Recent Market Performance and Investor Sentiment

Yesterday, Super Micro Computer (SMCI), the less discussed AI stock, experienced a notable decline of about nine percent in a single day, with early premarket indicators suggesting further losses today. Despite not garnering the same level of attention as Nvidia (NVDA), SMCI has been a favored player in the AI market, demonstrating impressive growth of over three hundred percent year-to-date prior to the recent pullback.

Initially perceived as a guaranteed success, the abrupt two-day downturn exceeding ten percent has left many investors puzzled, prompting discussions regarding the underlying causes.

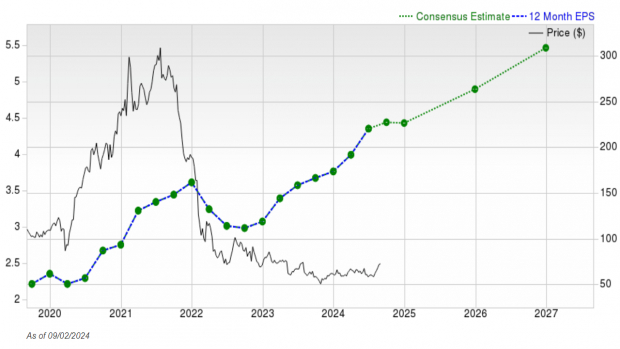

SMCI Year to Date

The primary reason behind this decline is evident—a planned issuance of two million new shares by Super Micro Computer, leading to the dilution of existing shares. While this move may be disheartening for those who purchased the stock near $1200 just days ago, it is a strategic decision that benefits SMCI and its shareholders, ultimately fostering market health.

Utilizing Capital for Growth and Innovation

Criticism often surrounds the stock market, with detractors describing it as akin to a casino, where the wealthy play to amass more wealth without creating tangible value. However, the issuance of new shares by a company like SMCI proves otherwise. While speculators have fueled SMCI’s ascent and generated substantial profits, the company’s ability to raise a significant amount of capital through a modest share offering—approximately $2 billion—speaks volumes.

The capital raised is intended for crucial operational support, including inventory purchases, scaling manufacturing capacities, and amplifying research and development efforts—actions that are vital for long-term shareholder interests. Despite the initial ambiguity of “other working capital purposes,” such filings commonly utilize this language, with the overarching goal being clear: empowering production expansion and innovative product development.

Market Opportunity Amid Volatility

The recent plunge in SMCI may have surprised experts who touted it as a non-Nvidia AI stock to watch, resulting in losses for top-buying traders. Nonetheless, the decline stems from a positive cause. Capital accumulation for driving growth epitomizes the stock market’s purpose, extending beyond the initial public offering phase.

SMCI’s management made a prudent decision by issuing shares post a remarkable 300% surge in under three months, aligning with the company’s obligation to shareholders. While the downward trend may persist, investing in SMCI at current or lower levels presents an opportunity, as a swift recovery is plausible in the near future.