean price target, now might be a prime moment for investors to consider AMZN stock. Let’s take a closer look.

The Amazon Stock Story

Washington-based Amazon.com, Inc. (AMZN), founded in 1994, boasts a staggering $1.9 trillion market cap. This e-commerce giant has transformed into a global tech powerhouse, dominating retail and branching into entertainment with Prime Video, Amazon Music, Prime Gaming, and Twitch. Amazon Web Services (AWS) spearheads enterprise cloud solutions and AI, showcasing its tech prowess. With logistics, smart home devices, and even healthcare ventures, Amazon continues to redefine industries, proving that its ambitions extend far beyond its online retail roots.

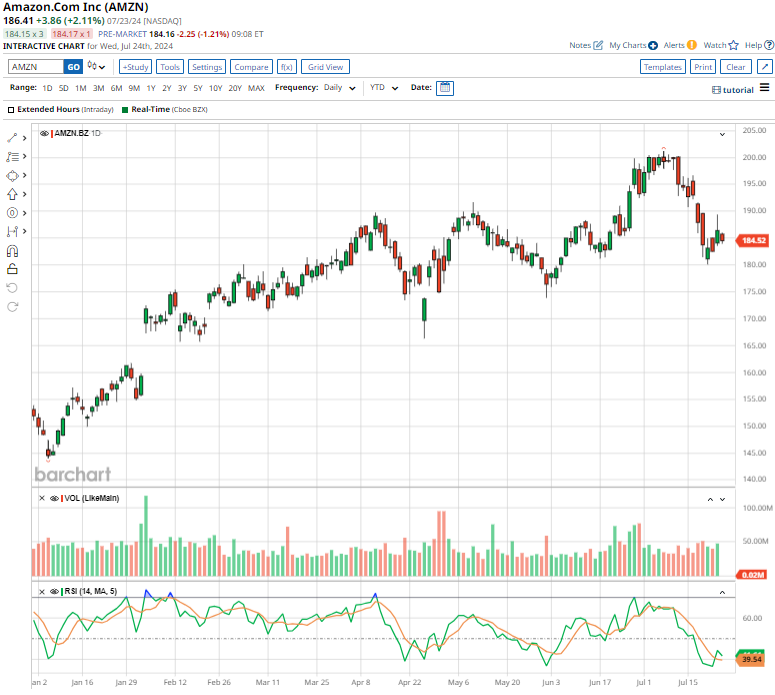

The tech giant’s stock has been on an impressive climb. Shares of Amazon have rallied 43% over the past 52 weeks and climbed 21.2% on a YTD basis, compared to the SPX’s 22.5% and 16.5% returns over the same periods, respectively.

With AMZN down about 9% from the highs set earlier this month at $201.20, this pullback could be shaping up into an attractive buy-the-dip opportunity for investors looking to capitalize on the next leg higher.

Priced at 38.96 times forward earnings, the stock trades at a discount to its own five-year average of 182.15x.

Amazon’s Solid Q1 Performance

On April 30, Amazon reported its Q1 earnings results, which surpassed Wall Street’s projections. While revenues climbed 12.5% annually to $143.3 billion, its adjusted EPS of $1.13 exceeded forecasts by 36.1%.

Amazon’s hefty free cash flow, which hit $50.1 billion during Q1, fuels its AI ventures and acquisitions. With $54 billion in cash, cash equivalents, and restricted cash, Amazon’s balance sheet remains rock-solid, ready for more strategic growth.

Expected to report its Q2 earnings results on Thursday, Aug. 1, Amazon anticipates continued growth, with analysts projecting robust earnings in the years ahead.

The Power of Amazon’s Hidden Gem

In 2014, Amazon acquired Twitch for $970 million, a strategic move to tap into the live-streaming wave. Fast forward almost a decade to 2023, and Twitch is generating approximately $3 billion annual revenue, establishing itself as a key player in Amazon’s success.

With Twitch attracting a wide audience and creating synergies within Amazon’s ecosystem, the platform is proving to be a valuable asset with untapped potential.

Analyst Laura Martin’s bullish outlook on Twitch has led to increased target prices for Amazon stock, highlighting the hidden value of this digital gem.