The Upcoming Earnings

As Q2 2025 results loom for Best Buy (NYSE: BBY), anticipation is rife. The retail behemoth, a stalwart in consumer electronics, is expected to unveil numbers on August 29. While earnings are projected to beat estimates marginally, a wavering stock trajectory could greet investors due to revenues missing the mark.

BBY’s stock voyage this year has seen it ascend from $78 to $89, albeit trailing the broader indices, like the S&P, which grew by 18%. Peer Amazon (NASDAQ: AMZN) witnessed a more modest 14% growth, leaving BBY potentially overvalued in the long haul. A volatile market, bloated by pandemic-induced spending and economic inflation, has muddled the waters for the electronics retailer.

Staring into the Abyss

For the imminent quarter, Best Buy foresees a 3% decline in comparable sales and an approximated non-GAAP operating income rate of 3.5%. Looking ahead to FY’25, revenue is proffered between $41.3-42.6 billion, with an EPS forecast between $5.75-6.20. Comparable sales aim to hover in the -3% to 0% range.

In a stark contrast of fates, BBY’s stock has trod a middling path, barely shifting from $85 in early 2021 to its current $90, a stark deviation from the S&P 500’s 50% rise during this triennium. Returns for BBY were a mere 4% in 2021, nosediving by 17% in 2022, only to rebound by 3% in 2023. These oscillations underlines the struggle to outshine the S&P 500, a challenge faced not only by individual stocks but also by titans like Amazon.

An Uncertain Future

Given Best Buy’s projected valuation at $90 a share, parity with the current market price seems afoot. Nonetheless, the future remains enigmatic. Will the retailer buck its lackluster historical trend and soar, or will it descend further in the face of economic storms?

Exploring Performance Metrics

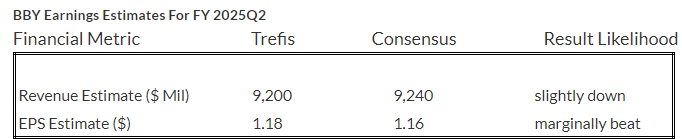

Revenue forecasts for Best Buy’s Q2 2025 are trailing slightly below consensus at an estimated $9.2 billion. The preceding quarter witnessed an unremarkable $8.9 billion in revenue, marking a 6.5% y-o-y plunge. Highlighting this dip, domestic comparable sales nosedived 6.3% with key areas like home theater, appliances, and mobile phones witnessing the steepest declines. Internationally, comparable sales stumbled by 3.3%. Full-year revenue predictions for FY’25 revolve around $41.9 billion, reflecting a 4% y-o-y reduction.

Earnings per share (EPS) for BBY’s Q2 2025 are expected to perch at $1.18 according to Trefis, a slight nudge beyond consensus predictions. The previous quarter saw an adjusted EPS of $1.20 versus $1.15 a year prior. While domestic gross margin witnessed an 80 basis-point uptick to 23.4%, international gross margins faltered, dipping 90 basis points to 22.8%. Nonetheless, the adjusted operating margin blossomed to 3.8% in Q1 2025, outpacing the 3.4% of the preceding year.

Peering into the Crystal Ball

A price evaluation in line with the present market price suggests stability for Best Buy’s stock moving forward. Yet, comparisons with peers and an erratic market pose challenges. Will Best Buy stand resilient amidst the tempest, or will it sway with the prevailing winds?

| Returns | Aug 2024 MTD [1] | 2024 YTD [1] | 2017-24 Total [2] |

| BBY Return | 3% | 16% | 166% |

| S&P 500 Return | 2% | 18% | 151% |

| Trefis Reinforced Value Portfolio | 4% | 12% | 729% |

[1] Returns as of 8/28/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates