April has not been kind to the broader stock market this year, with the S&P 500 down 5.5% between April 1 and April 19. Granted, the index is still up on the year, but with many stocks still trading at high multiples, some investors may be concerned about further downward pressure.

If you’re worried about a stock market sell-off, you may not exactly be looking at what stocks to buy. After all, isn’t that counterintuitive?

However, stock market corrections, and especially bear markets, have historically been phenomenal buying opportunities for patient investors. Here’s why Apple (NASDAQ: AAPL) is an excellent blue chip stock to buy now, even if the market continues selling off.

Image source: Getty Images.

The Not-So-Magnificent Year for Apple Stock

Apple is part of the “Magnificent Seven,” a term coined by Bank of America analyst Michael Hartnett to describe Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta Platforms, and Tesla.

While most of the Magnificent Seven (especially Nvidia and Meta) have done well so far this year, Apple is within just a couple of percentage points of its 52-week low and is down over 14% year to date. Apple has underperformed for a long period, especially relative to the rest of the tech sector.

Apple is the Perfect Value Play

Apple’s underperformance hasn’t been ideal for investors, but it does look good if the broader market continues selling off.

During periods of market expansion, investors tend to be more forward-looking and reward companies with an attractive growth trajectory. But during a correction, investors can get defensive and look for companies that can put up solid earnings right now, pay dividends, and have a reasonable valuation.

Apple’s growth has slowed, and it has yet to make a splash in artificial intelligence (AI) — although future iPhones may increasingly rely on AI chips. But what Apple has going for it is a reasonable valuation — with a price-to-earnings ratio of 25.7 compared to 27 for the S&P 500.

The quality of Apple’s earnings is also relatively high. There’s no denying that Apple relies on healthy consumer spending for product upgrades and increased service sales. However, its business has a high floor in that economic growth could slow or there could even be a recession, and Apple would probably not face nearly as severe of a downturn in its performance as more cyclical companies like Nvidia or Tesla.

So it’s not just Apple’s valuation based on its trailing earnings that makes it a good value, but the nature of the business model and Apple’s ability to deliver results throughout the economic cycle. Apple also has a massive capital return program. Over the past five fiscal years, it has spent a staggering $391.5 billion on buybacks and $72.5 billion on dividends.

|

Metric |

Fiscal 2019 |

Fiscal 2020 |

Fiscal 2021 |

Fiscal 2022 |

Fiscal 2023 |

|---|---|---|---|---|---|

|

Stock Buybacks |

$66.1 billion |

$72.4 billion |

$86 billion |

$89.4 billion |

$77.6 billion |

|

Total Dividends Paid |

$14.1 billion |

$14.1 billion |

$14.5 billion |

$14.8 billion |

$15 billion |

Data Source: YCharts.

Apple’s buyback program provides a nice cushion if the stock falls. Apple has the cash to step in and buy its stock, thereby reducing the share count and giving existing shareholders greater ownership of the company.

The dividend is an additional incentive to hold the stock through volatile periods. Granted, it only yields 0.6%, but it’s still a massive capital commitment for Apple to its shareholders.

Apple is Sitting on a Stockpile of Cash

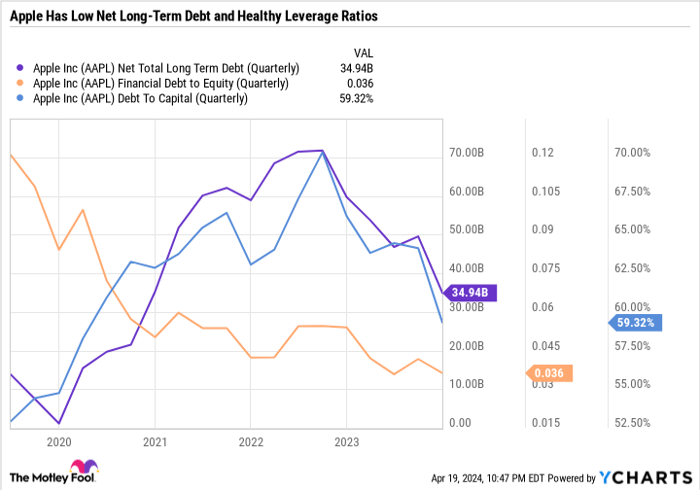

Another attribute that gives Apple an extra layer of insulation from unforeseen challenges is its financial health.

Unyielding Apple: A Rock of Stability Amid Volatility

The Apple Advantage

Apple stands firm amidst periods of volatility, backed by its strong brand, industry-leading position, robust valuation, capital return program, and solid balance sheet. While no stock is immune to downturns, Apple’s value-oriented nature sets it apart from its peers, particularly the other Magnificent Seven stocks.

Weathering Market Storms

Investors are advised to ensure the resilience of their portfolio in the face of volatility by maintaining a watchful eye and a list of preferred companies capable of weathering falling asset prices. The ability to not only hold stocks but inject fresh capital into the market lays the groundwork for long-term wealth accumulation. Apple, with its unshakeable fundamentals, emerges as a prime investment choice in the current market scenario, particularly amidst sell-offs.

Considerations Before Investing in Apple

Before delving into Apple stock, it’s crucial to consider various factors. The Motley Fool Stock Advisor analyst team recently highlighted ten promising stocks for investors, excluding Apple from the list. These selected stocks are anticipated to yield significant returns in the foreseeable future. The Stock Advisor service provides a clear roadmap to success for investors, offering guidance on portfolio construction, regular analyst updates, and two monthly stock recommendations. Since 2002, the Stock Advisor service has outperformed the S&P 500 by a significant margin.

For further insights on these ten recommended stocks, investors are encouraged to explore the full list.

*Stock Advisor returns as of April 22, 2024