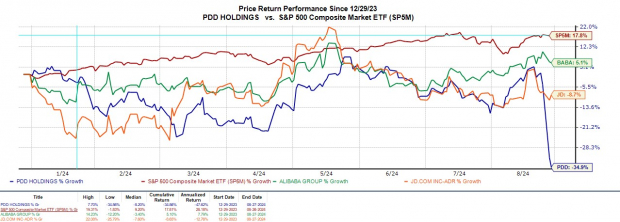

PDD Holdings (PDD) had been a shining star in the stock market until recently, witnessing a dramatic 30% decline post its Q2 earnings report. The multinational e-commerce giant forewarned of an impending profitability dip starting in Q3, attributing it to intensifying competition and broader economic anxieties in China, despite its reputation for offering discounted products that lure customers away from rivals like Alibaba and JD.com.

Image Source: Zacks Investment Research

Analyzing Q2 Performance

PDD reported Q2 sales of $13.35 billion, slightly missing estimates by 2%, but showcasing a remarkable 85% surge from the comparable quarter. The bottom line was robust, with Q2 EPS of $3.20 surpassing expectations by 10% and soaring 122% year-over-year. Impressively, PDD has consistently outperformed the Zacks EPS Consensus for 14 straight quarters, boasting an average earnings surprise of 41.14% in the previous four quarterly announcements.

Image Source: Zacks Investment Research

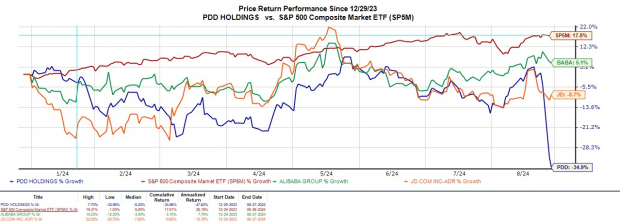

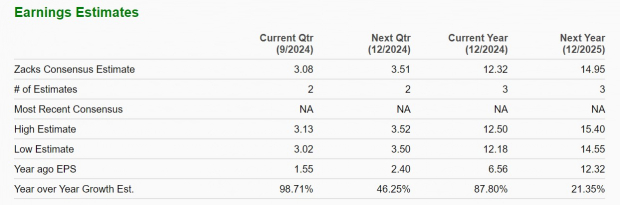

Forecasting Growth Trajectory

Estimates suggest PDD’s total sales are set to surge by 62% in fiscal 2024 to $56.27 billion from $34.64 billion in the previous year. Further growth of 27% is projected for FY25, reaching $71.59 billion. Annual earnings are also anticipated to skyrocket by 87% this year to $12.32 per share, compared to $6.56 in 2023, with a 21% additional increase foreseen for FY25. However, caution is warranted as there may be a revision in earnings estimates for FY24 and FY25 following the company’s recent profitability alert.

Image Source: Zacks Investment Research

Valuation Comparison

Currently priced at $95, PDD’s stock holds an 8.1X forward earnings multiple, significantly discounted compared to the S&P 500’s 23.7X. Even after the recent dip, PDD remains slightly above JD.com’s 6.5X but below Alibaba’s 9.4X valuation.

Image Source: Zacks Investment Research

Final Thoughts

Following the latest financial disclosure, PDD Holdings stock has been assigned a Zacks Rank #3 (Hold). While the post-earnings decline may appear tempting for investors, PDD seems to mirror the fate of several other Chinese e-commerce entities caught in the whirl of market volatility and economic uncertainties. PDD undoubtedly showcases promise for long-term investors given its growth trajectory, yet optimal buying opportunities may still lie ahead.