When examining the elite group of stocks known as the “Magnificent Seven,” one cannot overlook their stellar performance in recent years. Each member has exhibited remarkable growth, with some experiencing staggering increases of almost 20,000% over the past decade. However, amidst this impressive lineup, one standout, Tesla (NASDAQ: TSLA), has struggled, recording a negative return of approximately 16% in the last three years.

The call to remove Tesla from this esteemed cohort has gained traction among notable investors such as Jim Cramer. While an immediate replacement for Tesla might not be in the offing, there is a $900 billion contender that warrants serious consideration. This particular entity, although less technology-centric compared to its counterparts, holds the potential to emerge as the next $1 trillion powerhouse in the market.

Uncovering the Next Market Giant

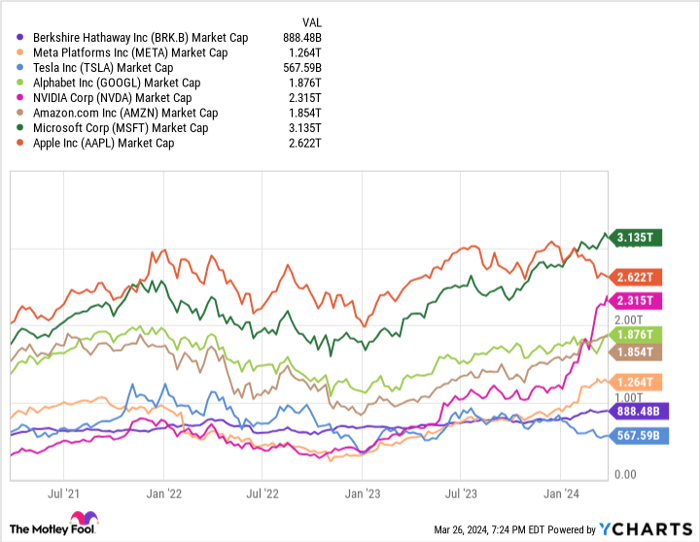

In the realm of trillion-dollar companies today, a predominant focus on technology prevails. The Magnificent Seven lineup currently features technology stalwarts like Alphabet, Meta Platforms, Apple, Amazon, Nvidia, and Microsoft, all deeply entrenched in the tech sector. Surprisingly, the member with the smallest market cap, Tesla, arguably lacks a strong tech orientation.

An intriguing candidate to replace Tesla is Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B). With a market cap hovering around $900 billion, a modest 13% uptick in its shares would propel it past the $1 trillion threshold, possibly within the current year. In stark contrast, Tesla presently sits at a market cap of about $570 billion. Though substantial, from a sheer size perspective, Berkshire aligns more fittingly with the Magnificent Seven archetype than Tesla.

You might wonder: Is Berkshire less of a tech entity than Tesla? The answer might just surprise you.

Primarily an insurance enterprise with an investment division at its core, Berkshire appears far removed from the tech arena. Yet, its premier publicly listed investment holding happens to be a Magnificent Seven constituent: Apple. This significant stake, valued at roughly $168 billion, accounts for almost 30% of Tesla’s present market cap.

Furthermore, Berkshire boasts an array of tech investments including stakes in Amazon, Snowflake, Visa, Mastercard, HP, and Nu Holdings. Notably, the conglomerate also holds a $2.4 billion position in BYD, an electric vehicle manufacturer challenging Tesla directly in the Chinese market.

While Berkshire may not match the tech-heavy focus of its Magnificent Seven peers, its collective technology investments, valued at under $200 billion, constitute nearly a quarter of its market cap, positioning it as a more tech-inclined proposition than commonly perceived.

An Astute Investment Opportunity

Drawing direct comparisons between Tesla and Berkshire proves arduous owing to their diverse revenue streams necessitating distinct valuation approaches. However, gauging each stock’s valuation relative to its peers offers valuable insights.

When juxtaposed with established automakers such as Ford, General Motors, and Volkswagen, Tesla emerges as a pricey choice. Even in comparison to fellow electric vehicle producers like Rivian, Tesla commands a substantial premium.

Berkshire, although demanding a premium vis-a-vis its competitors, exhibits a markedly lower premium. Based on price-to-book metrics, its shares trade at a premium of 20% to 50% relative to similar businesses. In contrast, Tesla commands nearly a 200% premium when evaluated against Rivian on a price-to-sales basis.

While Berkshire’s tech focus might fall short of warranting inclusion in the Magnificent Seven, its unanticipated tech exposure is discernible. Despite undergoing a significant decline, Tesla remains relatively overpriced, whereas Berkshire maintains a reasonably priced valuation, given its consistent record of success. While Berkshire may not slot into Tesla’s vacated Magnificent Seven spot in the near term, it could certainly secure a place in your personal investment portfolio.

Is allocating $1,000 to Berkshire Hathaway a prudent move at this juncture?

Prior to delving into Berkshire Hathaway stock, a crucial deliberation awaits:

The expert analyst team at Motley Fool Stock Advisor has pinpointed what they deem the 10 best stocks for potential investors to acquire. Surprisingly, Berkshire Hathaway did not make the esteemed list. The highlighted stocks exhibit the promise of delivering substantial returns in the ensuing years.

Offering a user-friendly roadmap to success, Stock Advisor equips investors with insights on portfolio construction, analyst updates, and two fresh stock recommendations each month. Since 2002, the Stock Advisor service has surpassed the S&P 500 return by over threefold*.

Glance over the 10 recommended stocks

*Stock Advisor returns recorded till March 25, 2024.