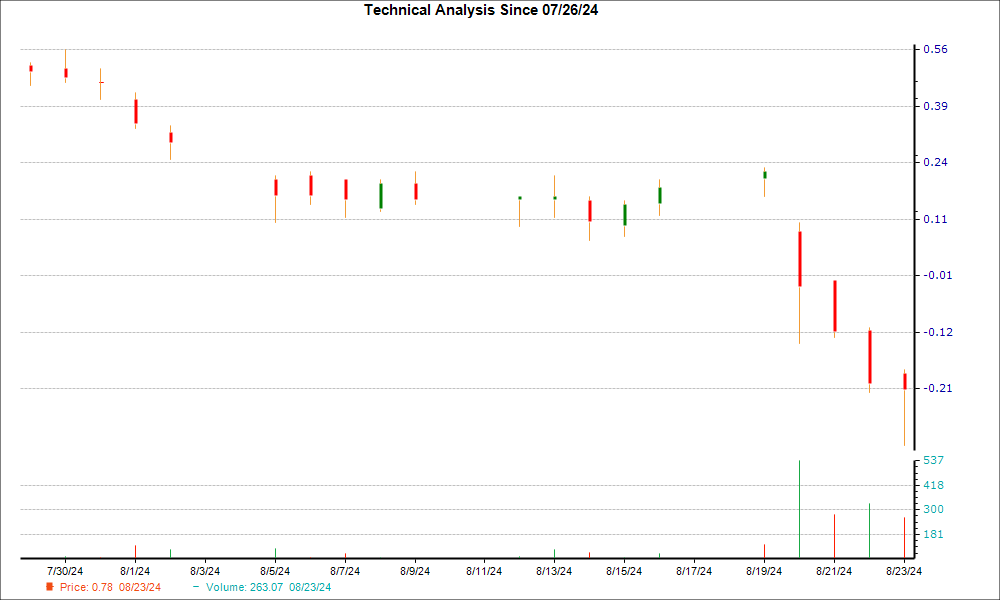

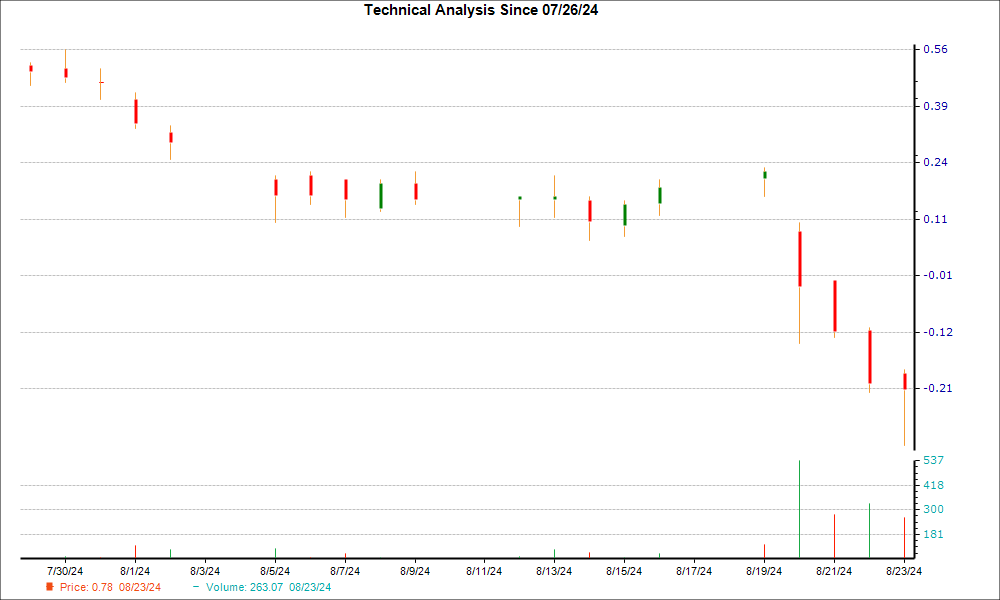

The recent price trend of Workhorse Group (WKHS) on NASDAQ has been on a downward trajectory, experiencing a significant 33.6% decline over the past week. However, a notable hammer chart pattern emerged in its latest trading session, hinting at a potential trend reversal in the near future. The hammer pattern suggests that the stock might soon find support as bullish momentum gains strength, potentially turning the tide for investors.

While the formation of a hammer pattern is a favorable technical signal indicating a possible bottoming out of the stock with a potential end to the selling pressure, mounting optimism among financial analysts regarding the future earnings of this company specializing in trucks and drones presents a solid fundamental factor. This positive sentiment among analysts bodes well for a potential turnaround in the stock’s performance.

Deciphering the Hammer Chart Pattern and Trading Strategies

The hammer chart pattern is a widely recognized formation in candlestick charting, characterized by a small candle body with a significant difference between the daily low and the open or close, forming a long lower wick or vertical line. This distinctive appearance gives the candle its name – ‘hammer.’

In essence, during a downtrend when bears dominate the market, a stock typically opens lower than the previous close and ends lower. However, on the day the hammer pattern emerges amidst the downtrend, the stock hits a new low before witnessing a rebound, indicating a shift in momentum. The emergence of buying interest at the day’s low propels the stock to close near or slightly above the opening price.

Signaling a shift in control from bears to bulls at the bottom of a downtrend, the hammer pattern signifies a potential reversal in trend, instilling optimism among investors. Observing this pattern across various timeframes, including daily, weekly, or intraday, serves as a valuable tool for traders across different investment horizons.

While the hammer pattern is a robust technical indicator, its reliability is enhanced when complemented with other bullish signals to confirm an impending reversal in stock price movement.

Factors Strengthening the Case for a Workhorse Group Revival

The recent uptrend in earnings estimate revisions for Workhorse Group underscores a positive fundamental outlook for the company, aligning with bullish market sentiment. Historical data indicates a strong correlation between earnings estimate trends and short-term stock price performance.

Notably, over the past month, the consensus EPS estimate for the current fiscal year has surged by 22.5%, reflecting a consensus among sell-side analysts that the company is poised to deliver better-than-expected earnings results.

Furthermore, Workhorse Group currently holds a Zacks Rank #2 (Buy), placing it in the top 20% of over 4,000 ranked stocks based on earnings estimate revisions and EPS surprises. Stocks with Zacks Rank of 1 or 2 traditionally outperform the broader market, indicating a potentially favorable outlook for Workhorse Group.

The Zacks Rank has a track record of accurately signaling improvements in a company’s prospects, providing investors with valuable insights into optimal entry points. Therefore, the Zacks Rank of 2 for Workhorse Group consolidates the fundamental premise for a possible stock reversal.